Retail to struggle as consumer spending slows

Firms reliant on spendthrift households will need to switch tack as consumer spending shows signs of slackening.

While we watch the continued turmoil in the share and bond markets, the Australian retail sector must prepare for more blows because the June quarter downturn in consumer spending looks to be the start of a long-term trend.

Over time, restrained consumer spending will hit rents and property values in what is Australia’s largest real estate sector. It will also increase the Federal Budget deficit and force organisations like the Reserve Bank to realise that conventional unemployment statistics are meaningless.

Given the further increase in US bond yields last night, it means that the interest rate pressure in Australia is the reverse of the US — we are going down as they head up.

This divergence is part of the reason why the Australian dollar is being pummeled.

And it almost certainly means that we are headed for lower interest rates, although they will have very little effect.

Australian companies relying on consumer spending growth will need to undertake a careful review of their strategies.

Earlier this week, David Uren revealed the drop in consumer spending growth in the June quarter (Weak consumption growth defies budget, RBA forecasts, September 12).

The foreseechange group, headed by Charlie Nelson, specialises in analysing the underlying trends that lead to changes in consumer spending patterns. Nelson has raised the alarm that the slowdown in June is not a one-off and is likely to continue for many quarters, extending well into 2017.

This slowdown is not uniform and some sectors and retail shopping centres will be hit much harder than others. Almost all shopping centres are trying to encourage services selling and specialty higher margin stores into their centres but the inevitable overall decline in rental income and property values will hit a vast number of Australians.

Foreseechange say the four main drivers of consumer spending growth — household income growth; willingness to spend; the wealth effect and using debt for consumption spending — are all pointing down.

In the case of household income two of the main components, population and wages growth, are unpleasant stories. Population growth has slowed from 1.8 per cent in 2012 to an estimated 1.3 per cent this year.

Wages growth has slumped from over 3.5 per cent in 2012 to just over 2 per cent this year. Slow employment growth makes it hard to demand higher wages and recent interest rate cuts have slashed the incomes of many people aged over 55 so household income growth will continue to be weak.

To underline why household incomes are struggling, the Macquarie group estimates that 20 minutes has been cut from the average Australian work week since the end of 2015. That’s a significant reduction and reflects the fact that in recent times the majority of employment growth has been in part time jobs.

If full time workers had been used, then Macquarie estimates employment would be 124,000 lower, and the unemployment rate 1 per cent higher. This makes a nonsense of conventional unemployment analysis.

The second driver of consumer behaviour is “willingness to spend” which foreseechange measure via a formula. That measurement showed that from late 2014 to late 2015 “willingness to spend” helped to sustain consumer-spending growth despite lower income. Now the “willingness to spend” stimulus is waning. Willingness to spend is particularly important factor in discretionary spending.

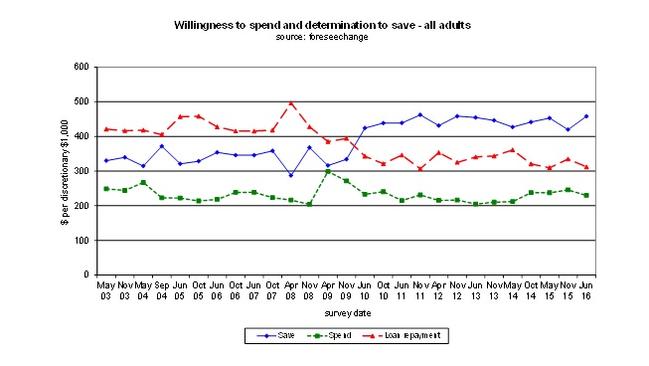

Nelson says people allocate their discretionary income between building savings, loan repayment, and spending. Consumer discretionary spending priorities change over time, depending on a wide range of factors.

And so between 2003 and 2009, the top discretionary priority was loan repayment but, since 2010, it has been building savings. While spending is consistently the lowest priority for use of spare cash, it is a reliable leading indicator of retail spending. The fall in the willingness to spend indicator in the June quarter is a not a good sign of what is to come.

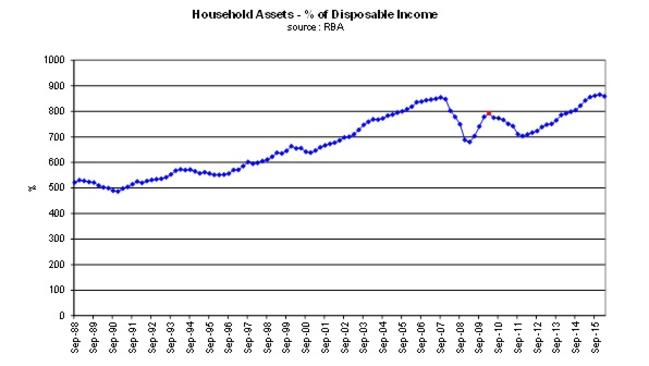

The third important driver is the wealth effect, best measured by the household assets to disposable income ratio (see the chart below). This is influenced mostly by residential property prices but also involves sharemarket moves. The latest fall in share prices will depress the “wealth effect” which mostly drives spending on expensive durables rather than consumables.

There have been two wealth recessions in this measure since 2007, but a good recovery since 2011 has boosted consumer-spending growth. This measure appears to have peaked in late 2015.

The only other possible source of a boost to spending — increase the use of debt to fund consumption — seems very unlikely as the increase in credit card balances outstanding has been growing by less than 3 per cent since 2012. Consumers have fallen out of love with debt-fuelled spending.

Marketers of goods and services to domestic consumers will therefore need to grow their share of a more slowly expanding pie. They will need to identify those consumers who are most willing and able to spend and target them with attractive product benefits and relevant communications.

But looking at the overall situation, Australians will need to learn how to grow demand for our goods and services in overseas markets. This will require more than free trade agreements.

And federal and state governments, hooked on the drug of big spending, will begin to suffer because household consumption expenditure represents around 55 per cent of the expenditure measure of GDP, so a slow down in consumer spending will slow economic growth and reduce the growth rate of GST revenue.

There are no easy solutions.

Hear from Alan Kohler, Robert Gottliebsen, Stephen Bartholomeusz & John Durie at a special member Q&A. Find out more or book tickets here.