McPherson’s rejects Raphael Geminder takeover bid

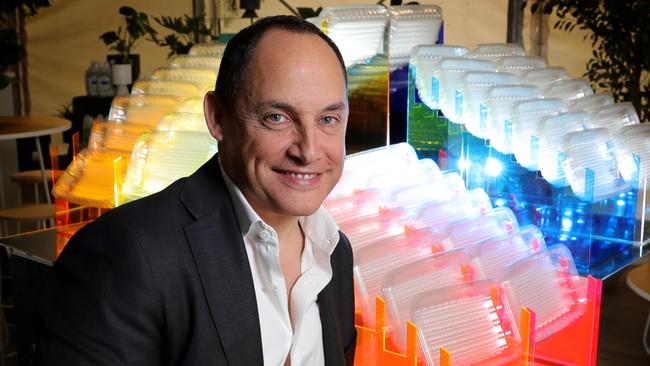

McPherson’s says Raphael Geminder’s offer ‘profoundly undervalues’ the firm, but doesn’t rule out working with him.

The chairman of takeover target McPherson’s is leaving the door open to work with billionaire Raphael Geminder in the interests of all shareholders and the company, but declared he won’t co-operate if the entrance of the takeover suitor into the boardroom is disruptive to directors and management.

Graham Cubbin stuck to his strong belief that Mr Geminder’s $1.34 per share takeover offer for the diversified industrial was opportunistic and severely undervalued the company, with McPherson’s focus on health, wellness and beauty providing an exciting opportunity for the group.

Speaking to The Australian on Wednesday after McPherson’s announced that its interim chief executive Grant Peck would be made permanent CEO and that it was also conducting an operational review, Mr Cubbin said he had not spoken to Mr Geminder since he had launched his $177m takeover last week and was unaware of Mr Geminder’s plans for the business.

Mr Cubbin said he would be contacting McPherson’s major shareholders on Wednesday to make the case Mr Geminder’s bid had undervalued the company and was opportunistic, but said he could work with the packaging billionaire if he gains enough control to demand a seat or seats at the board.

“I personally can work with anybody; I will always act in the best interests of shareholders, that is what we are doing at the moment,” Mr Cubbin said.

“We believe we have an excellent board. We believe in Grant that we have an awesome leader. He (Mr Geminder) hasn’t reached out to me, it was a hostile bid, we only got notice literally minutes before they launched the takeover offer on the stock exchange and his offer is at an extremely low price, which is recognised by some of our major shareholders like Simon Conn at Investors Mutual.

“Any way you look at it is a hostile bid, but in the fullness of time if the view was he (Mr Geminder) had something to contribute to the company, which would be in the long-term interests of shareholders, of course we would consider that.

“But I don’t want to see a disruption of either our board or our management team.”

Newly-appointed CEO Mr Peck agreed McPherson’s “can work with anyone”, but he was more focused on the growth opportunities for the group, which included ramping up its stable of health, wellness and beauty brands.

He said McPherson’s had “no idea” what Mr Geminder planned for the business.

“It is a bit hard to hypothesise when frankly we have got nothing other than what appears to be an opportunistic and cheap offer in an environment where his premium is a pretty anaemic premium,” Mr Peck said.

Diversified industrial McPherson’s firmed up its defences against the $177m takeover bid by appealing to its shareholders that Mr Geminder’s offer was “utterly opportunistic” and “profoundly undervalues” the company.

McPherson’s, which owns a stable of health and wellness brands, such as Dr LeWinn’s, Lady Jayne, Glam by Manicare and Swisspers, has also launched an operational review under the guidance of its new CEO and is asking its shareholders to await the outcome of the review before taking action on the takeover bid from Mr Geminder.

Mr Peck would not detail the direction or areas the operational review would delve into but stated it was not going down the route of selling off some of its businesses or demerging divisions, but rather would focus on replicating the success of some of its key health, beauty and wellness brands. It would also seek other growth markets outside of China where some of its brands such as Dr LeWinn’s had been performing strongly before COVID-19.

In response to McPherson’s announcements on Wednesday, Gallin, a wholly-owned subsidiary of Mr Geminder’s family vehicle Kin Group, put out its own statement saying the company hadn’t answered investor concerns about the company’s outlook.

“The company has failed to address the uncertainty investors face with regard its trading outlook or provide confidence it has the right experience or capability to fix its chronic underperformance.

“Gallin is closely reviewing the update and proposes to respond in due course, and looks forward to receiving more detailed and transparent information in McPherson’s targets statement.”

There were also some concerns about a trading outlook provided by McPherson’s on Wednesday, which pointed to a softer March for its Multix and Swisspers range.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout