AP Eagers axes 1200 jobs, wins rent relief

The nation’s biggest car dealer has made 1200 staff redundant to cut costs and won rent relief for many of its properties.

The nation’s biggest car dealer, AP Eagers, has made 1200 of its staff redundant to slash costs during the coronavirus pandemic and has also won rent relief for over half of its leased properties.

In a trading update, AP Eagers further said it had won $122 million in credit approvals from car parts manufacturers to aid liquidity through the crisis.

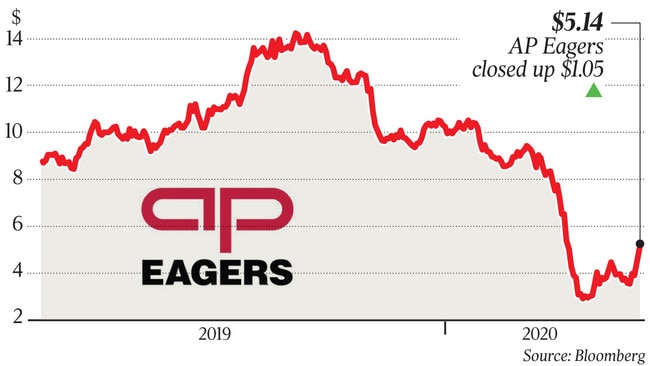

Shares in AP Eagers rocketed more than 26 per cent higher on back of the rental and finance news, closing up $1.07 to $5.16.

AP Eagers said that in mid-March, as an initial response to the pandemic and associated government-imposed restrictions, the company took the difficult decision to cut its workforce by about 1200 roles, reducing employee costs by approximately $6 million per month.

“AP Eagers is taking action to ensure we are able to retain as many of our 8200 employees as possible while moving to a temporary rostering arrangement across most parts of the business.

“The company is applying for the federal government’s JobKeeper assistance program and is confident a large proportion of the workforce will be eligible, helping to support the workforce and a faster recovery when the external environment improves.”

AP Eagers’ non-executive directors will forego director fees while all senior executives will take a 50 per cent reduction in remuneration packages and have agreed not to participate in new equity incentive plans in 2020.

Shares in AP Eagers rose 20 per cent to $4.94 in lunchtime trade.

The car dealer said the support of landlords was also critical to ensuring the company could navigate the crisis and they had helped cushion the blow by offering rent relief.

“AP Eagers continues to proactively engage with our landlords, who have to date agreed a combination of waiver and deferral of over 50 per cent of our lease commitments in terms of number of leases and value of rental outgoings for the next three months.

“In parallel, the company continues to actively review and optimise its property and dealership portfolio.”

AP Eagers has been strongly supported by key auto suppliers, in particular original equipment manufacturers (OEM) partners, who typically supply spare parts, who have offered a range of measures to support the liquidity of dealerships during this period.

“AP Eagers has secured credit approval for new working capital facilities from our OEM finance partners totalling $122 million.”

AP Eagers said it had moved rapidly to preserve cash and optimise liquidity. Measures include the deferral of tax payments, pre-emptive inventory management, reviews of marketing and advertising and a freeze on non-essential expenditure.

“We are confident these actions have established a liquidity profile that will ensure the company can navigate through the current crisis and is well positioned should the situation worsen.”

AP Eagers CEO, Martin Ward, said while the impact of the COVID-19 pandemic has been severe on the automotive retail industry, AP Eagers had responded swiftly.

“Our response has required us to make some difficult decisions and seek the support of our employees, manufacturing partners, landlords and financiers, to help ensure we can navigate the crisis.

“The duration and depth of COVID-19’s impact on our business remains uncertain but with strong foundations, decisive measures to preserve liquidity and the support of all our stakeholders, we are confident of overcoming this global pandemic and rebounding quickly for the benefit of our employees and all of our stakeholders.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout