Sea of red as gold stocks suffer $2bn hit

Australia’s goldminers have seen more than $2bn wiped off their collective value in a single session.

Australia’s goldminers have seen more than $2 billion wiped off their collective value in a single session after a bloody day for the sector.

The value of the ASX All Ordinaries Gold index, which plots the share movements of the 20 largest goldminers, shed 5.3 per cent yesterday in the latest bout of extreme volatility for the industry.

Resolute Mining, which was one of the best-performed stocks in Australia last year, slumped more than 12 per cent over the course of the day after releasing its interim profit result.

The result was complicated by Resolute’s decision to sell only just over half of the gold it mined during the period, meaning the headline profit and revenue figures were softer than some in the market had expected.

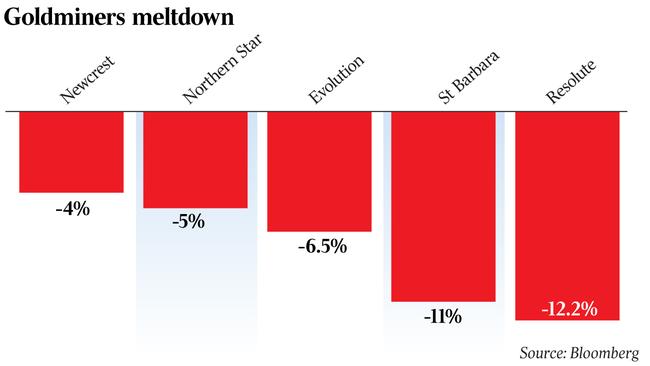

That fall at Resolute was almost matched by St Barbara (down 11 per cent), while bigger players Newcrest Mining (down 4 per cent), Northern Star Resources (down 5 per cent) and Evolution Mining (down 6.5 per cent) also suffered.

Yesterday’s heavy price falls came as the market readied for last night’s address to congress by Donald Trump, which was expected to shed more light on the US President’s plans for the American economy.

The sharp falls could well mark the start of the third wild swing in momentum for the gold space in the months since Mr Trump’s presidential win.

A Trump presidency was originally forecast to be a boon for goldminers, but the Australian sector instead slumped 34.5 per cent in the first month following his triumph.

The sector then posted a 43 per cent rally between December and February as the market rediscovered gold’s safehaven properties.

If yesterday is indeed the start of another big downswing for the gold sector, the mid-tier gold plays that took advantage of the recent positive market conditions to raise equity will be patting themselves on the back.

Dacian Gold, which is planning to develop the Mount Morgans gold deposit in outback WA, wrapped up a $92.2 million institutional placement on Friday and only yesterday sent out documents to retail shareholders hoping to participate in the (fortunately) fully underwritten $17.6m retail entitlement offer.

The stakes were high for Dacian, given it had to abandon its original $150m equity raising in November when gold’s initial post-Trump selldown was in full swing, and it now has enough cash to fund it through the construction of Mount Morgans.

Gold plays Blackham Resources ($35m), Gascoyne Resources ($55m) and Beadell Resources ($51m) also tapped the market for fresh equity raisings last month.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout