Transurban loss follows Covid hit to toll roads

Transurban has plunged to a $448m half-year loss after the pandemic caused a sharp fall in traffic on its road network.

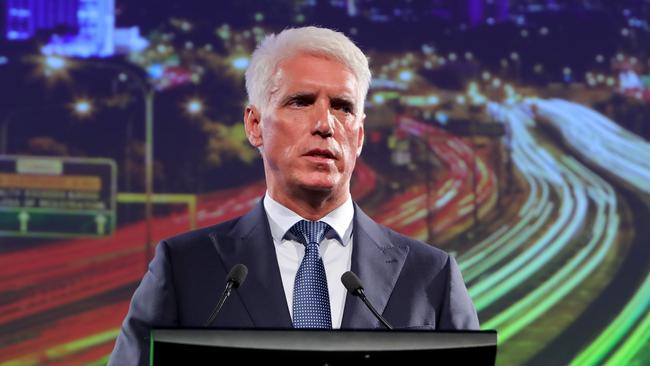

Transurban chief executive Scott Charlton has called for governments to step up their efforts to drive an infrastructure-led economic recovery from the COVID-19 pandemic and warned of the pandemic’s impact on the contracting sector’s ability to deliver key projects.

As Mr Charlton warned on Thursday that the planned 2023 completion date on the troubled $6.7bn West Gate Tunnel project in Melbourne was no longer achievable and substantial cost overruns were inevitable, he said decision-making and approval processes needed to be accelerated to help fast-track major infrastructure projects.

“The private sector is willing and governments are saying the right things. I am not sure we have seen the action yet so hopefully that action will follow,’’ he said.

His comments came as Transurban plunged to a half-year net loss of $448m, hit by an 18 per decline in average daily traffic on its road network over the past six months due to the ongoing effects of the COVID-19 pandemic.

The decline in traffic would have been 23.6 per cent if not for Transurban opening the M8 and NorthConnex toll roads in Sydney during the six months to December 31.

The company confirmed guidance it provided to investors in December that it would pay an interim dividend of 15c a share, down from its 31c dividend a year ago. It also reaffirmed the 2021 distribution was expected to be in line with free cashflow after capital releases.

Lower toll revenues cut proportionate earnings before depreciation, amortisation, net fiance costs and income taxes (EBITDA) 23 per cent to $840m, below analysts’ forecasts.

Mr Charlton said the company was focused on resolving the problems of the West Gate Tunnel project, declining to call it a “distraction”.

“We are putting a tremendous amount of effort into resolving it. So calling it a distraction is not the right word. But it is one part of a very large portfolio,’’ he said.

More broadly, he said Transurban was paying close attention to the capacity of the contracting sector to deliver on major infrastructure projects as COVID-19 continued to restrict movement across state and international borders.

“The delivery component in relation to the private and government sectors is an issue we all need to watch carefully — the contracting capability, the ability to get a workforce and the mobility of that workforce,” he said. “Construction workers are traditionally very mobile and that is a challenge right now.’’

Goldman Sachs said Transurban’s result was “slightly soft” but noted the overall earnings quality was “OK”, with cashflow conversion “solid” at 90 per cent.

Mr Charlton agreed the results of the past year were an “aberration” for the company as traffic volumes had largely recovered to pre-COVID-19 levels in the markets where restrictions had lifted, such as Sydney and Brisbane.

“If you look at NSW and Queensland, the recovery as far as roads is well and truly on and close to normal and Victoria could get there easily if it can allow people back into the CBD offices. North America is really dependant on the vaccine,’’ he said.

“If the vaccine is not here in Australia, we are exposed to further government restrictions if there is an outbreak. So we are really dependent upon the vaccine for certainty.”

Mr Charlton said the firm was examining opportunities to expand in North America after raising $2.8bn in December from selling a 50 per cent stake in its US toll roads to AustralianSuper, the Canada Pension Plan Investment Board and UniSuper.

The company’s shares have traded flat in a range between $13 and $14 over the past six months. They closed down 9c, or 0.7 per cent, on Thursday at $13.37.

In December, Transurban made the surprise hire of ANZ chief financial officer Michelle Jablko as its new chief financial officer.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout