Peter Warne’s retirement plans add to Macquarie overhaul

Macquarie chairman Peter Warne has thrown succession planning back into the spotlight after flagging his likely retirement in 2021.

Macquarie Group chairman Peter Warne has thrown succession planning back into the spotlight after flagging his likely retirement in 2021, adding to a spate of executive changes over the past nine months.

The asset management giant and investment bank’s CEO Shemara Wikramanayake will lose her fourth executive in September when co-head of corporate and asset finance Garry Farrell retires.

She took the reins from Nicholas Moore in December and has since lost three other members of the executive team: Tim Bishop, Andrew Downe and Ben Brazil. All have been replaced with internal successors. At Macquarie’s annual meeting yesterday, Mr Warne told investors 2021 was the “most likely” end of his board tenure and that succession planning would include looking at both existing directors and external candidates.

“I will have had 14 years at that point,” Mr Warne said.

He has been chair since 2016 and joined the board in 2007. Macquarie’s board includes former Reserve Bank governor Glenn Stevens, experienced director Jillian Broadbent, former Insurance Australia Group CEO Michael Hawker and Woolworths chair Gordon Cairns, who is stepping down next year.

Mr Moore ceased being a paid adviser to Macquarie yesterday, Ms Wikramanayake told investors.

Mr Warne also used the AGM to express some support for the prudential regulator’s proposed overhaul of pay structures in the finance sector, but stopped short of endorsing a prescriptive threshold on the composition of bonuses.

“We are generally supportive of the general direction … non-financial risks are certainly something we take into account,” he said.

But when quizzed further on the sidelines of the AGM, Mr Warne told The Australian he didn’t support a structure that prescribed that bonus metrics were equally comprised of non-financial measures such as conduct, culture and customer satisfaction.

“We don’t like that system,” he said.

“We’ve never been in favour of that sort of model.” He said Macquarie’s pay model included a profit share component, but if an employee was to earn their entire performance allocation they must be deemed to have met non-financial metrics.

The Australian Prudential Regulation Authority is proposing banks, insurers and superannuation companies impose a 50 per cent weighting to financial and non-financial risks for short and long-term bonuses. It also wants longer periods to claw payments back if required.

Macquarie’s remuneration report was overwhelmingly supported by investors yesterday, with just a 4.5 per cent protest vote.

The Australian Shareholders’ Association voted against the rem report, saying the company needed to be more transparent on its pay structures and performance hurdles.

The ASA was also concerned that Macquarie didn’t release its governance self-assessment submitted to APRA last year.

On that topic, Mr Warne said Macquarie made a “very detailed” submission on the basis it was confidential and included commercially sensitive material.

He said releasing the document would be of little use as it would be heavily redacted but agreed to consider publishing a summary.

Macquarie used the AGM to reaffirm its guidance for profit to be “slightly down” in its 2020 year. That is despite Ms Wikramanayake telling investors the operating performance of its business divisions in the first quarter was “broadly in line” with the same period last year. In May, Macquarie reported net profit climbed 17 per cent to a record $2.98bn for the 12 months ended March 31. The company has posted higher earnings every year since 2013.

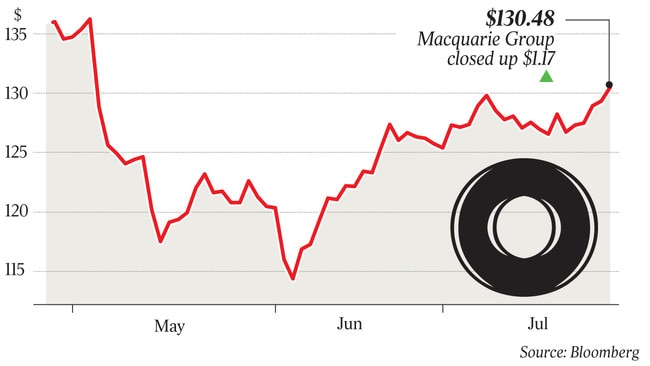

Macquarie’s shares initially dipped on the update before rallying to finish yesterday’s session 0.9 per cent higher at $130.48.

Yesterday’s announcements included that Macquarie’s corporate and asset finance unit would be absorbed into three of Macquarie’s other divisions. The principal finance business — excluding transport — joins the investment banking arm Macquarie Capital, while transport finance moves to Macquarie Asset Management. The asset finance business goes to Commodities and Global Markets.

The corporate and asset finance unit’s other co-head Florian Herold joins Macquarie Capital and remains on the group’s executive committee.

Australian Foundation Investment Co’s Geoff Driver said he remained positive on Macquarie’s medium to long-term prospects, despite a host of executive changes.

“We have confidence because of that strong culture and the way they grow people internally,” he said. “Those issues are not going to divert us from what we like about the company.”

Shaw and Partners analyst Brett Le Mesurier said the corporate and asset finance division was being disbanded and transferred into other units that were “making progress”.

“There is no growth in corporate and asset finance and so it’s being dismantled as a standalone division,” he said.

Macquarie’s business units that are less leveraged to financial markets had a lower contribution to profit in the quarter, while the markets businesses were up.

Ms Wikramanayake attributed that to the strong performance of the Commodities and Global Markets unit.

The trading update showed Macquarie Asset Management had $552.7bn under management as at June 30, up 2 per cent on the prior three months.

At a group level, Macquarie has surplus capital of $5bn.

UBS analyst Jonathan Mott said Macquarie would find it challenging to repeat its 2019 record profit, but expected the company to continue to execute on its plans.

“We expect the stock to range trade around current levels until it begins to generate positive earnings momentum,” he said.

Macquarie has a track record of providing conservative guidance early in its year and ratcheting that up as it gets closer to March 31.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout