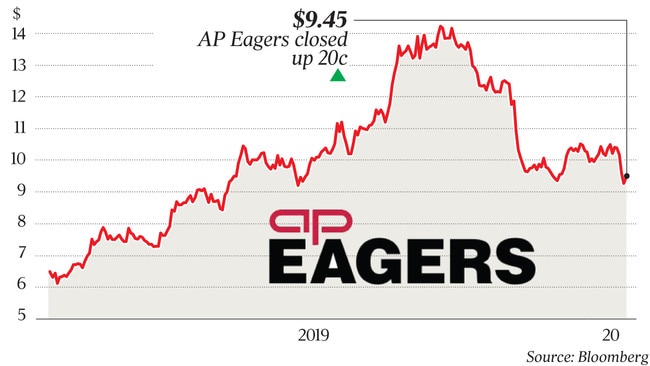

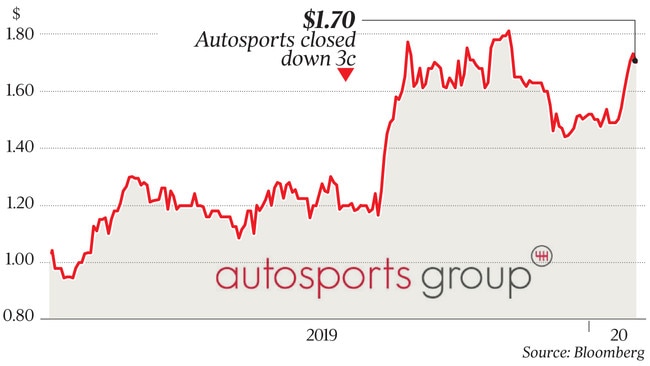

Investors in automotive dealerships AP Eagers and Autosports are bracing themselves for additional profit downgrades in the coming days, after new motor vehicle sales for 2019 plunged to their lowest in eight years.

Car sales last year fell 7.8 per cent, according to data from the Federal Chamber of Automotive Industries, and the expectation is that this will weigh further on the bottom lines of AP Eagers and Autosports.

AP Eagers, which is 27 per cent-owned by dealership king and Sydney Roosters chairman Nick Politis, issued two profit downgrades last year.

Now some question whether another is on the cards.

They are also not discounting a move by Autosports, which has seen its share price fall from 2016, when it first floated.

With its market value at $348m, Autosports could even be a private equity takeover target should its share price fall further at a time firms are cashed up and ready to spend amid the low interest rate environment.

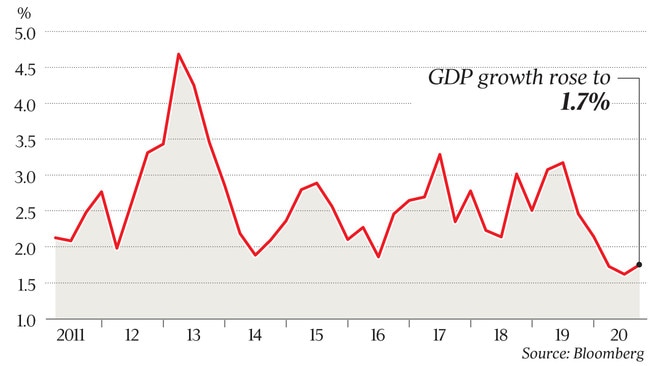

Last year was the second consecutive year of falling car sales, and sales are unlikely to improve any time soon. The situation is a telltale sign for Australia’s broader economy in 2019, when falling house prices made homeowners hesitant over spending on major items like cars, due to weak wage growth and high household debt.

The Reserve Bank estimates that a 1 per cent increase in household wealth raises expenditure on motor vehicles by 0.6 per cent.

Lending restrictions have become tighter since the royal commission and dealers are wrestling with big competition and thin margins. The restrictions come after AP Eagers completed its $2.4bn merger with AHG in September. Its market value is $2.4bn.

AP Eagers has a $300m-odd property portfolio, with ownership of more than 30 of its vehicle dealerships, which offers the company an option of securing more funds by selling the assets if it needs cash.

It is wrestling with low car sales at a time when it is also moving to sell the refrigerated logistics business it inherited from AHG. Anchorage Capital Partners is understood to be carrying out extensive work on the business that is up for sale.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout