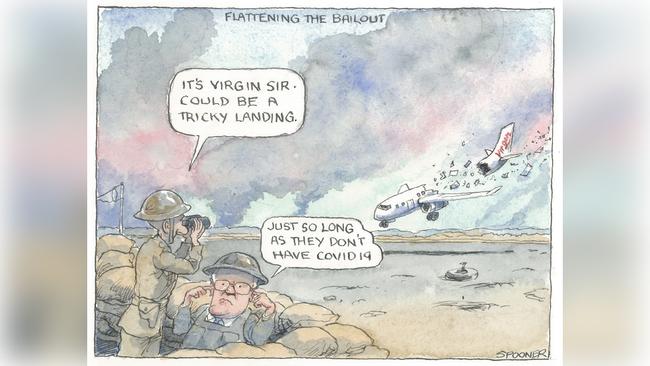

This game is different because we are in the middle of a global pandemic and the government has already dealt its first hand by shutting down travel and putting Virgin into its present misery.

Canberra wants the airline to sort out its own issues to minimise its rescue role, while the bond holders know a government-backed package offers the best hope.

In reality, everyone is waiting for Canberra to decide.

There are myriad decisions for Canberra, with the most fundamental being when it and the states open up the skies again — and that decision won’t be made this week.

That leaves the issue of whether to back Virgin with some sort of convertible debt issue or guarantee to help it survive.

There are two factions — one thinks Australia needs two airlines and the government is morally bound to do something, seeing as it closed the skies. The other says there is a huge moral hazard and Canberra has done its bit with its packages supporting wages and in all providing debt totalling some 15 per cent of GDP.

The line that the rescue would just help the foreign airlines is nonsense because this decision is all about roughly 9000 staff, 6000 contractors and 25 million people who fly Virgin every year.

Virgin is in better shape pre-virus than Ansett was when it collapsed, but the fact is unless the government or another investor emerges the company won’t come out of its present trading halt.

When Ansett collapsed in 2001, it spawned what is now Rex, Skywest and John Holland Engineering among other ventures, but Virgin was the only real competitor to Qantas.

Qantas doesn’t want to be a monopoly because that would involve too much oversight and in reality it would rather compete with a wounded Virgin.

The rescue isn’t quite as simple as the convertible note floated here on Monday because Virgin needs some sort of scheme of arrangement to sort out other issues like its $3bn in debt tied to aircraft leases, the likely closure of Tiger, the end to international flights and instead network deals with its equity holders.

But before all of that comes the decision from Canberra about whether to support the airline.

On Tuesday it was due to unveil a new skeleton subsidised route structure, but that would provide peanuts.

The $1bn that Deputy Prime Minister Michael McCormack talks about has yet to be seen by either Qantas or Virgin, and instead the only recipients so far appear to be the Air Services Commission and Rex.

It’s time for that furphy to be put to bed.

Still, government is already up to its neck in assistance, the RBA has done its bit and Rod Sims has converted the ACCC into the Australian Cartel Co-operation Commission by granting interim authorisations to everyone from the supermarket giants to health funds that don’t want to compete, and the latest being life insurers to make sure they provide coronavirus cover to health workers and first respondents like the police.

A conga line of other companies would present equally advantageous reasons for assistance as Virgin, and in case they don’t we have Andrew Liveris to roll out the protectionist’s kit bag for some new (old) ideas.

If Australia emerges from the virus with even more concentrated industries reliant on government support, that U-shaped recovery that is now consensus will take much longer to climb to the other side.

Airlines around the world are being bailed out, the latest to put its snout in the trough being Air France-KLM, which is waiting to see in what shape its handout is delivered from the French and Dutch governments.

Just about every US carrier has gone through debt restructuring under its debtor-led Chapter 11 bankruptcy process. Delta, the largest, has just pocketed a $US2bn ($3.1bn) line of credit from the Trump administration.

Virgin’s Paul Scurrah wants his portion as Qantas’s Alan Joyce watches, doing his level best this time to keep his mouth quiet until the time is right and his hand shoots out for some loot.

Virgin has five airline shareholders controlling 91 per cent of the stock whose combined stake was worth $660m when trading was halted on Tuesday, but in reality, as noted yesterday, it’s worth zero.

The unsecured creditors have debt with a nominal value of $2bn but when it trades by appointment it is worth between 35c and 50c in the dollar in five different tranches, one worth $350m listed in Australia and trading at 35c.

The airline shareholders would have some leverage in terms of farewell packages, but bondholder support is more problematic.

In insolvency terms, creditors vote by value and number, and while the Virgin staff would dominate the numerical count, the bondholders would win on value.

There are deals to be done on the aircraft over which some debt is tied, because Virgin will restrict its offshore flying.

The package is being worked on by the restructuring team at Houlihan Lokey with help from former UBS deputy Guy Fowler, UBS and Morgan Stanley.

Its final shape will be clearer when Canberra makes its decision but for now there is as much uncertainty on the future of the airline as there is on the path of the coronavirus.

Recession reality

While the Virgin waiting game played out, NAB economist Alan Oster provided some reality with his latest business survey, which showed the depth of the recession Australia is now enduring. Business confidence, conditions and forward orders had record falls for the latest monthly survey.

NAB thinks the economy fell into the red in the first quarter and will fall by 7 per cent this quarter, be negative again in the September quarter and bounce 4.5 per cent in the December quarter.

Next year will be a slow recovery and it will take some time in 2022 until GDP matches 2019 levels, with unemployment at 11.7 per cent as the major factor slowing the recovery.

All this and the government still cannot be expected to provide any guide on just when the virus-led controls can be lifted.

That alone explains the business gloom and the reason why business leaders are starting to get impatient — an understandable frustration but the government is right to maintain the discipline.

Canberra and the Virgin bond holders are playing a virtual game of dare to see who blinks first in the grand restructuring game of brinkmanship to see who recovers some value from the resurrection of the airline.