The destruction caused by bushfires raging across the nation should spur Commonwealth Bank and Westpac to more closely analyse exiting general insurance.

They are the only major banks directly providing general insurance because ANZ and National Australia Bank outsource their products.

The latest round of deliberations at CBA and Westpac would come against the backdrop of combined bushfire catastrophe losses since September that have ballooned to almost $1bn. The Insurance Council of Australia tally also reflects 11,272 claims and is climbing.

Westpac’s own economic team on Friday estimated total losses at $5bn, higher than the 2009 Victorian bushfires but smaller than the 2010-11 Queensland floods.

While CBA and Westpac are small players in general insurance compared to the likes of Insurance Australia Group and Suncorp in personal lines, the lack of scale can also be an argument for exiting.

The back-to-basics theme that has reverberated through the banking sector in light of the Hayne royal commission has already triggered a wave of wealth management and other divestments.

CBA has begun a strategic review of its general insurance arm, including giving consideration to selling it or outsourcing the products. Westpac provides its own home and contents insurance to customers, but has already outsourced car insurance to Allianz.

National Australia Bank has general insurance outsourcing arrangements including with Allianz, while ANZ has paired with QBE Insurance.

For CBA and Westpac it will come down to close examination of the returns their general insurance units are generating and how capital intensive they are.

CBA has already offloaded its life insurance arm — where returns are highly challenged — to pan-Asian group AIA and Westpac has JPMorgan on deck to consider whether it should pull the pin on life insurance too.

General insurance businesses are typically not as capital intensive as the life insurance, but increased frequency or severity in natural disasters may concern big bank bosses. Moody’s vice president and senior credit officer Frank Mirenzi this week warned: “Despite the manageable impact for insurers, the catastrophic fires highlight that the P&C (property and casualty) insurance industry is at the forefront of environmental risk.

“The industry is exposed to the economic consequences of climate change, primarily through the unpredictable effect of climate change on the frequency and severity of weather-related catastrophic events, such as hurricanes, floods, convective storms, drought and wildfires.”

In CBA’s full-year results presentation handed down last August the general insurance operations were classified in a “strategic review” category.

The presentation lumped general insurance and mortgage broking together, saying they contributed just $33m to CBA’s group cash net profit in fiscal 2019, down 73 per cent on the previous year.

The general insurance business — which now sits within CBA’s retail bank — was hit by higher claims from increased extreme weather events including the NSW hail storms and Queensland floods.

Income purely from insurance, on a cash basis, came in at $147m in the 12 months ended June 30, down from $238m a year earlier.

Westpac’s financial accounts for the year ended September 30 showed cash earnings from general insurance dropping 43 per cent to $62m. The results were weighed on by a spike in claims in the first half of Westpac’s year impacted by the NSW hailstorms and Queensland floods.

Still, annual gross written premium for general insurance in 2019 printed at $538m, up on $503m the year before.

Given the small overall amounts involved in the context of CBA and Westpac’s respective core divisions, it may make sense to rule a line in the sand under general insurance and exit.

While there are competition considerations for bigger personal lines players IAG and Suncorp, others including QBE, Allianz and Zurich may look to get involved if the sale route is taken by CBA or Westpac.

The other consideration is greater levels of regulation flowing through to the insurance sector. The royal commission’s recommendations for the industry included that unfair contract provisions are applied to insurance contracts and that hawking of insurance was banned. It also called for the industry to implement an executive accountability regime, like that already in place in banking.

For now though, the general insurance industry’s priority is dealing with bushfire claims and rebuilding efforts. It’s been an emotive week on the topic of bushfires and response plans and donations have been forthcoming.

The federal government — which initially confronted fierce criticism for not mobilising a clear response to the fires sooner — has since pledged to spend an initial $2bn to fund the new National Bushfire Recovery Agency.

A top-level insurance industry and regulator delegation met with Treasurer Josh Frydenberg on Tuesday to discuss a co-ordinated response with the states.

The meeting was attended by IAG chief executive Peter Harmer and his counterpart at Suncorp Steve Johnston. The meeting was also attended by QBE’s Australia boss Vivek Bhatia, Zurich’s Tim Plant, Allianz’s Richard Feledy, Commonwealth Bank’s Miles Sowden, Westpac’s Peter Dennis and ICA CEO Rob Whelan.

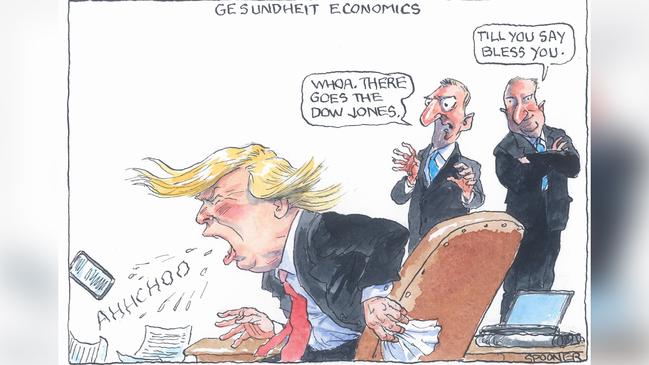

Market highs

Investors are digesting the local bourse this week hitting a new high and market stalwarts including Wilson Asset Management’s Geoff Wilson warning of an end to the record bull market.

Platform provider Powerwrap reckons investors are now more actively looking at their investment options as official interest rates hover at record lows — and may be cut further — and the search for other sources of yield continues.

Powerwrap boss Will Davidson has strong views on a growing allocation by wealthy investors to alternative asset classes.

Investors that house funds on Powerwrap’s platform have an allocation of about 14 per cent to alternative asset classes including infrastructure, hedge funds, private equity and mezzanine debt.

Davidson expects that will continue to grow and top 20 per cent.

Powerwrap — which has $8.75bn in funds under administration — this week entered a platform agreement with Melbourne-based Wattle Partners Private Wealth.

Mr Davidson also highlights findings of the 2019 Powerwrap and Investment Trends High Net Worth Investor Report, which late last year found that wealthy investor expectations for capital growth in ASX companies were negative for just the second time on record.

The report found the number of high net worth investors in Australia rose for a third straight year to 490,000, with that group collectively controlling just over $2 trillion in investable assets.

That’s a huge number given Australia’s total pool of superannuation assets amounted to $2.9 trillion as at September 30.

Next up though investors will closely watch the February profit season for clues on company growth prospects.