$1.8bn writedown as CIMIC exits Middle East

Australia’s biggest construction company will take a $1.8bn writedown and scrap its dividend after axing its Middle East business.

Australia’s biggest construction company, CIMIC, will take a $1.8bn writedown and scrap its final dividend after axing its troubled Middle East business, blaming tough market conditions in the region.

CIMIC, formerly known as Leighton Holdings, will offload its non-controlling 45 per cent stake in the Dubai-based BIC Contracting joint venture, previously badged as Al Habtoor Leighton, with a shortlist of bidders drawn up.

The giant writedown includes a cash outlay of $700m to cover debts the Gulf joint venture still owes to lenders, with a final dividend for 2019 axed.

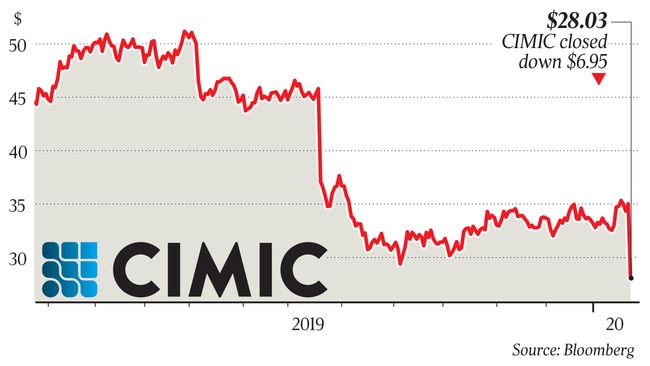

CIMIC shares plummeted 19.9 per cent to $28.03, marking their lowest level in over three years.

“Wow, I’ve always thought there would be skeletons in the CIMIC closet,” Forager Funds Management chief investment officer Steve Johnson tweeted. “Today’s $1.8bn skeleton is more like a mass grave in the backyard.”

The Sydney-based engineering group — which is building major infrastructure projects in Australia including Melbourne’s troubled West Gate Tunnel — said it had started talks with lenders, creditors, clients and stakeholders following “an accelerated deterioration of local market conditions” in the Middle East.

“After thorough evaluation of all available options, CIMIC has decided to exit the region and focus its resources and capital allocation on growth opportunities in its main core markets and geographies: Australia, New Zealand and Asia Pacific,” the company said in a statement.

The move was flagged by The Australian’s DataRoom in December.

CIMIC first gained exposure to the Middle East in 2007 when Leighton merged its regional operations with Al-Habtoor Engineering group, taking a 45 per cent stake in the combined company for $870m in a bid to win new business in the booming Gulf construction market.

Leighton at the time moved its international headquarters to Dubai from Kuala Lumpur to cash in on the region’s thriving building sector, which initially appeared to have dodged any major fallout from the global financial crisis.

Still, market conditions eventually started to unravel and the group has for years struggled to collect hundreds of millions of dollars of bad debts in the region, with court proceedings often drawn out and lacking regulatory enforcement.

Al Habtoor was established in Dubai in 1970 and made a name for itself in the Gulf’s burgeoning market after building the city’s distinctive sail-shaped Burj Al Arab hotel.

However, the joint venture has soured in recent years, with the Al Habtoor group distancing itself from the subsidiary amid a broader downturn in the region’s construction markets.

CIMIC is controlled by the Spanish-German shareholder Hochtief-ACS, which owns a 73 per cent stake in the business. The Hong Kong-based GMT Research — which sparked a $1.5bn fall in CIMIC’s stock last May after questioning CIMIC’s financial account “engineering” — said it became increasingly concerned over the company’s substantial factoring of receivables and a spike in debt guarantees for its Middle East joint venture.

CIMIC had stopped recognising losses at BIC Contracting, according to GMT, clouding the ability of investors to assess the unit’s financial performance while the company’s debt guarantees for the division continued to spiral.

The research alleged CIMIC had boosted pre-tax profits by up to $800m by pre-booking contract revenue, and flagged a potential $700m reversal in previously booked revenue in response to newly introduced Australian accounting guidelines. CIMIC said at the time it complied with its disclosure obligations and its results were fully audited. “Following CIMIC’s interim results in July, we highlighted the rapid increase in guarantees for BICC’s debt,” GMT analyst Nigel Stevenson told The Australian on Thursday. “The spiralling of BICC’s debts which CIMIC had guaranteed was a key warning sign that BICC’s performance was rapidly deteriorating.”

One company insider said CIMIC’s attempt to sell its subsidiary Thiess may have partly been driven by cashflow concerns sparked by its Middle East woes.

“There has been a feeling in the market they were trying to dredge up an offset with a Thiess deal and that’s because they knew there was a big hit coming,” the source said.

CIMIC expects 2019 net profit of around $800m.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout