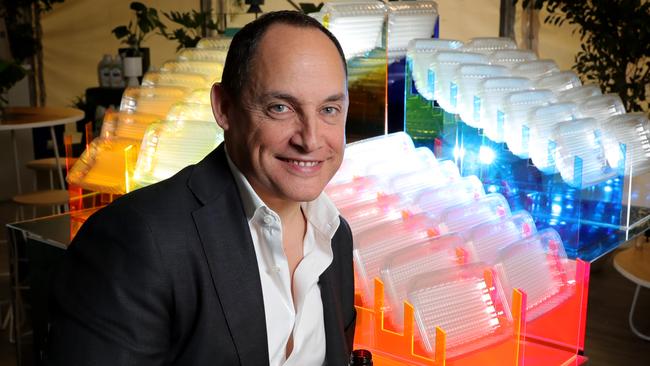

Richlister Raphael Geminder seeks to take packaging group Pact private with $232m takeover bid

With Pact’s share price down 80 per cent since its float in 2013, richlister and majority owner Raphael Geminder has lobbed a $232m takeover bid.

Richlister Raphael Geminder will need to convince a large slab of minority shareholders in his underperforming packaging company Pact to accept a takeover bid of 68c a share, which is below the current share price, if he wants to delist the company from the ASX and run it as a private business.

Mr Geminder, who is Pact’s founder, chairman and largest shareholder with a stake of just over 50 per cent, will also be sweating on a recommendation from the board as it seeks an independent valuation of the business and if the 68c-a-share offer is fair and reasonable.

If the packaging mogul wishes to remove the Pact business from the ASX, essentially privatising it, he will need to get to at least 75 per cent ownership by winning over minority shareholders and the few institutions on the share register to his off-market takeover bid. However, even then at 75 per cent he will need to apply to the ASX for that approval.

That task could be made slightly more difficult as shares in Pact immediately spiked on news of the takeover bid launched by Mr Geminder’s private investment vehicle, Kin Group, with the shares rallying 8 per cent to a high of 73c, before closing at 72.5c.

Mr Geminder’s Kin Group is prepared to buy shares at 68c and will open the window for Pact shareholders to accept the offer in two weeks. However, if the stock remains above that offer price, as it is now as some hedge funds rush the bid to cause mischief and make money, the takeover might stall.

Kin Group insiders have noted that in the past two takeover bids launched by Mr Geminder for a public company – industrials company McPherson’s and retailer The Reject Shop – he made only one bid and did not raise the offer.

A key investor in the looming battle for Pact will be Investors Mutual, which has a stake of just under 7 per cent and is one of the largest institutional investors on the share register. A spokesman for Investors Mutual said the funds manager would not be commenting on the bid.

On Wednesday, Mr Geminder made his offer to minority shareholders in ASX-listed packaging company Pact to take it private after heavy losses, rising debt levels and a share price that has collapsed by more than 80 per cent in the past five years.

In a statement to the stock exchange on Wednesday, Kin Group said it had made an unconditional off-market takeover offer to acquire all the Pact shares it did not own at 68c cash a share.

The offer is a long way from 10 years ago, when Pact raised about $649m based on an initial public offer of $3.80 a share. The Pact float was the largest IPO in the Australian market in 2013 and the second-largest IPO for a packaging company completed globally.

In 2017, Pact shares were trading at just under $7 and the company was valued at more than $2bn. But big Pact losses have resulted in a tumbling share price. The stock is down 58 per cent in the past 12 months.

In his case to minority shareholders, Mr Geminder is arguing that, given Kin’s current majority ownership, the prospect of a competing offer eventuating is highly unlikely, and given the uncertain macroeconomic outlook and operational issues at the company it was in the best interest of all shareholders that the company was taken private.

“Kin Group considers that success for Pact is best achieved under private ownership without the additional costs, market volatility and complexities of being an ASX-listed company,” Kin said in a statement.

“Kin Group intends to delist Pact from the ASX as soon as it is able to do so – subject to the ASX listing rules, legal, tax and other considerations, and the level of acceptances.”

At the same time, Kin Group released a change of substantial shareholder notice to the market, revealing that Mr Geminder had increased his stake in Pact to just over 50 per cent.

“The offer provides shareholders with liquidity and certainty of an unconditional, all-cash offer at a price above Pact’s share price of 67.5c per share at the close of trading on September 12 and allows shareholders to avoid any further risk associated with their Pact investment,” Kin Group said in its statement.

Kin said Pact faced a challenging environment, with supply chain disruptions, inflationary pressures, fluctuating resin prices, labour constraints and macroeconomic uncertainty.

These challenges were also made more threatening by the fact Pact was a smaller company with a high level of debt even after the partial sale of a business unit.

n a statement, Pact said the board of directors was not yet in a position to make a formal recommendation to shareholders in relation to the bid. Shareholders should take no action at this time, the board said.

Given Mr Geminder is chairman he has recused himself from the board and committee consideration of the offer for the duration of the offer period.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout