BusinessNow: Live coverage of financial markets and companies, plus analysis and opinion

Local shares failed to climb out of the red following a lack of clear market directive in the US President’s address.

BusinessNow: Live market coverage on Wednesday, March 1. Today brings fourth-quarter GDP, Chinese manufacturing data and Donald Trump’s speech to Congress.

Daniel Palmer 4.40pm: Local stocks close down on opaque Trump

The Australian sharemarket has ended weaker as a lack of clarity on tax reform from US President Donald Trump and falling commodity prices offered investors a route to red for the eight day in nine.

Local stocks were also hampered by softness in telecommunications as Telstra traded ex-dividend.

At the close, the benchmark S&P/ASX 200 index dipped 7.4 points, or 0.13 per cent, to 5,704.8, while the broader All Ordinaries index slid 10.1 points, or 0.18 per cent, to 5,750.9.

The market bounced around through the session as traders digested a better-than-expected reading on local economic growth that boosted the banks and, later, an eagerly awaited speech from Mr Trump that dampened sentiment.

In his address the US President pledged “historic tax reform” but again declined to specify exactly what they might entail, to the chagrin of investors who are growing weary on the timeline for action.

“President Donald Trump’s speech to a joint session of Congress offered only a little additional clarity on the tax reforms and additional spending the White House will be seeking from Congress,” Capital Economics chief US economist Paul Ashworth said.

“With Congress getting bogged down by Republican infighting over efforts to repeal and replace existing healthcare legislation, it will take considerably longer to pass tax reform than we initially thought on election night. There is now a good chance that it won’t happen until early next year.”

There has been a quick shift in investors’ mindsets from micro to macro on the back of earnings season, which wrapped up on Tuesday.

However, traders will continue to digest a mixed reporting season over coming days.

“Solid sales growth and a bounceback in overall profit are two key takeaways from the company reports released over February,” CMC Markets chief market strategist Michael McCarthy said.

“However there was enormous variability between companies and sectors.

“The strength of mining earnings is remarkable, but other sectors showed increases as well; healthcare, consumer services, financials and energy. This could see upgrades from analysts over the coming weeks.”

Copping a downgrade following its Tuesday report was Harvey Norman, with its shares tumbling 6 per cent as a result.

Meanwhile, the resources space — an outperformer through the season — was on the nose as oil and iron ore prices skidded offshore. In energy, Santos skidded 2.1 per cent to $3.72, while Woodside lost 1.5 per cent to $30.88.

In materials, BHP Billiton surrendered 0.5 per cent to $24.88, Fortescue gave back 0.5 per cent to $6.60 and Rio Tinto slipped 1 per cent to $61.37.

“Early signs of support for materials stocks dissipated on Tuesday with profit taking continuing in anticipation of a downturn in commodity prices,” CMC Markets chief market analyst Ric Spooner said.

In finance, the big four banks were all in the black after a red open. CBA and Westpac both rose 0.6 per cent, while ANZ added 0.5 per cent and NAB lifted 0.3 per cent.

Among other blue chips, telco giant Telstra slumped 3.7 per cent to $4.64 as it traded ex-dividend, while Qantas was steady at $3.75.

Meanwhile, the Australian dollar swung in a wide range from US76.35 cents to US77c given the impact of GDP data and Mr Trump’s address before ending local trade at US76.55c. It began the local session at US76.5c.

Scott Murdoch 4.36pm: Tariq Butt sells major Wellard holding

Embattled cattle producer Wellard Holding’s major shareholder, Pakistani meat trader Tariq Butt has sold his 9.48 per cent stake to the Homes a Court family.

In an announcement to the market, Butt Nominees — an investment vehicle controlled by Mr Butt, said the stock would be sold to Heytesbury for 21c. The stock is currently trading at 18.5c and was considered one of the worst performing stocks in 2016.

The investment firm is expected to book a small loss on its Wellard shareholding.

More to come

4.00pm: VIDEO: Trump’s Congress address in 3 min

3.51pm: Only LG in Samsung heir’s new cell

Samsung heir Lee Jae-yong’s new home is a cell measuring 6.3 square metres — roughly half the size of a parking space — and equipped with a foldable mattress, table, chair, sink, toilet and an LG television.

The vice chairman of Samsung Electronics wears a khaki jumpsuit and uses a communal shower, according to an official at the Seoul detention centre where he is being held. He eats alone in his cell, his three meals — usually rice, soup and a handful of side dishes — valued at about $US1.25 each and adding up to a daily total of some 2,500 calories. He must wash his own utensils.

Mr Lee is allowed to watch television for seven hours on weekdays and 11 hours on weekends, though just one channel of preapproved programs, the official said. There is one program not preapproved: The nightly news, which of late has often featured detailed reports on his own legal predicament.

3.35pm: Harvey Norman, what a ride! Time to sell

Harvey Norman may be topping out, according to Macquarie analysts, who say “we are now starting to see signs that Harvey Norman’s franchise earnings may be peaking”.

Macquarie and JP Morgan both downgraded the stock to sell, with new price targets of $5.05 and $4.60, respectfully.

A booming housing market has been a key driver of Harvey Norman’s healthy profit numbers, along with the demise of rival retailer Dick Smith, but analysts fear the best may now be behind HVN.

For the six months to December 31, the household goods retailer (HVN) booked net profit of $257.3 million, up 38.7 per cent on the prior corresponding period.

The result was driven by property revaluations worth $75.7m, up almost fourfold on last year.

“In recent years Harvey Norman has leveraged a supportive external backdrop, including rising house prices, and significant self-help initiatives such as store closures, cost reductions and working capital efficiency improvements to drive earnings and share price performance,’ JP Morgan said as it downgraded the stock to ‘lighten’, with a ‘medium’ risk assessment. “However, we believe the support of several of these factors is moderating.”

Harvey Norman shares have plunged on the negativity, down 6.6 per cent to $4.81 at 2:25pm AEDT.

Earlier today shares in the retailer fell to a two-and-a-half month low of $4.66 (-9.5 per cent) after hitting a four-month high of $5.24 yesterday.

3.10pm: Risk remains of bond yield fall: NAB

After Trump reiterated plans to boost US economic growth and make the nation ‘great again’, “detail and action is now needed before the reflation trade takes off again”, according to NAB.

Fed tightening expectations will maintain upward pressure on bond yields with a March rate hike possible, but this should be reflected largely in the front of the curve, says NAB’s head of interest rate strategy Skye Masters.

She notes there are a lot of events due in coming week that will create noise and potentially impact market sentiment where investors remain net short.

“Well held trading ranges are likely to again be tested but there still remains risk that the lower end of the trading range is broken before the upper band is tested,” she adds.

John Durie 2.55pm: Magellan’s Douglas puts on a show

Mine eyes have seen the glory of the coming of Hamish Douglass the Magellan Financial Group fund manager who performed before some 2,000 people in Melbourne last night as he spruiked before some adoring financial planners on the future of technology.

Artificial intelligence, driverless cars, robots and a very different future are the themes from a manager whose stocks just happen to include Apple, Google, Facebook, Microsoft and Hospital Corp.

Closer to home, his infrastructure group has money in Transurban, Sydney Airport and Woolworths.

Douglass is not afraid of likening himself to the great Warren Buffett, noting Buffett followed him into Apple and describing the event last night as a “Woodstock for capitalists”.

That’s what the Berkshire Hathaway annual meeting is called but who cares about such references when you are Douglass in full flight and change from your suit into Steve Jobs-type clothes with jeans and a black skivvy.

As one broker noted in his comments to clients: “Is this guy Elvis, Johnny O’Keefe or a very good version of Warren Buffett?”

2.28pm: Dollar pares gains as Trump clamour fades

The Aussie dollar is paring intraday gains after hitting a two-day high amid US$ weakness and shares are fading amid disappointment with the lack of policy detail in Trump’s speech.

After rising to 0.7700, AUD/USD has slipped to US76.64 cents and could now test the 10-day low of US76.37 cents it his this morning.

At the same time the S&P/ASX 200 share index has fallen back toward the 13-day low of 5675 it hit this morning.

The local bourse is down 0.4pc at 5685.9, and US E-mini S&P 500 futures have halved their intraday rise.

Trump’s speech was rich in platitudes but light on details of the “phenomenal” tax package he pledged three weeks ago.

This could get ugly for equities given the optimism that’s built into the market and the lack of detail on pro-growth plans.

2.03pm: Mayne Pharma shares fall on Trump talk

Mayne Pharma (MYX) falls as much as 5.4pc as Trump emphasises the need bring down drug prices.

1.54pm: Gold recovers, ASX falls amid Trump speech

Spot gold pares almost all of its intraday fall, while local equities have fallen back towards the 13-day low of 5681 on the ASX.

Bloomberg notes the speech has so far been for “main street” Americans. Market fodder, including details of the so-called “phenomenal” tax package are yet to surface.

1.32pm: US dollar dips, markets grow impatient

It seems the market is getting impatient with the president.

So far Mr Trump has been congratulating himself and his administration on its first 40 days in office.

Investors are waiting for details on the president’s tax and economic plans but no clarity has been given yet.

At 1:25pm the Aussie dollar has gained to US77 cents, a two-day high, up from intraday low US76.37. The greenback is also weakening against other major currencies.

Wall Street’s S&P futures are also weakening as President Trump speaks.

1.10pm: Aussie dollar spikes as Trump begins

$A spikes to US76.83 cents as Donald Trump takes the podium.

1.08pm: Call for Aussie rate cut scrapped

@ShaneOliverAMP scraps call for #RBA rate cuts 2017: "rates on hold rest of year..possibly hike H2 2018" #ausbiz @SkyBusiness pic.twitter.com/ePxLn0gJjW

— Carson Scott (@CarsonScott) March 1, 2017

Daniel Palmer 12.54pm: Macmahon shares soar on takeover twist

Shares in engineering group Macmahon have shot up 15 per cent in lunchtime deals as investors mulled a twist to a hostile takeover push from Cimic.

In an update to the market this morning, Macmahon (MAH) said it had reached a non-binding agreement with Indonesian mining group PT Amman Mineral Nusa Tenggara to sell a blocking stake of up to 50.1 per cent in return for assets worth around $US150 million ($196m).

The deal also sees Macmahon receive a mining contract worth around $US400 million a year, with the details first flagged by The Australian yesterday.

Macmahon said the offering of a stake to AMNT would be based on a 20.3 cent a share valuation, with the suitor to receive between 40 and 50.1 per cent based on the final valuation for the suite of equipment and vehicle assets it has put forward as part of the deal.

The development is designed to put Cimic’s $174m hostile all-cash play for control in the shade as the AMNT valuation on Macmahon stock equates to a 40 per cent premium to the 14.5c a share valuation put forward by Cimic.

Macmahon shares surged on the news and were trading up 13.3 per cent at 17c by 12.30pm (AEDT).

More to come

Daniel Palmer 12.48pm: China Caixin PMI beats expectations

CAIXIN China manufacturing PMI beats expectations, rising to 51.7pc vs. 50.8pc expected

This supports the above consensus rise in China’s official manufacturing PMI released earlier today.

$A continues to trade near the intraday high of US76.66 cents.

12.25pm: How the market looks pre-Trump

Local investors have had a chance to see two key pieces of data today, the fourth quarter GDP result came in well above expectations, while official Chinese manufacturing numbers also showed a beat to expectations. The biggest event of the day, however, is just about to kick off.

All eyes are on Congress, where President Trump is set to deliver what he hyped as his “biggest speech to date”. Investors will be looking for detail on his plans for pushing through election promises, and economist say a lack of clarity will hurt the US dollar.

The ASX 200 remains under pressure at lunch, down 0.3 per cent to 5694 points.

Telstra and Crown are weighing on the market as they trade ex-dividend, Telstra is 3.4 per cent lighter while Crown drops 8.5 per cent after shelling out a hefty special dividend.

Harvey Norman and Spotless are both also hurting, down 7.1 per cent and 6.1 per cent, respectively, following broker downgrades.

Elsewhere Commonwealth Bank has gained 0.2 per cent to $82.51 and ANZ is up 0.4 per cent, while Westpac and NAB both trickle slightly lower.

BHP Billiton is down 1 per cent, Rio Tinto has given up 0.8 per cent and Fortescue Metals is 1.1 per cent in the red today.

12.06pm: China manufacturing PMI beats expectations

China’s February manufacturing PMI rose to 51.6 vs. 51.2 expected.

Services PMI slowed to 54.2 vs. 54.6 the previous month.

Overall the data aren’t surprising enough to move the dial.

11.57am: Transurban wins US road project

Toll roads operator Transurban has won another significant road project in the US, gaining approval for a $US460 million ($A601 million) contract for express lanes on a stretch of highway south of Washington DC.

Transurban has already built express lanes on the Interstate 95 (I-95) route south of Washington DC in northern Virginia, and the new contract is for the extension of express lanes to the Interstate 395, which leads into the US capital.

Transurban (TCL) up seven cents at $11.10 at 1140 AEDT.

11.45am: Woodside shareholders stoke CEO pay cut

Woodside Petroleum trimmed the hefty paycheck of chief executive Peter Coleman by around $1m in 2016 despite the company’s profits rebounding strongly as the oil price recovered.

The action was predicated on meetings with investors that left Woodside directors in no doubt the $US7.6 million ($10m) remuneration package Mr Coleman received in 2015 was perceived to be too high.

That issue had already been made abundantly clear in April last year when Woodside (WPL) received a “first strike” at its AGM as 27.59 per cent of votes were cast against the remuneration report.

A second strike would open the door for a board spill, but the directors are hoping a more than 10 per cent reduction in Mr Coleman’s pay to $US6.7m ($8.9m) will be enough to get investors on side at its next AGM on May 5.

11.32am: GDP smashes expectations, $A roars to life

4Q GDP rose 1.1pc Q/Q vs. 0.8pc expected

Year-on-year GDP rose 2.4pc vs. 2.0pc expected

$A spikes to US76.66cents from US76.46cents, last US76.55cents

Read more here

Turi Condon 11.23am: Sydney house prices reignite

Sydney’s housing prices have reignited, growing at over 18 per cent last year — the fastest pace in 15 years, according to researcher CoreLogic.

Last year’s interest rate cuts lit a fire under housing markets across the capital cities with prices rising 11.7 per cent, the highest annual growth rate since the upturn began.

“The annual growth rate across the combined capitals hasn’t been this strong since the 12 months ending June 2010,” according to CoreLogic head of research Tim Lawless.

“In Sydney, where the annual rate of growth is now 18.4 per cent, this is the highest annual growth rate since the 12 months ending December 2002 when the housing boom of the early 2000s started to slow,” Mr Lawless said.

11.15am: Consensus for GDP due 11:30am AEDT

December quarter GDP data due at 1130 AEDT.

Market consensus is 0.8pc Q/Q and 2pc Y/Y.

11.05am: Q&A: Are you set for super changes?

Sweeping changes to superannuation rules are set to kick off on July 1. Yet, with only months to

go, most Australians still know little about them.

The changes, which will affect both super contributions and the taxing of superannuation income, are keeping financial advisers busy as time runs out for investors to make plans.

What are the choices investors can take?

Where are the opportunities?

How does it all work?

Leave your questions for Wealth Editor James Kirby in the comments section on this page and James will answer them from 12.15pm (AEDT) to 12.45pm today.

Daniel Palmer 10.50am: Aussie manufacturing data quells qualms

New figures suggest Australia’s manufacturing sector is in its healthiest shape in 15 years despite ongoing worries about the industry’s future.

The monthly performance of manufacturing index (PMI) from the Australian Industry Group showed an 8.1 point surge to a robust reading of 59.3 points in February.

The figure is the highest since May 2002, with the improvement in conditions showing as the fifth straight month of expansion.

Six of the seven subindexes expanded through the month, with the improvement driven by new orders and sales.

The only decline came in inventories as manufacturers struggled to keep up with the surge in demand.

Among the sectors measured by the survey, seven of the eight noted better conditions, with only printing and recording media remaining in contractionary territory below 50 points.

Eli Greenblat 10.42am: Bellamy’s set to appoint Peters as new chair

Bellamy’s is expected to announce as soon as today that newly appointed director and ally of dissident major shareholder Jan Cameron, Sydney lawyer Rodd Peters, will be the company’s new acting chairman after its board was swept away by investors at a rowdy extraordinary meeting in Melbourne yesterday.

The infant milk formula group is also bracing for a new class action lawsuit to be thrown at the company, with Maurice Blackburn tipped to lodge its case this week with the courts to join Slater & Gordon which has also began court action over Bellamy’s missed profit guidance and plummeting share price.

