Star Entertainment investors shrug off VIP concerns as CEO says politics not affecting sentiment

Star Entertainment’s shares have lifted as investors look past its high-roller woes and focus on domestic growth.

The Star Entertainment Group’s domestic growth has offset investor concerns about VIP volumes, as chief Matt Bekier says political uncertainty is yet to hit local sentiment at its casinos.

The Australian-listed company (SGR), which has casinos in Sydney, Brisbane and the Gold Coast, today revealed that its normalised gross revenue — which removes the volatility of high-roller win rates — was down 6.1 per cent to $1.27 billion. The normalised net profit after tax was 2.4 per cent lower at $124m. The company said the result was impacted by its VIP turnover, which declined 33 per cent in the first half of fiscal 2019 to $20.7bn.

The half-year statutory net revenue was 14.9 per cent higher at $1.15bn, while the statutory net profit after tax was up 351 per cent at $149m. Earnings before interest, tax, depreciation and amortisation climbed 65.9 per cent $331m.

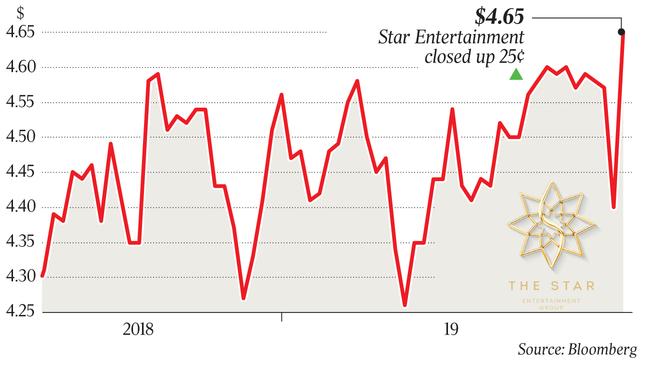

Investors reacted positively to the half-year result, with shares in the company up 5.9 per cent at $4.65.

“The market likes it because of the domestic result. The domestic numbers are strong and we have good momentum,” The Star’s chief Matt Bekier said.

“On VIP, the market understands that the global market hasn’t changed. Macau is still up a little bit.

“There is a little bit of volatility in terms of (VIP) volume but there are some bright spots in that business. The win rate is strong, visitation is up and the Gold Coast is now 2.5 times the size of (Crown) Perth in terms of VIP.”

Mr Bekier said domestic revenues at the Sydney casino continued to grow strongly, with the effective transitioning of its highest value guests to the private gaming room, Sovereign 1.5, a highlight as The Star upgrades and expands the Sovereign Resort.

“We decided to accelerate the construction project at Sydney by creating a temporary private gaming room for our top players and the market was nervous about how effective that would be, partly helped by our competitors, who talked it down and said it was going to be terrible,” Mr Bekier said.

“The temporary room is better than the old room and the new room is going to be ten times better than the temporary room.”

The Star’s chief added that VIP always captured people’s attention but he outlined that it was only 15 per cent of earnings.

“The action is the domestic business, which is why our share price is up because the market is looking at it and seeing that it is robust,” Mr Bekier said.

The Star said the performance of its VIP business reflected moderating market growth, a high win rate — enjoyed by the casino — of 1.62 per cent and an unusually low turn of 9.7 times.

A higher win rate impacts turnover negatively because players will tap out earlier if losing, hence the “low turn” figure.

The Star’s rival, Crown Resorts, yesterday reported a fall in its VIP turnover, flagging that while it had a “reasonable” number of visitors from China, their spend was down.

Actual VIP revenue at The Star increased 2.5 per cent, which was assisted by the high win rate. The Star also pointed to a solid sales performance in its VIP business, which it said delivered 10 per cent growth in unique patron visitation, with front money of $2.1bn flat on the prior corresponding period.

Mr Bekier said the VIP performance did not concern him, adding that the casino company had been saying for some time that the sweet spot for it was the lower end of the VIP scale.

The “whales” generated a higher turnover but narrow margins, whereas the more attractive business for The Star, according to Mr Bekier was the lower end of the VIP scale, which would be a customer in the $200,000 to $2m range.

The Star’s CEO said the company continued to believe VIP was an attractive market with good long and medium term potential.

“We are not changing our strategy, or cutting back on the sales teams, or cutting back on capex plans,” he said.

“We also continue to expand teams in South East Asia, particularly in the premium mass segment that is doing well there.”

He added though that the softening of Chinese consumer sentiment was having an impact, highlighting that talk of trade wars made people nervous and they weren’t taking as much risk as they otherwise would.

The Star generally enjoys a bump during Chinese New Year and Mr Bekier said while the numbers this year were OK, it was not a record year.

“The inbound Chinese tourism numbers (for Australia) are still growing but not at the same rate they have been in the past and we are seeing that reflected in our business,” he said.

Mr Bekier also said that the Australian federal election, expected in May, had not yet had an impact on domestic numbers.

He said that historically, elections created uncertainty and people did not know whether they could hang onto investment properties, or whether their franking credits were going to be worth anything.

“There is always nervousness around that but it hasn’t shown up in numbers,” Mr Bekier said.

“We looked at the trading in the first seven weeks and it looks exactly like the first half.”

The half-year results showed that at The Star’s flagship asset, Sydney, statutory gross revenue declined 7.3 per cent, while EBITDA was up 59 per cent, which was supported by a higher win rate in the VIP business.

Slots revenue grew 9.9 per cent, which increased The Star’s electronic gaming market share to a record 9.4 per cent. It also said that table revenues grew 4.9 per cent, which was supported by solid growth in the private gaming room.

The VIP business front money at the Sydney casino was down 20 per cent, with turnover down 49 per cent because of high rollers spending less time at the tables. This impacted Sydney’s overall normalised performance, with normalised gross revenue down 15.4 per cent and EBITDA down 6.3 per cent.

The Queensland business, which includes the Gold Coast and Brisbane, reported record statutory and normalised gross revenue and EBITDA.

The VIP business turnover at the Queensland assets was up 90 per cent.

“Pleasing growth in domestic and international volumes in the Gold Coast support our growth strategy and confidence in the long-term potential of that location,” Mr Bekier said.

The board declared at interim dividend 10.5c-a-share, which was a 40 per cent increase on the same period last year.

John O’Neill, chairman of The Star, said the dividend demonstrated the strength of the company’s balance sheet and the confidence it had in the momentum of its business.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout