The action was timed to perfection with TWE launching its latest Penfolds products in a gala event in Shanghai on Tuesday.

The dumping complaint against Australian wine is on any reading a nonsense given China has no real industry competing at the high end of the wine industry. The action comes after similar attacks on Australian barley imports and interim historic attacks on dairy exports.

From China’s perspective wine is the perfect scapegoat.

The upside for Australian consumers is if China actually proceeds to take action against wine exports to the country then the local market will be flooded with cheaper products.

As one analyst said, “there will be a lot of cheap Penfolds to be drunk in Australia”.

Then again Ford might be hoping for a massive sales binge to get in before Beijing raises prices.

If logic prevails and this is more talk than action then TWE will regain the $1.4bn in value lost yesterday on the news with its stock price down 14.3 per cent to $10.58 a share.

Wine is a “nice to have” rather than “must have” product like iron ore, and Australian wine is the largest source of imports in China at 37 per cent, followed by France at 27 per cent, Chile at 13 per cent and Italy at 6 per cent.

Over the last three years the value of Australian wine exports have increased by around $582m, 85 per cent of which went to China.

The figures are more dramatic for red wine with China accounting for $501m of the $550m increase in sales.

On BAML figures, TWE’s earnings before interest and tax will increase from $533m for the year just gone to $1bn in 2023, and 85 per cent of that increase was supposed to come from China.

Anti-dumping action is an obvious form of attack against Australia given China is the country attacked most often by the Australian Dumping Commission.

Overall there are 81 measures in place against 22 countries but China accounts for 17 cases, double the next nearest in Thailand at eight.

Dumping duties are imposed when the goods in question are exported at below the normal value in the country of origin and cause injury to the local industry.

The latter leg would be hard for China to establish.

Steel and aluminium account for 81 per cent of all Australian dumping complaints being sourced from the two domestic supplies who have effective monopolies in their respective product ranges — BlueScope and Liberty Steel.

Chinese authorities often complain that Australia bypasses the normal rule with China steel because the authorities don’t accept Chinese prices and instead use a benchmark of neighbouring countries including Taiwan, Malaysia, South Korea and Thailand.

None of which is particularly helpful for TWE’s Ford because the Chinese complaint appears based more on political tension between Australia and China and not on the fine details of the World Trade Organisation rules.

Ford said in a statement: “This decision matters deeply to our business and the entire wine industry, both in Australia and China. We have played a long-term positive role in growing the wine category in China, and we will continue to take a leadership role as this issue plays out.”

The move also comes as Treasurer Josh Frydenberg is delaying approval of China dairy group Mengniu’s $600m purchase of Lion Dairy from Kirin’s Lion Australia.

Leaner, greener BHP

BHP boss Mike Henry declared his commercial ties with China “had never been stronger” which was nice for him to say and a reflection of the fact China needs his products.

Henry talks up growth but on the basis of yesterday’s profit briefing it is a leaner and greener BHP he has in his mind.

Henry confirmed talk of thermal coal and Bass Strait oil asset sales while iron ore exports to China led the way with a stunning performance, accounting for 67 per cent of earnings or $US14.6bn on a 70 per cent profit margin and a 56 per cent return on capital.

Copper was the next biggest contributor to the $US22bn in earnings with $US4.3bn at a 45 per cent profit margin and 7 per cent return on capital.

BHP’s earnings peaked at the top of the mining cycle in 2011 at $US37bn and that year it spent $US12.4bn on capex and its dividend was $US1.01 a share.

In 2020 the company reported earnings of $US22bn and paid $US6.1bn in dividends or $U1.20 a share and capex was $US7.6bn.

CFO Peter Beaven noted in 10 out of the last 11 years the company has paid out more than $US6bn in dividends so maybe shareholders are doing okay but it’s growth which is now being sought.

UBS analyst Dr Glyn Lawcock noted acquisitions had never been a strong suit for the company, when you consider 15 years ago it acquired WMC for the Olympic Dam project which has never quite delivered.

Then there was $US40bn spent buying and building shale oil in the US which produced $US10bn in earnings and $US10.6bn in sale proceeds, potash in Canada didn’t get to ground zero and on the list goes.

Potash is still on the agenda with the board now to decide on the future of the Jansen project in the middle of next year after delaying the decision again due to COVID restrictions in the mine.

Henry like the rest of the industry is lumbered with increased scrutiny on native title work post the Rio Juukan Gorge snafu.

He supports WA Treasurer Ben Wyatt’s caution that while the public focus is welcome what the native title holders want is empowerment and it is important that what happens next does not rob them of any powers.

BHP controls have a 12-month reset so an asset is timed out every year, which means the native title issues are looked at again.

Cain delivers

In two years Coles’s Stephen Cain has established himself as a first rate supermarket boss, posting a 10.7 per cent increase in earnings on a 6.8 per cent increase in sales.

The operating leverage wasn’t quite as strong as the market hoped but it remains to be seen how his friends at Woolworths perform by comparison.

COVID has proved a tonic for increased sales with Coles’s fourth quarter sales up 7.1 per cent, after 13.1 per cent in third quarter where he beat Woolies for the first time after being topped for the last 11 out of 12 quarters.

The cost of doing business fell slightly and margins increased with Coles avoiding the gold plating which Woolworths was guilty of in past quarters and maintaining strong discipline.

This has included better logistics planning to make store refills easier, better lighting control, fridges which turn off when the temperature is right and further measures to prevent store thefts.

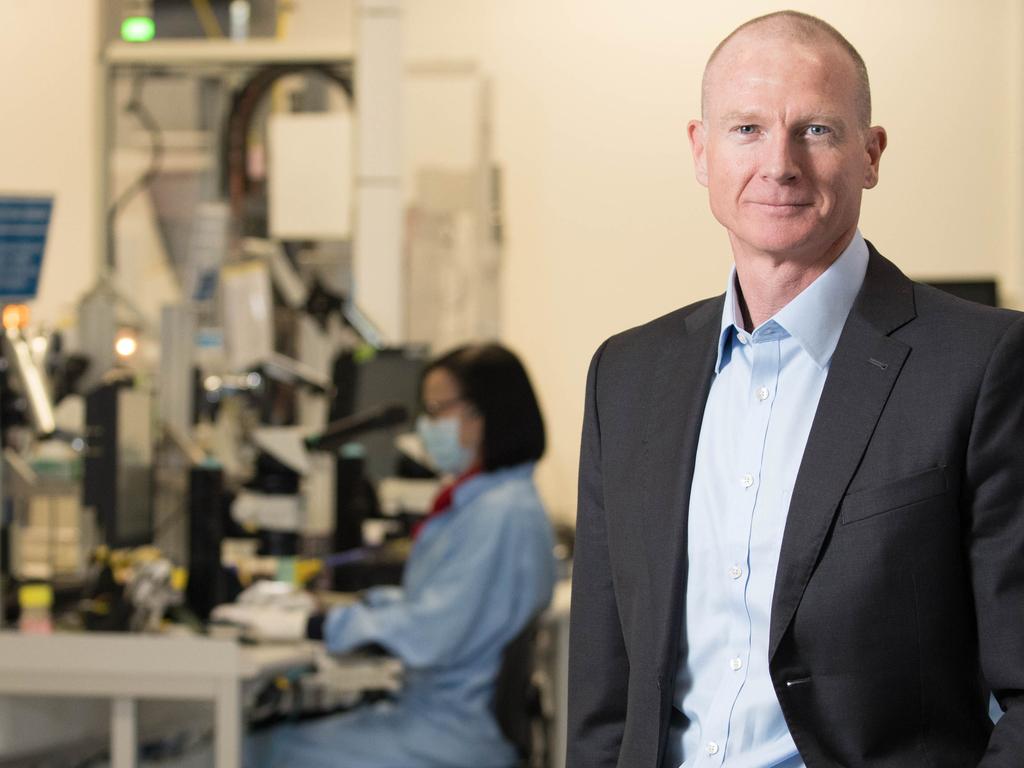

Tim Ford, the new boss of Australia’s biggest wine company Treasury Wine Estates, has found himself in a nightmare at the centre of a political storm with the potential of blowing up 85 per cent of his growth prospects.