Yesterday’s two-hour shareholder meeting saw two directors ejected from the board while chairman Rob Woolley resigned beforehand and didn’t even bother to turn up.

And with director Launa Inman also stepping down at the EGM, Bellamy’s has been left with a thinned-out board of only three directors.

10.36am: ASX deteriorates ahead of Trump speech

The S & P/ASX 200 chart has deteriorated significantly before Trump’s State of the Union speech at 1300 AEDT.

Having fallen to 5681.7 today, the index has tentatively broken the 50-day moving average at 5697.

This follows a worrisome reversal of intraday strength yesterday and a break of the trend line from the US election low.

Whether or not these are “false breaks” or more sustained moves will depend on the global reaction to Trump’s speech.

The next major chart support level is the 5600 area and the Feb 7 low at 5582.7 will be key.

Domestic GDP data are due at 1130 AEDT and China PMI data are due at 1200 AEDT.

10.23am: ASX 200 drops to 13-day low

Australia’s S & P/ASX 200 share index has dropped 0.5pc to a 13-day low of 5681.7.

This follows overnight falls on the US share market, as well as iron ore prices.

Iron ore miners BHP Billiton, Rio Tinto and Fortescue fall 0.9pc-1.4pc.

The four major banks are down 0.2pc-0.4pc.

Telstra, Crown, Perpetual and Platinum down sharply ex-dividend.

Spotless is down 6.4pc and Harvey Norman is down 3.9pc on broker downgrades after their results.

10.09am: Iron ore likely to shake blues soon: ANZ

Iron ore price falls yesterday should be relatively short lived, according to ANZ.

ANZ notes that China’s NPC is expected to announce further capacity closure targets for 2017 this weekend.

China’s premier Li Kequiang of his annual work report to China’s National People’s Congress on Sunday.

Spot iron ore fell 1.2pc to $91.27 a tonne yesterday, while Dalian iron ore futures fell 1.4pc to CNY695.5 a tonne overnight.

10.03am: Brekky Wrap: Market’s three-point play

Aussie stocks will look to ease into the day ahead of a few key chunks of news, with the local GDP figure at 11:30am, Chinese manufacturing numbers at midday and the “biggest speech to date” from Donald Trump set to shape the day’s trade starting at 1pm.

The SPI 200 is pointing to a flat start but fair value suggests a 0.1 per cent slip could be more likely.

Several big-name stocks will be trading ex-dividend, which will weigh on the market. Telstra will be ex-div, as will Perpetual, Alumina and Platinum Asset. Crown Resorts will also be trading without its big, juicy 83 cent special dividend, paid on top of its regular 30-cent interim distribution.

Yesterday saw the local index drop 0.2 per cent, with a sharp intraday reversal not looking particularly good from a chart perspective. The 5712.3 point level marks the lowest close in more than two weeks.

In terms of offshore drivers, the Dow broke a 12-day winning streak, down 0.1 per cent, while the price of iron ore dropped 1.2 per cent to $US91.27 and oil price remained broadly flat. BHP Billiton’s ADRs suggest a 1.6 per cent fall could be on the cards.

9.59am: Water under the bridge: Aussie 4Q GDP

GDP watchers are looking to dust themselves off today for the fourth quarter result, set to be released at 11:30am AEDT, after being thrown a hand grenade last time.

The consensus among economists is for a 0.8 per cent quarter-on-quarter result and 2 per cent year-on-year.

The September quarter revealed a shock contraction, the first since March 2011, but experts predict a return to form is on the cards for the December quarter result. Aka — relax, no technical recession.

ANZ says it sees GDP coming in at to have increased 1 per cent for the quarter, with a strong increase in company profits and improving business investment likely to support growth, while consumer spending is also expected to strengthen modestly.

Nerves are still a little raw following the September result, however, which saw a 0.5 per cent fall (seasonally adjusted) — the worst fall since the fourth quarter of 2008.

9.52am: Broker ratings update

Specialty Fashion (SFH) cut to Neutral vs. Buy — Citi

Orocobre (ORE) raised to Buy vs. Neutral — Citi

Beadell Resources (BDR) cut to Neutral vs. Buy — Citi

9.50am: GDP figures don’t do the US justice: ANZ

Underlying strength in the US economy is better than the headline numbers suggest, according to ANZ.

US 4Q GDP last night was unrevised at a 1.9 per cent annual rate vs. 2.1 per cent expected, but private consumption was revised up to 3 per cent.

“This momentum looks like it will be carried into Q1 2017 with recent forward looking indicators pointing toward 2.5 per cent growth,” ANZ economist Daniel Gradwell says.

“Strength in consumer confidence typically implies firm consumption growth, and may also have implications for encouraging people back into the labour force, which would help offset demographic headwinds.”

He notes that over the past six months the US economy has grown at a 2.7 per cent annual pace versus potential growth estimates of 1.8 per cent.

“The Fed has been prepared to let the economy run ‘hot’, but for how long is the question, especially with the new administration targeting 3 per cent plus growth?”

He says if the FOMC wants the option of tightening in March, it will need to talk up that prospect this week.

Fed’s Kaplan said raising rates “sooner rather than later means in the near future” while Williams said March was getting “serious consideration” and that the US has reached full employment.

The market-implied probability of a Fed March rate hike rose to 59 per cent vs. 56 per cent yesterday.

9.28am: What to expect from Trump today

Donald Trump will today take the podium and speak to Congress, and the world, in what he is calling his “biggest speech to date”. The global market has been hushed in anticipation for several days now. Will this be the moment where a clear and concise plan is for the year’s foreign and domestic economic policies will be laid out?

The President is expected to start speaking at 1pm AEDT.

Where to look

The US dollar and all major currencies will act as a scoreboard during the speech — clarity and positivity will filter through to US dollar strength, while loose, loud and aggressive language could be taken as a poor sign for the economy.

“All eyes are on Trump’s speech as traders await clarity over his policies,” ANZ economist Daniel Gradwell said.

“Failure to live up to his hype could result in weakness for the US dollar, in particular against the Japanese Yen.”

At around 8:20am (AEDT) this morning the Aussie dollar was buying US76.56 cents, down around US0.4c since 2:30am (AEDT) and the greenback strengthens in anticipation of the speech.

The Aussie remains elevated, however, compared with the US71.64c it was buying at the end of 2016.

What could he say?

The New York Post’s Michael Goodwin wrote the president’s speech is “likely to be a shock-and-awe blowout of pure Trumpism”.

But The Australian’s Robert Gottliebsen today breaks down what the market does and doesn’t want to hear:

In pure market terms, migration and media are side issues and any concentration on them means Trump is getting bogged down and the business agenda may be delayed.

To some extent, abolishing Obamacare is also a side issue for the markets although it has a big impact on heath stocks. But the American market understands that Obamacare is on top of Trump’s agenda and so health must be fixed first. It’s proving more complex for Trump’s people than was expected.

The market is craving details about the timing and specifics of Trump’s plans to slash taxes, abolish regulations and embark on massive infrastructure spending.

Wall Street is betting that enormous corporate tax savings will translate into much greater profits. Trump wants to reduce the corporate tax rate to between 15 and 20 per cent from the current 25 per cent.

What if markets HATE what they hear? (… time to buy)

A tantrum from investors thanks to not finding the clarity they’re looking for from Trump could create a buying opportunity.

“After a phenomenal 16 per cent rally since the US election we remain bullish US stocks, but from a risk/reward perspective we would not buy until they experience a correction of around 4 per cent,” say Market Matters analysts.

“Today’s speech could potentially be the catalyst for this degree of correction and so plans need to be laid for any buying opportunities that may arise this afternoon, or in the near future. The Australian market often over reacts during these volatile times simply because we are open when other major western indexes are tucked up in bed (e.g. US election last November).”

9.22am: Broker ratings changes

WorleyParsons (WOR) raised to Neutral vs. Underperform — Macquarie

Harvey Norman (HVN) cut to Underweight vs. Neutral — J.P. Morgan

Harvey Norman (HVN) cut to Underperfom vs. Neutral — Macquarie

Bank of Queensland (BOQ) raised to Buy vs. Neutral — Shaw & Partners

Bank of Queensland (BOQ) cut to Hold vs. Buy — Bell Potter

AWE Group (AWE) raised to Neutral vs. Underperform — Credit Suisse

AWE Group (AWE) raised to Buy vs. Neutral — UBS

Adairs (ADH) cut to Neutral vs. Buy — Goldman Sachs

Spotless (SPO) cut to Sell vs. Hold — Deutsche Bank

Damon Kitney 9.00am: The bitter tale of Bellamy’s new board

The afternoon Rex Airlines flight to Melbourne from Wynyard Airport outside Burnie in picturesque northwest Tasmania took off on Monday with one VIP missing from the passenger list.

Rob Woolley has done the flight hundreds of times. He’s on first name terms with the ground staff and cabin crew. But he never made this one.

As he contemplated life in his Wynyard home earlier in the day, the 66-year-old former accountant could only think of what he would confront next morning, hundreds of kilometres across Bass Strait in the Fairmont Room of Melbourne’s Park Hyatt hotel.

There for the long-awaited extraordinary meeting of Bellamy’s shareholders would be his lifelong friends — now seemingly turned enemies — Jan Cameron, Hugh Robertson and Laura McBain.

Plus Cameron’s coterie of new directors and advisers.

And the latter would be armed with proxies from two late entrants on to the Bellamy’s share register — US-based Delta Partners and the Hong Kong-based Janchor Partners — which would ensure that only one member of Woolley’s existing board would survive the meeting.

8.48pm: VIDEO: Trump’s address to Congress ahead

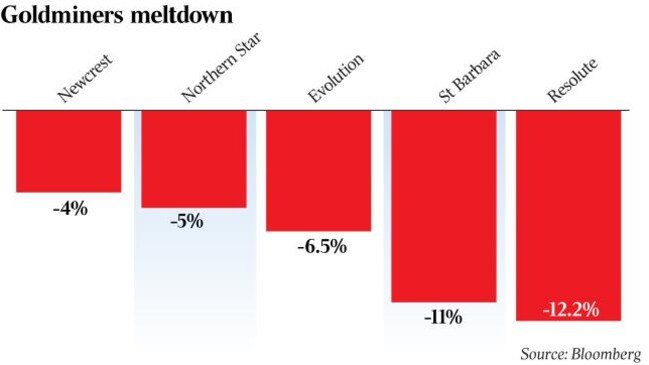

8.31am: Amazon lays ground for local assault

Bridget Carter and Ben Wilmot write:

US online retail powerhouse Amazon has advanced its plans to set up an Australian operation by launching a process to appoint a real estate firm to find the company a chain of distribution centres.

The prospect of Amazon’s entry has local retailers crying foul, with retail tycoon Gerry Harvey yesterday slamming the company as “not a good corporate citizen” and accusing it of having long-term plans to control the market via predatory pricing.

The Harvey Norman boss warned Amazon might struggle to distribute its products locally and would have to set up across Australia or land its customers with hefty transport bills.

Amazon, which has assessed setting up locally for some years, appears well aware of the problem and is now seeking an industrial property agent to find a network of storage sheds from which it can distribute its products.

Michael Roddan 8.24am: Investor property lending running ‘hot’

Investor lending in the property market is running hot and analysts say the frenzy is likely to continue unless there is a “dramatic” tightening of lending standards.

Data from the banking regulator shows Commonwealth Bank grew its investor loan book at twice the rate of the entire banking system during the seasonally slower month of January.

Meanwhile, a report released by ratings agency Standard & Poor’s yesterday said “a continued build-up of economic imbalances” was heightening the risk of a “low probability scenario of a sharp correction in property prices”. “There is a significant risk of continued build-up of private sector debt and house price growth” due to low interest rates and the lack of housing supply, S & P credit analyst Sharad Jain said.

RBA governor Philip Lowe continues to push the message that a “sobering combination” of high household debt and sluggish wage growth risks crushing the economy. Last week Dr Lowe argued that changes to capital gains tax and negative gearing could take some heat out of the market. The government has taken both tax reforms off the table.

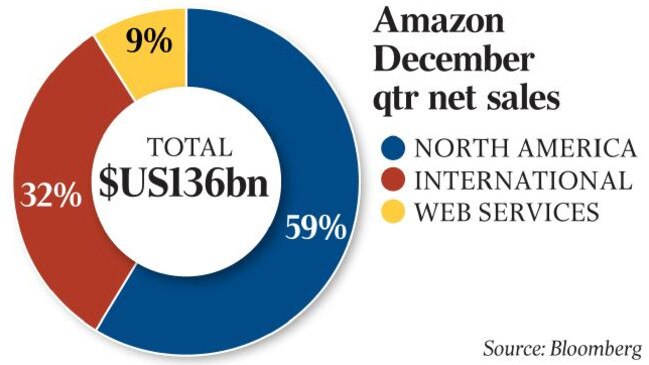

Paul Garvey 8.15am: Gold bugs feel the heat

Australia’s goldminers have seen more than $2 billion wiped off their collective value in a single session after a bloody day for the sector.

The value of the ASX All Ordinaries Gold index, which plots the share movements of the 20 largest goldminers, shed 5.3 per cent yesterday in the latest bout of extreme volatility for the industry.

Resolute Mining, which was one of the best-performed stocks in Australia last year, slumped more than 12 per cent over the course of the day after releasing its interim profit result.

The result was complicated by Resolute’s decision to sell only just over half of the gold it mined during the period, meaning the headline profit and revenue figures were softer than some in the market had expected.

That fall at Resolute was almost matched by St Barbara (down 11 per cent), while bigger players Newcrest Mining (down 4 per cent), Northern Star Resources (down 5 per cent) and Evolution Mining (down 6.5 per cent) also suffered.

Yesterday’s heavy price falls came as the market readied for last night’s address to congress by Donald Trump, which was expected to shed more light on the US President’s plans for the American economy.

The sharp falls could well mark the start of the third wild swing in momentum for the gold space in the months since Mr Trump’s presidential win.

7.45am: Aussie dollar slips against greenback

The Australian dollar is slightly lower against its US counterpart with markets in wait-and-see mode ahead of US president Donald Trump’s keenly awaited address to Congress and local economic growth data.

At 7.40am (AEDT), the Australian dollar was worth US 76.66 cents, down from US76.86c on Tuesday.

Westpac’s Imre Speizer said the local currency ranged sideways overnight, between US76.66c and US76.95cas markets remained in a wait-and-see mode ahead of US president Donald Trump’s address to Congress.

Australian gross domestic product figures are expected to show a 0.9 per cent lift for the fourth quarter of 2016, following a 0.5 per cent contraction in the previous three months.

The US dollar dropped 0.27 per cent to 100.85 against a basket of major currencies.

The Aussie dollar is also down against the yen and the euro.

AAP

7.20am: Stocks set for flat start

The Australian market looks set to open flat with markets in wait-and-see mode ahead of US President Donald Trump’s first address to Congress and with local growth figures due later on Wednesday.

At 7.19am (AEDT), the share price futures index was up one point at 5,685.

In the US, the Dow Jones Industrial Average looked to have snapped a 12-session winning streak, and was down 0.13 per cent in late afternoon trading. The S & P 500 and the Nasdaq were also lower, down 0.29 per cent and 0.60 per cent, respectively.

Markets hope to hear details on President Trump’s promised tax and infrastructure spending plans in his speech, due at 1pm (AEDT).

Meanwhile, in local economic news on Wednesday, the Australian Bureau of Statistics releases national accounts — including gross domestic product — figures for the December quarters.

No major equities news is expected. The Australian market on Tuesday closed lower for the fourth straight day. The benchmark S & P/ASX200 index fell 12 points, or 0.21 per cent, to 5,712.2 points.

The broader All Ordinaries index lost 12.8 points, or 0.22 per cent, to 5,761 points.

AAP

6.55am: US retail stocks drag on Wall Street

Investors sold retail shares after Target gave a weak profit forecast for the year, as major US indexes slipped Tuesday.

The Dow Jones Industrial Average fell 37 points, or 0.2 per cent, to 20,800 after reaching a 12th-consecutive record high Monday. The S & P 500 lost 0.3 per cent and the Nasdaq Composite fell 0.6 per cent.

Consumer discretionary stocks were among the biggest decliners in the S & P 500, falling 0.6 per cent Shares of Target dropped 12 per cent after the company gave a downbeat forecast for earnings this year and said sales and profit declined in the fourth quarter.

Dow Jones

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout