Pact Group rejects Raphael Geminder’s ‘opportunistic’ bid

Shares are higher after battlelines were drawn between chairman and major shareholder Raphael Geminder and the rest of the board at the Victorian packaging group he wants to fully own.

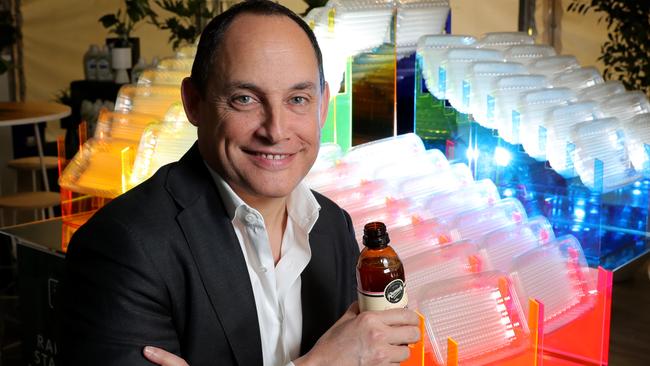

Melbourne-based packaging company Pact Group’s board is gearing for a takeover battle of sorts with its major investor and chairman Raphael Geminder, asking shareholders to reject his “opportunistic” $232m offer after an independent expert ruled the bid “neither fair nor reasonable”.

The unsolicited 68c per share offer by Mr Geminder, who founded Pact and already controls just over 50 per cent of the group, was lobbed in September by his Kin Group subsidiary, Bennamon Industries.

The Independent Board Committee (IBC)’s appointed expert Kroll Australia has now reached its assessment after estimating the value of each Pact share at $1.06-$1.51, according to a target’s statement released on Friday.

Shares closed steady at 72c on Friday.

“Kin Group is attempting to increase its level of control over Pact without paying a customary premium,” the IBC told investors.

It is also currently not in a position to unilaterally delist Pact and its reasons to accept the offer “are not compelling”.

Kin Group will need to raise its holding to at least 75 per cent from the 50.02 per cent stake on October 11.

“In addition, there would need to be less than 150 other shareholders with shares worth $500 or more. There are currently more than 6,500 Pact shareholders with such holding,” the target’s statement notes.

“Even if both tests were satisfied, the offer would then need to have been kept open for two weeks after the 75 per cent level was reached. Shareholders that do not accept the offer would then need to be given at least 3 months’ notice of the delisting,” according to the statement.

The underperformance of Pact has been a thorn in investors’ side after it reported a net loss of $6.6m for the year ended June 30 – after its $12.2m profit in the 2022 financial year. It came despite revenues increasing 6 per cent to $1.9bn last financial year.

But Pact reminded investors it is executing on its “transformation strategy”, including a $20m cost reduction initiative and a pending divestment to reduce leverage by $160m.

“The offer does not reflect the potential benefit of these initiatives,” the IBC told investors.

Mr Geminder will need to now convince a large slab of minority shareholders to back his aim to take Pact private after heavy losses, rising debt levels and a share price that has collapsed by more than 80 per cent in the past five years.

The offer is a long way from 10 years ago, when Pact raised about $649m based on an initial public offer of $3.80 a share. The Pact float was the largest IPO in the Australian market in 2013 and the second-largest IPO for a packaging company completed globally.

A key investor in the battle for full control of Pact will be Investors Mutual, which has a stake of circa 5.5-6 per cent and is one of the largest institutional investors on the share register.

IML has backed the board’s decision to reject Mr Geminder’s bid for full control.

In a statement after market close, IML’s senior portfolio manager Simon Conn said the independent expert has valued Pact “at a minimum of $1, a significant premium to the bid of 68c”.

“It seems pretty clear that the 68c bid from Kin Group is totally inadequate and we support the Board’s rejection of the bid.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout