Rip Curl founders enjoy final payday before Kathmandu sale

The founders of surfwear brand Rip Curl shared a multi-million dollar payout before its sale to Kathmandu.

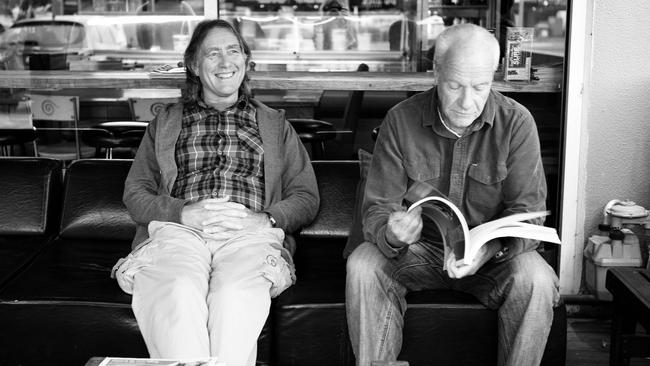

The founders of iconic surfwear brand Rip Curl, Doug “Claw” Warbrick and Brian “Sing Ding” Singer shared in a final $20 million payday before their company was sold to adventurewear retailer Kathmandu, via a rich flow of dividends.

Latest financial results for the formerly privately-owned Rip Curl also show the surfwear company was scooped up by Kathmandu just as the business was seeing its profitability leap ahead, with 2019 profits jumping by 50 per cent.

On October 1, Rip Curl’s founders and biggest owners announced a deal to sell their global business for $350 million to outdoor adventure wear and equipment retailer Kathmandu.

READ MORE: Kathmandu buys Rip Curl for $350m | Two surfing mates give up their ‘baby’

Rip Curl was founded by surfing friends Mr Warbrick and Mr Singer in the Victorian seaside town of Torquay in 1969.

It grew into a popular surf brand designing, making and selling surfing equipment and apparel, with a global presence across Australia, New Zealand, North America, Europe, South East Asia and Brazil.

Rip Curl’s two founders owned 72 per cent of the business before its sale and for years have enjoyed a strong flow of dividends.

The surfwear company’s latest and last financial accounts before the sale to Kathmandu show Rip Curl declared a series of dividends in the last 12 months that amounted to $19.6 million.

The accounts reveal a dividend of $6 million was paid in October, followed by a dividend of $4.55 million in December and $9.07 million in May this year. Rip Curl paid total dividends of $18.37 million in 2016 and 2017, spread between a $9.185 million final 2016 dividend and an interim dividend for 2017 of $9.186 million.

Kathmandu bought the brand at a good time, with profit momentum building.

For the fiscal 2019 year Rip Curl posted a net profit of $15.2 million from continuing operations, up from $9.69 million in 2018. During the year it sold part of its Indonesian business.

The bottom line net profit for 2019 was $13.54 million.

Revenue for the year increased to $478.2 million from $459.2 million in 2018.

Rip Curl said it saw encouraging signs from its owner store network in Australia and sales from its online platforms.

Restructure and reorganisation costs of $5.1 million was also booked in 2019.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout