Weak consumption growth defies budget, RBA forecasts

Weak consumer spending is challenging budget and RBA predictions that households would drive economic growth.

Weak consumer spending is challenging both budget and Reserve Bank predictions that households would be the mainstay of economic growth over the coming year.

The retail sector has been suffering poor sales since the beginning of the year, but it had been thought that broader measures of consumption, including spending on education, health, utilities and other services, would show firmer growth.

The May budget reported that consumption was being supported by strong employment growth, falling petrol prices and a buoyant housing market, which was delivering a boost to wealth and generating higher sales of household goods.

The budget predicted that household spending, which accounts for about 55 per cent of the economy, would continue rising at a rate of 3 per cent a year, after inflation, over the next four years.

Wage growth would remain subdued, but Treasury expected households to maintain their consumption levels by winding back their savings. The budget papers noted that “uncertainty around the pace of decline in the household saving rate poses a risk to the rate of consumption growth”.

The more recent Reserve Bank economic update, released last month, had detected that consumption growth was a lower than it had expected earlier this year but predicted it would rise at a little above its long-term trend rate of around 3 per cent this year, supported by “moderate income growth and increases in household wealth”.

However, consumer spending rose by only 0.4 per cent in the June quarter, the slowest growth in three years. There may be quarterly volatility in the number, but averaged over the past six months, the annual rate of household consumption growth has dropped back from an annual rate of 3.4 per cent in December to 2.3 per cent now. The soft consumption growth was evident across most of the country.

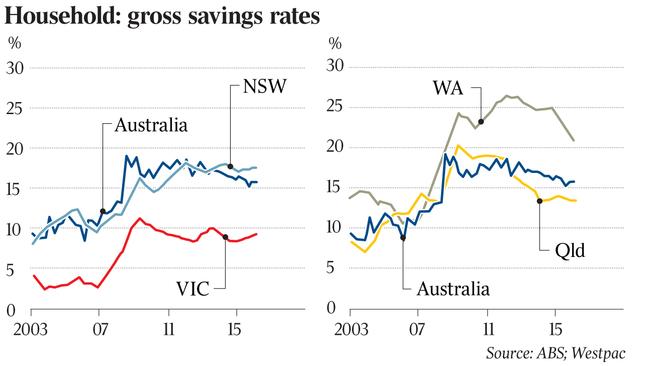

The savings rate, which had peaked with households saving 11 per cent of their disposable income in 2013, has been drifting lower, dropping as low as 7.5 per cent in the December quarter last year. However, it has stabilised at 8 per cent over the past six months.

Although not predicted, the slowdown in consumption growth is not surprising, given weaker employment growth and stagnant household incomes. There was a surge in hiring in the second half of last year, with employment rising at an annual rate of 3 per cent, however jobs growth has slowed to around half that rate this year.

Moreover, it is part-time jobs that are being generated while full-time positions are being lost. The hours worked peaked in December and has been drifting lower since then. Total wage income rose by only 0.5 per cent in the June quarter while the increase in compensation per employee was just 0.2 per cent.

These national trends conceal some significant state differences. Westpac senior economist Matthew Hassan compiles estimates of state household savings rates, based on Australian Bureau of Statistics estimates of consumption and labour income. Hassan says the figures are approximate, but the savings rate appears to be falling in the mining states as households suffer falling wages as the mining boom winds down. In NSW and Victoria, by contrast, the savings rate appears to be lifting, with households banking some of their faster growth in income rather than spending it.

Hassan says there is little evidence of the house price boom in Sydney and Melbourne generating much of a “wealth” effect on consumption. In earlier house price booms, people withdrew equity from their homes and used it to fund consumption.

An analysis by the Reserve Bank, cited by Philip Lowe in a speech last year as deputy governor, shows that while a rise in housing wealth of $100 leads to a rise in non-housing spending of between $2 and $4 a year, it is not a simple relationship. People are not literally spending some of their additional wealth.

“The link between housing wealth and spending arises not so much through the traditional pure wealth channel, but rather because higher housing prices are sometimes a proxy for faster expected income growth into the future. And it is this lift in expected income growth that spending is really responding to,” Lowe said.

Using the longitudinal household income survey, HILDA, the RBA found that when housing prices lift in a particular area, spending by both owner-occupiers and renters rises, suggesting that increased house prices are generating expectations of increased incomes for everyone.

With income growth at its lowest level on record, it is not surprising the house price boom is having little effect on consumption.

The Westpac-Melbourne Institute consumer sentiment survey shows that while households are feeling better about their personal finances, they remain concerned about the economic outlook over the next 12 months.

Hassan says this flows through to job security. Households had been showing a gradual improvement in their views about the employment outlook until early this year, but this has stalled over the past five months.

There are some tentative signs the outlook for incomes may be improving. National Australia Bank chief markets economist Ivan Colhoun keeps track of salary data generated by the Seek online recruitment service.

In NSW, salaries were flat between 2012 and the middle of last year, but there has been growth of about 2.1 per cent since then. In Victoria, salaries dipped between 2012 and 2014, but there has been a 5 per cent lift since the beginning of last year.

There were steep falls in average advertised salaries in Western Australia (16 per cent) and Queensland (12 per cent) between 2012 and the middle of last year, but they are now beginning to rise.

One positive development in the June quarter was the lift in Australia’s terms of trade as prices for the key export commodities, iron ore and coal, improved for the first time in three years. This generated a lift in national income.

Westpac’s Hassan says it is surprising how closely national income is tied to household income. One would expect a boost in export prices to translate into a lift in household incomes only with a significant lag; however, in practice, it has occurred rapidly.

This suggests that hourly wages should start lifting over the remainder of the financial year. Firm job ads are also encouraging for the employment outlook. Any lift in household consumption is likely to start with improved incomes.