Treasury Wine Estates forecasting a return to high single-digit earnings growth

Treasury Wine Estates chief executive Tim Ford is determined to rebuild the winemaker’s growth credentials despite a shuttered Chinese market.

Treasury Wine Estates chief executive Tim Ford is determined to rebuild the winemaker’s growth credentials despite a shuttered Chinese market, and is pledging a restructure of his sprawling wine operations and recent rebound in consumer spending from America to Australia will grow profits “stronger for longer”.

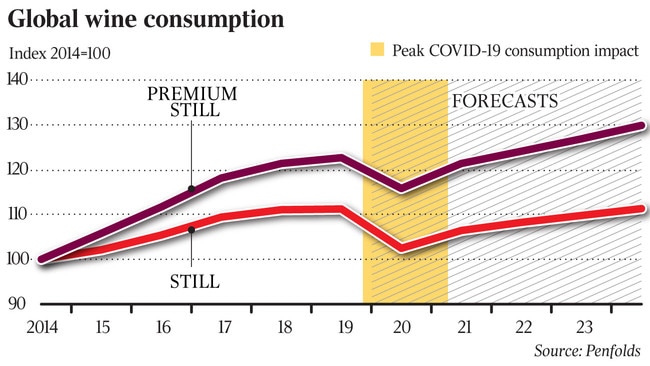

And as the vaccines for COVID-19 roll out consumers are once again reaching for a bottle of wine as they socialise with family and friends, and increasingly they are spending money on premium and luxury wines that are the cornerstone of Treasury Wine’s portfolio.

Unveiling his blueprint for Treasury Wine to cope with the new realities of crippling Chinese tariffs that robbed him of the company’s once key profit engine and a new company structure that splits it into three divisions from July 1, Mr Ford told analysts at its investor day he will return the company to high single-digit earnings growth.

After the investor day on Thursday Mr Ford told The Australian that Treasury Wine, whose stable of brands include the luxury Penfolds, Wolf Blass and Lindemans, will remain a growth company that earns a good return on capital and can pay superior dividends to shareholders.

“We see growth across multiple portfolios, multiple markets, and a premium brands portfolio focus will drive our growth consistently at that high single digit levels over the next five years,” Mr Ford told The Australian.

“We think the focus and accountability that will be driven through those three business units, where they are measuring themselves against themselves and how they are going to grow their own businesses not only at the profit level and margin level but also the return on capital employed.

“It will certainly improve each of those divisions which then combined will improve the total Treasury Wine Estates business.”

The market embraced his growth vision, sending shares in Treasury Wine — which was demerged from brewer Foster’s 10 years ago — up 27c, or 2.7 per cent, to $10.22 on a day when the broader market fell.

“We are a growth company, a long-term growth company. And our first decade has been successful on that front and we’re certainly pretty confident for the next decade too,” he said.

The upbeat assessment came as Mr Ford, who took the reins from former Treasury Wine CEO Michael Clarke in July, saw a recovery in his wine sales and volumes in markets where COVID-19 restrictions were easing and drinkers were out socialising and celebrating.

“We are seeing pretty consistent return to significant consumption growth, particularly in premium price points here in Australia. We are seeing in the US market a return to some pretty strong growth in those channels that had been impacted by the pandemic as the vaccination rolled out in the US as well. The trends are relatively consistent across the board and play to our portfolio, the premium and luxury mix that is in those channels as they open.

“We are certainly seeing positive signs in those markets where the vaccine is rolling out.”

From July Treasury Wine will split into three divisions: its flagship Penfolds brand, Treasury Premium Brands and a North American business unit, which Mr Ford believes will help drive accountability and company profit growth.

Treasury Wine Estates is hoping to plug the massive profit gap left in its business from the loss of the highly profitable Chinese market last year following the imposition of a 175 per cent plus tariff on its Australian wines.

The winemaker is also promising greater benefits from a review of its global supply chain and has set out its earnings targets for its key operations across its flagship Penfolds, commercial wines and its North American business.

Treasury Wine is targeting net zero emissions by 2030 under an accelerated sustainability program.

At the investor day Treasury Wine said it expects fiscal 2021 pre-tax earnings to be in the range of $495m to $515m, slightly ahead of current market consensus expectations. That would represent growth of 33 per cent in the second half compared to the prior corresponding period at the midpoint of the guidance range.

In February Treasury Wine revealed the punishing weight of the Chinese tariffs imposed from November, disruption from COVID-19 across all its markets, and lost trade from shuttered restaurants and bars had bruised its half-year accounts, with first-half net profit down 42.8 per cent to $120.9m. Revenue slipped by 8.2 per cent to $1.42bn.

On Thursday Treasury Wine also revealed for the first time key financial metrics around its Penfolds brand, showing it had some of the fattest margins for a luxury brand in the world. It unveiled the Penfolds group of wines had sales of $544.3m in 2018, rising to $816m in 2019 and $765.2m. Penfolds had earnings of $363.3m in 2019 and $357.3m in 2020. Its earnings margins were 47 per cent in 2020, up from 45 per cent in 2019.

The company said over the long-term it is targeting the delivery of sustainable top-line growth and high single-digit average earnings growth. Treasury Wine’s long-term financial objectives also include the continued effort to sell more premium labels, expansion of its group earnings margin to the target of 25 per cent and restoring and then growing return on capital.

Mr Ford said Penfolds is targeting 40-45 per cent margin, including investment to grow distribution; Treasury Americas maintaining its 25 per cent margin ambition; and Treasury Premium Brands targeting margin in the high-teens.

The winemaker said that as previously announced it is currently undertaking a global supply-chain optimisation program. This program is now expected to deliver annualised benefits of at least $75m by fiscal 2023, up from the $50m of annualised benefits announced previously.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout