Jan Cameron eyes $300m Bellamy’s payday

The Chinese bid for milk group Bellamy’s has triggered a near $300m payday for Kathmandu founder Jan Cameron.

China has swooped on Bellamy’s Australia in a $1.5bn takeover bid that seeks to secure its supply of “clean and green” infant milk formula but could set the suitor on a collision course with the Foreign Investment Review Board as trade tensions flare.

The bid by China Mengniu Dairy has triggered a near $300m payday for Bellamy’s biggest shareholder, reclusive Tasmanian businesswoman and founder of the Kathmandu clothing and equipment chain, Jan Cameron.

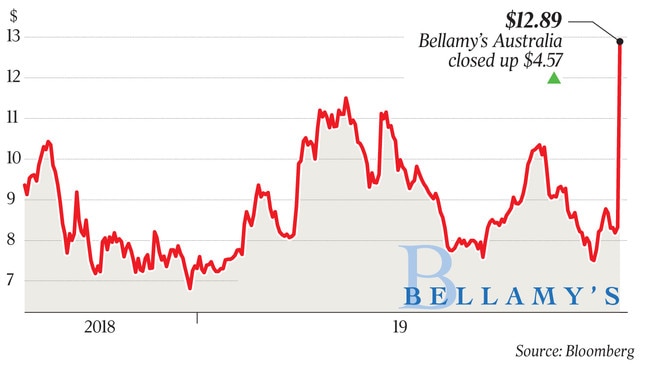

Shares in Bellamy’s rocketed more than 50 per cent on the takeover offer to a high of $12.98.

However, the stock is still a long way from its peaks above $20 when investors were enamoured of its booming sales into China and the prospects of hundreds of millions of Chinese newborns being fed Bellamy’s products.

The deal represents the first Chinese takeover of an infant milk formula group and the biggest Chinese takeover in the dairy sector since Moon Lake Investments bought Van Diemen’s Land Company dairy in 2016.

China Mengniu Dairy is listed on the Hong Kong stock exchange and enmeshed in China Inc through its second biggest shareholder, the Chinese state-owned Cofco agricultural conglomerate.

Monday’s bid will need approval by the FIRB.

It comes at a time when Chinese investment and perceived influence is a hot-button issue in Canberra, as well as financial circles.

However, Bellamy’s chief executive Andrew Cohen said the two companies remained confident the licence would ultimately be granted.

“This transaction can further deliver on our founder’s original vision of a truly iconic Australian brand,” Mr Cohen said.

Bellamy’s Australia deputy chairman John Murphy said China Mengniu Dairy’s $1.5bn takeover bid for the infant milk formula business would “tick a lot of boxes” for all stakeholders, from governments to consumers, and he hoped the bid wouldn’t be tripped up by the FIRB.

Speaking to The Australian on Monday after Bellamy’s announced its board had unanimously backed an offer from Mengniu of $12.65 a share in cash, Mr Murphy said the takeover proposal was good for Australian manufacturing and investment, and part of a wider theme of consolidation in the consumer goods industry.

Announcing shareholder backing for the deal, Bellamy’s said shareholders would also receive a 60c special dividend paid by the company before the takeover was implemented.

The offer is at a 59 per cent premium to the last closing price for Bellamy’s.

Bellamy’s shares surged by more than 55 per cent and later closed up $4.57, or 54.92 per cent, at $12.89.

Mr Murphy said trade tensions between China and the US or the wider western world should not overshadow the advantages and benefits of the takeover proposal.

Mengniu has already begun its opening discussions with the FIRB, which Bellamy’s is supporting.

The Mengniu FIRB application lists the state-owned Cofco as one of its biggest shareholders with a 16 per cent stake.

This could threaten the deal as governments here and in the US fret over Chinese access and control of technologies, patents and manufacturing assets.

“The other party is leading that process on FIRB. We continue to be fully engaged and respect that process, and we are positive about what the outcome might be,’’ Mr Murphy told The Australian.

“It ticks a lot of boxes for Australia and what it supports in terms of ongoing supply chain manufacturing presence, organic (milk) pool, employees — we think it ticks a lot of boxes.

“In terms of Australian manufacturing, Australian sourcing … ticking employment, building a bigger business, investing in brands, continuing to have a presence in Australia with a divisional office.

“And all we’re seeing, we can only just comment on the different stakeholders across the whole community and landscape and we think this is a very positive outcome on those fronts.’’

Mr Murphy said there “was no conspiracy” surrounding the takeover, given Bellamy’s had its Chinese import licence delayed for more than a year for unexplained reasons before suddenly becoming the target of a takeover by a Chinese company whose biggest shareholders include a state-owned enterprise.

“I think when we look at it, our licence, we are not the only ones … there are a lot of players globally in businesses waiting for a licence so there is no conspiracy element to this, the process, and we respect that.”

Armytage Private portfolio manager Bradley King said despite trade machinations, particularly between China and the US, Australia was still an important cog in global commodity movements.

“The quality premium still exists whether it be dairy-based products in Bellamy’s recent takeover offer, Capilano Honey or our mining exports,” he said.

“The price offered is a knockout.

“By having direct ownership it removes any issues in supply from the daigou traders and will be more palatable with China’s cross-border e-commerce policies.

“On one hand it’s a shame to see the ASX lose another top quality food brand, but on the other hand highlights Australia as a world leader in food processing and quality control.”

Mengniu chief executive Jeffrey Lu Minfang said Bellamy’s organic brand position, local operation and supply chain were critical to the bid.

“Bellamy’s is a leading Australian brand with a proud Tasmanian heritage and track record of supplying high-quality organic products to Australian mums and dads,” Mr Lu Minfang said.

“Our sales growth ambitions for Bellamy’s in Australia, and the broader Asia-Pacific region, will see investment in the local dairy industry to ensure the required capacity is in place to achieve these plans.”

Bellamy’s shares have had a classic rollercoaster run on the sharemarket, rallying from just above $4 five years ago to rise above $10, then quickly collapsing due to disappointing downgrades and profit warnings before resurging to highs above $20 as the market fell in and out and then back in love with the business.

Hurting the company has been the radically changing regulatory environment, where Bellamy’s has been forced to apply for a number of Chinese import licences, one of which has been delayed for more than a year for unexplained reasons.

Mr Cohen denied the Mengniu takeover would fast-track the Chinese regulation process.

“I don’t think this owner would change the likelihood of achieving this licence or when it would be achieved,” Mr Cohen said. “I will point out that many (companies) are awaiting their licences … including Chinese businesses.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout