$1.3bn blow for CIMIC as administrator moves on Qatar unit

Construction giant CIMIC faces a fresh business setback in the Middle East after its Qatar venture was served with hundreds of legal claims.

Construction giant CIMIC faces a fresh business setback in the Middle East after its Qatar venture was served with hundreds of legal claims demanding unpaid debts topping $US1bn ($1.3bn), with an administrator appointed amid fears that delays in paying hundreds of workers could spark a humanitarian crisis.

CIMIC, Australia’s biggest construction company, has seen its Middle East offshoot slapped with over 350 legal claims in gas-rich Qatar, including a lawsuit from its local partner Hawar Group, amid concerns hundreds of workers have been unpaid for months leaving some unable to leave the country, sources told The Australian.

A Qatari administrator is also investigating whether the CIMIC venture has moved funds out of the country, with the legal probe expected to delay any deal to sell its stake, complicating the contractor’s plan to abandon the Middle East after suffering huge losses.

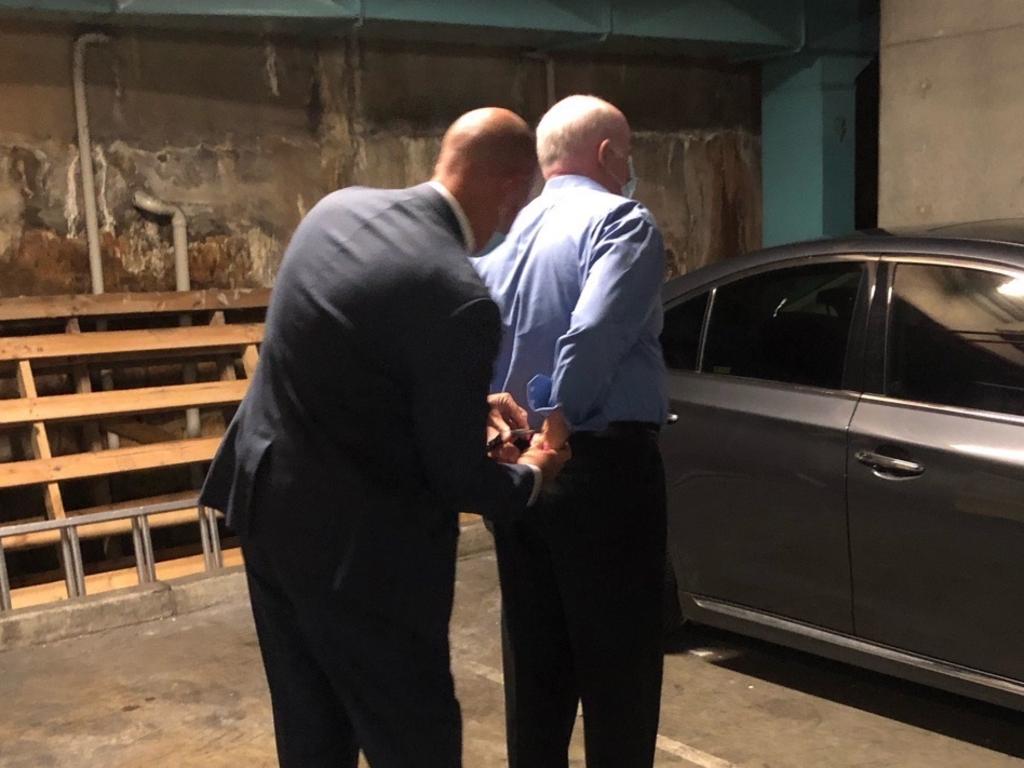

The legal move is the latest setback in the Middle East for the Spanish-controlled company, previously known as Leighton, following a high profile bribery probe over Iraq oil deals that led to charges being laid by the AFP.

CIMIC, which is set to report its annual results on Wednesday, surprised shareholders a year ago with a $1.8bn writedown and a decision to quit its troubled Middle East business, blaming tough market conditions in the region. It pledged $700min cash to cover debts the Gulf joint venture still owes to lenders.

The engineering group — which is building major infrastructure projects in Australia including Melbourne’s troubled $6.7bn West Gate Tunnel — planned to offload its non-controlling 45 per cent stake in the Dubai-based BIC Contracting joint venture, previously badged as Al Habtoor Leighton, with a shortlist of bidders drawn up.

However, any planned sale faces a major stumbling block due to brewing litigation.

BIC’s Leighton Contracting Qatar arm was in disarray with its 51 per cent majority owner, Hawar, launching legal action seeking “to intervene on account of perceived failings by the management appointed by the foreign shareholder”, a statement by Qatar’s Judicial Administrator said. Dozens of suppliers and subcontractors have also filed legal claims in the Qatari court system with many operators unable to pay workers or finish projects until they recovered outstanding debts, sources said.

Several hundred mostly foreign workers owed salaries and end of benefit services became stranded in labour camps, unable to afford flights to their home countries with few able to find alternative work as the COVID-19 slowdown sapped momentum in construction projects.

CIMIC declined to comment while BICC did not respond to requests from The Australian. CIMIC is controlled by the Spanish-German shareholder Hochtief-ACS, which owns a 73 per cent stake in the ASX-listed business.

CIMIC’s relationship through BICC with Hawar has been strained for several years over unresolved disputes covering commissions, profits and mismanagement of the company.

Following a request from Hawar for official intervention, a Qatari court appointed a judicial administrator to Leighton Contracting Qatar to ensure workers were paid outstanding wages as fears grew over their fate.

“As the company has failed to meet payroll obligations over several months, and left accommodation and catering providers unpaid, the humanitarian issue is the first priority of the administrator to resolve,” the Qatari Judicial Administrator said in a statement. “We are making progress on this and no employee will fail to receive his or her dues eventually.

“Among the key focus areas of our duty as administrator is to ensure that employees who have been terminated as far back as October 2019 are provided with their termination benefits and settlements and either allowed to change to another employer in Qatar or return to their country of origin.”

Internal BICC emails seen by The Australian detail how executives questioned the best way of managing the legal actions as it scrambled to address fallout from the ongoing dispute.

“It will be good for the board to also consider this new development,” BICC’s chief risk officer said in August 2020. “My suggestion is for a budget to be approved to allow us to take external legal advice on what such appointment means and how we can co-operate to the benefit of Leighton Contracting Qatar and BICC.”

A probe into Leighton Contracting Qatar’s financial position and transfer of money is also being carried out.

“It is early days yet in our evaluation of the company’s fiscal position. However, there is clear evidence that funds have been transferred out of Qatar by the management in the past, and there may be grounds to seek recovery from associated parties outside Qatar, once this evidence is confirmed,” the Judicial Administrator added.

Funds also need to be available for major ongoing projects being built by the Leighton Contracting Qatar venture, the Judicial Administrator said.

“Leighton Contracting Qatar is engaged in several projects of significance for major clients including government agencies, and it is most important for the administrator to ensure funding is made available for completion of these and not diverted to the benefit of either shareholder or any preferred supplier. You will appreciate that this entails negotiation with clients, banks and suppliers or subcontractors, and this is where the administrator is most engaged.”

CIMIC first gained exposure to the Middle East in 2007 when Leighton merged its regional operations with Al-Habtoor Engineering group, taking a 45 per cent stake in the combined company for $870m in a bid to win new business in the booming Gulf construction market.

Leighton moved its international headquarters to Dubai from Kuala Lumpur to cash in on the region’s thriving building sector, which initially appeared to have dodged any major fallout from the financial crisis.

But conditions eventually started to unravel and the group has for years struggled to collect hundreds of millions of dollars of bad debts in the region, with court proceedings often drawn out.

Al Habtoor was established in Dubai in 1970 and made a name for itself after building the city’s distinctive sail-shaped BurjAl Arab hotel. However, the joint venture has soured in recent years, with the Al Habtoor group distancing itself from the subsidiary amid a downturn in construction markets. Al Habtoor sold its stake in 2016 to then chair Riad Al-Sadik who now owns 55 per cent of BICC.

Do you know more? Please contact Perry Williams at williamsp@theaustralian.com.au