Kathmandu profit lifts on strong Australian sales

Adventurewear retailer Kathmandu lifts annual profit 13.7pc, as Australian growth offsets NZ weakness.

Kathmandu chief executive Xavier Simonet believes the retailer’s popular American footwear brand Oboz can help introduce North American shoppers to the Kathmandu adventurewear and equipment range as he seeks to harvest earnings from outside Australia and New Zealand.

Although US shoppers are still largely oblivious to the Kathmandu brand, the company was able to use its Oboz footwear business to get in front of the type of wholesale customers that were most likely to be attracted to the hiking, camping, bushwalking and snow gear outfitter.

“The focus clearly with the acquisition of Oboz is North America because with Oboz we have a great brand that is driving growth for us and contributing to our profit growth,” Mr Simonet told The Australian on Wednesday as the retailer posted a 13.7 per cent lift in full-year net profit to $NZ57.63m ($53.43m).

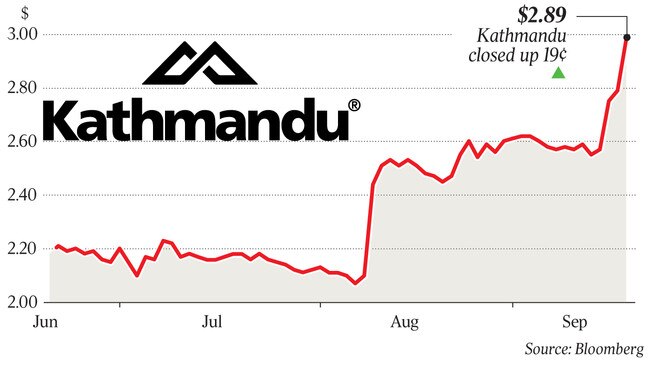

The market liked the result, sending Kathmandu shares up 20c, or 7.6 per cent, to $2.83.

Kathmandu bought hiking-boot brand Oboz last year for $US75m. The business helped propel earnings in fiscal 2019 while sales for Kathmandu in Australia also rose strongly, but the New Zealand arm suffered from price competition and sliding earnings.

Mr Simonet said the US could prove fertile ground to roll out the Kathmandu brand as shoppers and wholesalers got to know it through Oboz.

“We have a base in America that we can leverage in terms of infrastructure and relationships and the customers Oboz has are exactly the customers we would want to work with Kathmandu.

“Kathmandu doesn’t have any brand awareness in North America and we are going step by step to grow brand awareness and brand equity in North America as we invest behind the brand and grow a wholesale store network there.

“So really America is our strong focus at the moment, driven by Oboz. It’s not going to be transformative, but step-by-step profitable growth.”

Kathmandu’s strong lift in profit for the 12 months to the end of July was driven by the growing earnings strength of its Australian chains and the addition of the Oboz footwear business to its group results. A late start to winter impacted the company’s sales in New Zealand, where sales fell, but that was offset by strong growth in Australia.

The company said full-year sales were $NZ545.618m, up 9.7 per cent, with same-store sales up 0.6 per cent across the group and its Australian stores increasing like-for-like sales by 2.7 per cent. Mr Simonet said the company had delivered another record sales and profit result.

“The key drivers of this growth were a positive contribution from the Australian business, and rapid sales and profit growth from Oboz,” he said.

Total sales in Kathmandu’s largest market, Australia, were up 4.5 per cent with continued growth in key product categories. Same-store sales growth of 2.7 per cent in Australia reflected the team’s focus on providing a great customer shopping experience, the company said.

Profitability at its Australian stores rose 2.7 per cent to $48.9m.

New Zealand sales were down 3.1 per cent, where earnings fell 8.5 per cent to $NZ26m.

Online sales were up 9.2 per cent and now make up 10.1 per cent of direct sales to consumers.

A final dividend of NZ12c a share, up from NZ11c, will be payable on October 11.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout