Medibank calls for medical device probe, plans special dividend after full year profit lift

Medibank’s boss has called for a deep dive into the “unusual” rise in medical device use in the private sector.

The head of Australia’s largest health insurer has called for a deep dive into the “unusual” rise in medical device use in the private sector as he calls for further reforms to address affordability.

Craig Drummond, chief executive of Medibank (MPL), said today that the insurer had not seen the total dollar amount of the benefit it passed onto customers — via lower annual premiums — post previous reforms to reduce the cost of medical devices.

Insurers had previously agreed to pass onto consumers the full benefit of savings from cuts to prices on some items on the Prostheses List, which determines what funds must pay for medical devices.

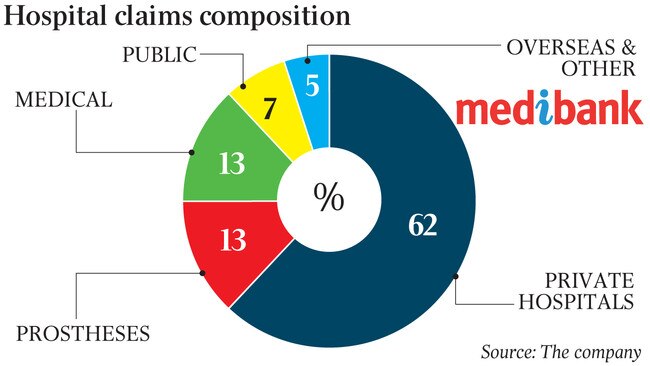

New private health insurance stats out this week from the financial regulator showed that there was an 8.6 per cent growth in claims cost for medical devices over the last year, against hospital claims, which were stable at 0.3 per cent.

“For some bizarre reason, volumes have accelerated quite sharply in prostheses,” Mr Drummond said.

“It is something that needs to be looked at as it seems unusual when broad hospital utilisation rates are low, we are seeing a sharp escalation in volumes of medical devices.

“We will pay for the right care if our customers need it but there needs to be a hard look at what is happening here because it does not feel right.”

Mr Drummond said further reform on the cost of medical devices in Australia’s private healthcare system was needed.

“We are still significantly priced above international prices,” he said.

The Medical Technology Association of Australia signed an agreement with the federal government in 2017, which agreed to lower the cost of some items on the Prostheses List, with the benefit to be passed on to health insurance premiums.

The MTAA said this week that a claim by the health insurance lobby group that device companies were driving sales volume to offset government reforms was disingenuous and “factually incorrect”.

The medical device industry body said that despite an 8.6 per cent increase in volume, an 8.5 per cent drop in average benefit level had meant that insurers had paid $13 million less for medical devices over the last financial year.

“The medical devices industry has made the only direct contribution to keeping the cost of private health insurance down, delivering the lowest premium increase in 18 years,” Ian Burgess, chief executive of the MTAA, said.

The Australian-listed Medibank released its annual results today, which reported that its group net profit after tax increased 3.1 per cent to $458.7 million.

Mr Drummond defended the company’s profit in an environment when customer affordability was an issue.

He highlighted that the average industry profit margin had decreased over the last year from 5.25 per cent to 4.89 per cent.

“There is no question we have to do more on affordability but if you look at the whole private healthcare industry, 4.89 per cent is a low margin compared to the other participants in the market,” Mr Drummond said.

“Our margin is higher (than the average) but we have been aggressively cutting our own costs and investing in innovation.”

The Medibank chief said the industry was working to get premiums lower, adding that getting it closer to wages growth was critical.

“There is also an economic overlay where the consumer has been feeling the pinch from the sluggish domestic economy,” he said.

“The election and the reform process through that January-May period did take the top off demand for our industry product and that has probably been pushed into July-August.”

The Medibank chief also said that some media reports on the industry had taken the bait from some commentators that the industry was in a “death spiral”, which he said was a view he did not agree with.

“There is a need for reform and ongoing change and we need to look at our own costs but there is a lot of emotive language being used,” he said.

“We are concerned about the whole health system, both public and private need to be sustainable. All of the stakeholders need to make change and innovate.”

Medibank announced today a broader cost savings target, increasing a previously announced target of $60m to $90m over five years.

“If we go to government or to the consumer and say it’s only a certain percentage (annual premium) increase that doesn’t go down well if our own costs are rising sharply,” Mr Drummond said.

The insurer’s results also reported that health Insurance operating profit increased by 1.3 per cent to $542.5m. At a fund level, Medibank grew net resident policyholder numbers by 15,100, or 0.8 per cent.

“Given the challenging environment we thought it was a solid result,” Mr Drummond said.

“To have policyholder growth every quarter of the year is a new thing for us, particularly given the broader market has been a bit soft.”

The insurer also announced today that a move to a lower target capital range in fiscal 2020 had resulted in a release of about $65m in capital, which would be returned to shareholders as a special fully franked dividend of 2.50c.

Medibank also said its final dividend of 7.4c-per-share would take its full-year dividend to 13.1c-per share.

“The special dividend is reflective of a reduction of Medibank’s capital range from 12-14 per cent to 11-13 per cent of premium revenue,” Mr Drummond said.

The company has forecast flat overall private health insurance market volumes, adding that on the current policyholder trajectory, it expected to see Medibank brand volumes stabilise by the end of fiscal 2020 and grow during 2021.

Medibank also expects hospital and extras utilisation growth to remain around current levels for this financial year with prostheses expenditure expected to add modestly to claims growth compared to last year.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout