Medibank open to buying rivals, calls for reform as profit sinks

Medibank is open to buying distressed rivals as the financial regulator warns industry consolidation is inevitable.

Medibank chief executive Craig Drummond is ready to begin a spending spree, acquiring financially stressed competitors as the financial regulator warns that only three health insurers will have a viable business model by 2022.

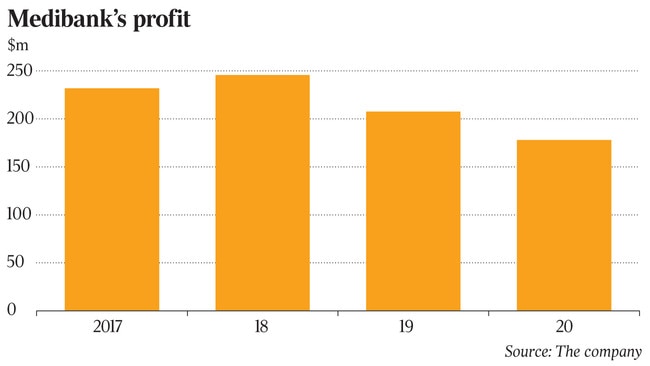

Mr Drummond’s comments came as Medibank, Australia’s biggest health insurer, posted a 9 per cent slump in half-year net profit to $178.6m amid “extraordinary” high prostheses claims.

He said unless there was urgent government reform in the health insurance sector it would pave the way for consolidation and Medibank was ready to open its wallet.

“We are keen to grow organically unless the environment becomes significantly stressed, in which case we are open to looking to take on other funds if they get themselves into financial difficulty,” Mr Drummond told The Australian.

“We are happy to continue to go down that path. I think there is going to be more than three funds that will be in the game.

“There is no question that some funds are already under stress and if the environment continues without some of the reforms that we have been talking about, it’s going to be a much smaller industry.”

On top of the Medibank chief executive Craig Drummond’s reform wishlist is an overhaul of prostheses — replacement knees, hips and other joints — which he said was costing health insurers about $2bn a year and rising about 6 per cent a year.

“The key driver of claims growth was a 6.4 per cent increase in prostheses cost, which was responsible for 69 per cent of the increase of growth in hospital claims.

“This is extraordinary given a subdued 1.1 per cent increase in hospital utilisation for the half.

“Generally if you have 1.1 per cent uplift in the number of people going to hospital, you typically don’t continue to have this significant acceleration … of prosthesis utilisation. That means you’re using more devices per person.”

Medibank’s shares closed 2 per cent lower at $2.92 on Thursday.

It is the second time in four months that Mr Drummond has questioned the spiralling costs of prosthesis. Last November he blamed a $21m cost blowout on soaring prostheses claims, which he said “didn’t feel right”.

Up until 2017, prostheses cost two to three times more in Australia than overseas. The federal government, which mandates the cost, brought the prices of cardiac, hip, knee and eye prostheses more inline with other countries in a move that aimed to save $250m.

But Private Healthcare Australia chief executive Rachel David said device sales representatives began upselling ancillary products, such as skin glue, in their prosthesis kits, with volumes in the general miscellaneous category surging about 19 per cent in 2019 alone.

Dr David said this has meant the $250m in savings the government envisaged had only totalled about $13m, squeezing margins.

According to the Australian Prudential Regulatory Authority, health insurer net margins declined from 5.2 per cent to 3.9 per cent in 2019. Despite the deterioration in insurance performance, profitability improved due to an increase in net investment income, largely driven by stronger returns in equities in the year ending December.

Dr David said she hoped Australia’s 37 health funds would remain viable but without significant reform change she conceded consolidation was likely.

“In the current economy, with household income remaining flat and the demographic issue of people living longer and demanding more surgery, it will be challenging for a fund without scale to continue unless there are significant changes.”

Medibank paid $2.9bn in claims in the six months to December 31, against a premium revenue increase of 2.4 per cent to $3.316bn.

The results came as almost 10,000 Australians dumped private health cover in the last three months of 2019, leaving the share of members with hospital cover at its lowest level in 12.5 years and deepening the industry’s “death spiral” crisis.

“Participation, out-of-pockets and lifetime health cover loading remain concerns emblematic of headline problems: claims growth being larger than premium growth,” Macquarie analysts wrote in a note to investors.

“Almost every indicator is now pointing towards a negative trajectory, reinforcing fears that industry performance could continue to get worse.”

Medibank will pay an interim dividend of 5.7c a share on March 26.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout