The deal shouldn’t be blocked, but logic and the FIRB are not always on the same page, especially when it comes to sensitive political issues.

On a more positive view, with the Australian dairy industry on its knees in many places due to the drought, the $1.5bn deal is a welcome boost.

This is especially important as Mengniu is a known party and, from the experience of those at Burra Foods where it is a 60 per cent shareholder, a hands-off supportive owner.

Other corporate players, like Fonterra, are on their knees, Bega is stretched and Canadian-based Saputo is nearing its buying limits on ACCC concerns.

As it stands, the deal represents a windfall for some of the Bellamy’s team — starting with early shareholder Jan Cameron, who has about 19 per cent of the company, worth close to $257m.

At $13.25 a share, the deal represents a substantial premium of the 2014 listing at $1 a share.

Cameron, of course, is still a wildcard and has yet to declare her hand.

The company reports her as being positive about the deal, but she is yet to say that publicly and the retail maverick wasn’t returning calls yesterday.

Chief executive Andrew Cohen has 2.5 million options at different strike prices, which works out at a gain of some $14.9m, plus close to $700,000 on his 51,355 shares.

Not a bad return for someone who’s turn-up-to-work pay is more like $800,000 and even that is considered hefty for a company that reported a profit of $21.7m last year on revenues of $266.2m.

Deputy chairman John Murphy, who is credited as being a key negotiator, has about 194,000 options, which puts him ahead $1.5m on the deal.

The former CUB boss who still does 1000 sit-ups a day will have something to plan in his daily routine, while chairman John Ho, from Hong Kong-based Janchor, has 8.8 million shares worth $116m under the deal.

The selling point of this deal is its organic milk powder venture based in Launceston that imports its product from around the world because Australia doesn’t have enough organic dairy. The product is mixed mainly by third parties like Bega in Victoria.

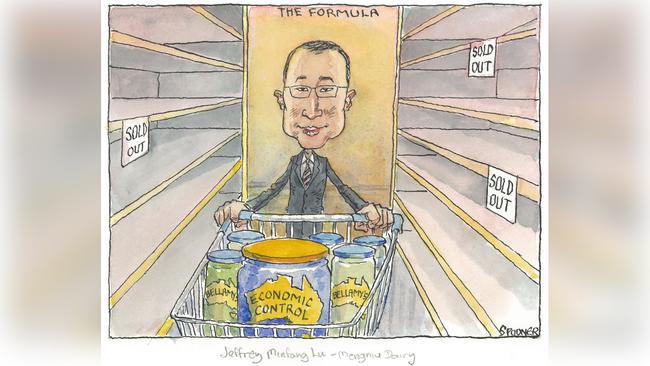

Some might say it’s a classic Chinese play, given Bellamy’s long running issues around licensing in China, and in this case its Camperdown site. But now comes the solution — a Chinese takeover.

That, of course, credits the Chinese government with extraordinary vision and planning.

It must be said other plants face similar licence uncertainty.

Suffice it to say assuming the deal proceeds there will be many watching with interest just how the regulatory wheel turns for Bellamy’s.

A parliamentary sitting week when China control is a big issue is probably not an ideal time to launch a bid, even if the share price premium on offer is 60 per cent

Cameron was the key player in overturning Bellamy’s chairman Rob Woolley and his comrades two years ago in a board coup, which saw Hong Kong-based Ho seize control.

In 2017, after hitting a valuation of $1.4bn the previous year, the company was caught on the wrong end of a take-or-pay contract with Fonterra after over-estimating its Chinese sales.

The bidder, Mengniu, is part of the giant China National Cereals, Oils and Foodstuffs conglomerate, which is no stranger to Australia, having acquired a 60 per cent stake in Burra Foods three years ago.

For Ho, Chinese ownership could well clear one of the persistent difficulties the company has faced in getting Chinese approval for its product, which is aimed at the Chinese market.

The deal in many respects is the logical next step for a company that has been a marketing coup from its founding in 2003, selling itself as an organic dairy food company based in Tasmania.

This was despite the fact much of its product was imported from Australia and New Zealand and mixed in Victoria, but organic and Launceston has a better ring to it.

Under former boss Laura McBain, Bellamy’s increased sales from $3m a year in 2006 to $240m when she was shown the door in 2017.

Under Cohen’s leadership, Bellamy’s profitability has been restored, but market concern was shown by the heavy short interest in the stock, which was 15 per cent short, and explains the 56 per cent jump in the stock price on Monday to $12.96, just short of the $13.25-a-share bid price.

The Hong Kong-based HSBC team met with Ho about three months ago to talk through the deal, which was finalised in a last-minute flurry in the past two weeks.

HSBC and Norton Rose represented Mengniu and Morgan Stanley and Allens stepped up for Bellamy’s.

New energy powers

On Tuesday, Energy Minister Angus Taylor and Treasurer Josh Frydenberg will present the Coalition party room their planned energy investment bill aka Treasury Laws Amendment prohibiting energy market misconduct.

The law has three main aims: to ensure any cost reductions are passed on in retail prices, to ensure the company is playing by the ASX disclosure rules and is not withholding supply — so as a generator they contract with any retailer who presents for the deal.

The big three — AGL, Origin and Energy Australia — are both wholesaler and retailer, which is where the problems and market power emerge.

The ACCC said on Monday that price rises in the past decade were due 32 per cent to unnecessary green subsidies (rooftop panels no longer subsidised), 29 per cent to poles and wires, 26 per cent to retail profit margins and 14 per cent for wholesale.

The government’s aims are fine — it’s the way it is directing penalties that is wrong.

To combat any of the big three refusing to contract with a smaller retailer, the suggested plan is to give the Treasurer effective power to contract energy prices — and that would be unprecedented and disruptive. Given the government is the sole shareholder in Snowy Hydro it would also represent a clear conflict of interest.

It is extraordinary that the same conservative government, which committed the heresy of a sector-specific tax on the big banks two years ago, would be considering repeating the act with a sector-specific divestment power.

The move comes against ACCC recommendations and is in direct conflict with the advice to government four years ago by RBA board member Ian Harper and unlike similar offshore laws that are economy-wide.

That is in the US and Britain they could apply the same to banks or internet platforms or energy companies, which doesn’t make the powers any more palatable, just more wrong.

Britain, it should be noted, requires an ACCC inquiry before any such move.

The powers would increase investment risk and volatility and in this way directly conflict with the government’s stated aim of reducing prices and increasing stability.

The ACCC not surprisingly gave its default offer plans the big tick in its report on Monday noting that while the big three are cutting out discounts to recoup margins lost with their offers program, the smaller retailers are still offering discounts.

The Foreign Investment Review Board looms as a major hurdle to China Mengniu’s $1.5bn bid for Bellamy’s, with political sensitivity around Beijing heightened in the wake of the Gladys Liu controversy.