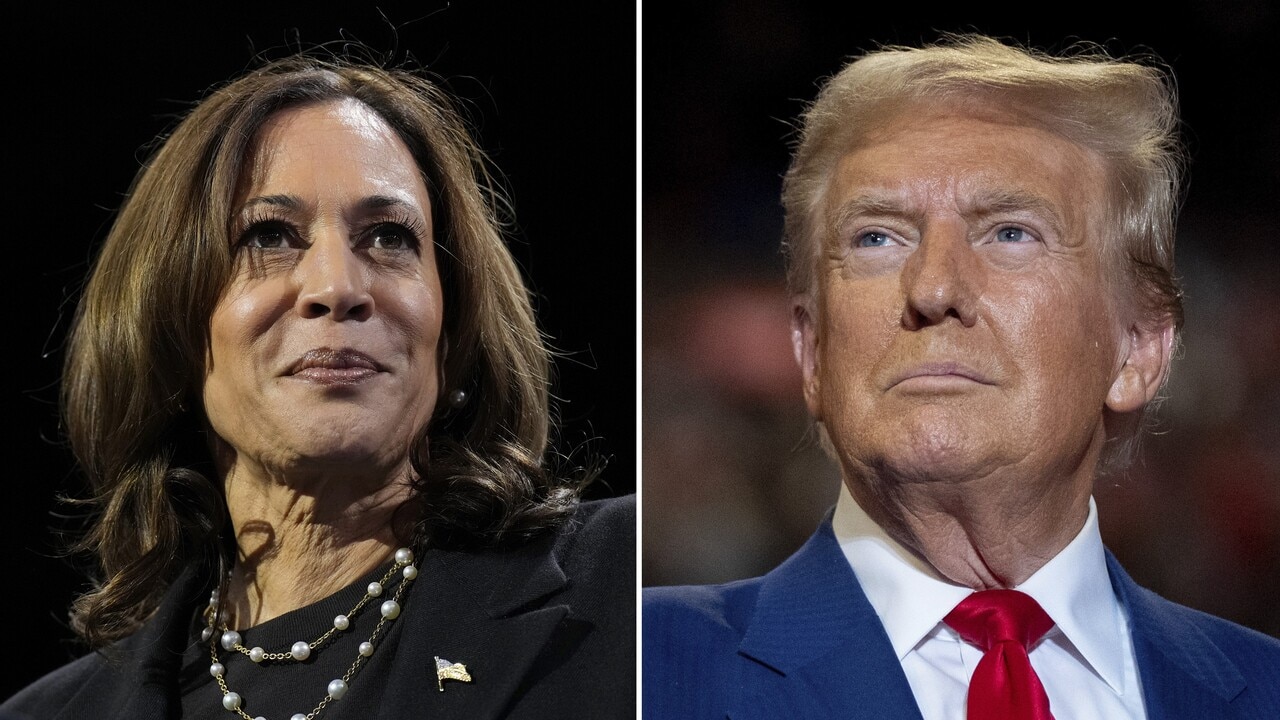

Business braces for US election ripples, Trump triumph

If Trump wins, expect sweeping tariffs which will recalibrate global supply chains. Australian business is on edge ahead of this week’s US election.

The use of bitcoin and other digital assets will “skyrocket” if Donald Trump wins the Presidential election next week, paving the way for a similar wave in Australia, according to cryptocurrency expert Liam Hennessy.

A Trump presidency would give the crypto currency sector a “steroids boost” as he moved to sack the chair of the Securities and Exchange Commission, Gary Gensler, who has been cool on digital assets, encouraging US government departments to use bitcoin, he said.

Mr Hennessy said Mr Trump had promised other changes to “supercharge” the sector, including holding a portion of US Treasuries in bitcoin, and easing regulations, including allowing banks to use bitcoin for capital.

“Kamala Harris will support digital assets like a personal trainer,” said Mr Hennessy, a Brisbane-based partner of law firm Clyde & Co, an adjunct professor of law at Griffith University, and an adviser to the Dubai Future Foundation. “But Trump will support them like a steroids dealer. It will give credibility to a new asset class and really supercharge it.”

Such a move, he said, would see the rest of the world follow the US in actively encouraging the use of digital assets.

“If Trump is elected, they’ll follow him like the Pied Piper. Politics, money and regulation is supporting the rise of long-term adoption of digital assets,” he said.

“If Trump wins, digital assets will skyrocket and Australia will take notice.”

Mr Hennessy said a shift in the US could see more encouragement for politicians in Australia to back bitcoin and the use of digital assets.

He said regulators and policymakers in Australia were putting a lot of work into the potential regulatory framework around the use of cryptocurrencies, but political support was lacking.

Mr Hennessy said increasing expectations digital assets including crypto would take off under a Trump presidency could be seen in the rising price of bitcoin in recent weeks.

The price of bitcoin was down to $US80,730 in early September when it appeared Democratic nominee Kamala Harris was ahead in the polls, but was trading at more than $US104,100 this week.

Corporate leaders size up presidential hopefuls

As the US election approaches, corporate leaders around the world are assessing the potential policies of either candidate and how it may affect their business.

A potential Trump presidency is expected to involve lower taxes and regulation, but with new tariffs which could hurt global trade.

“If Trump wins, expect sweeping tariffs that will recalibrate global supply chains,” Ben T. Smith, head of digital and analytics with US management consulting firm Kearney, told The Australian.

Speaking during a visit to Australia this week, he said Mr Trump would start with a big tariff hike on most imports from China and a universal tariff for imports from most other countries.

He said a Harris presidency would see a continuation of many of Biden’s trade policies and even some of the same officials.

But he said there would be “an expanded focus on sustainability and workforce requirements in most US trade policies”

“No matter who wins, companies should expect tighter export controls, tougher forced labour enforcement, and a heavily debated renegotiation of the US-Mexico-Canada (trade) Agreement,” he said.

Mr Smith said the next president was “likely to continue advancing security ties with Australia through the AUKUS partnership”.

He said Australia would need to balance its defence ties with the US with its $327bn trade relationship with China, its largest trading partner.

Tariffs the top concern for US businesses

A new report by Kearney says US companies are now assessing the potential impact of a Trump or Harris win on their business, with tariffs their biggest single concern.

Trump, who calls himself “tariff man”, has threatened to impose tariffs of between 10 and 20 per cent on all imported goods and tariffs of up to 60 per cent on goods from China.

He has also signalled he will punish US firms who move production offshore, vowing to hit US machinery manufacturer John Deere for its plans to move some production to Mexico, saying he will tax its exports of Mexican made goods into the US at 200 per cent.

He has also threatened to hit Mexican-made goods with 100 per cent tariffs.

A Harris administration is expected to continue President Biden’s approach of more targeted tariffs and export controls.

The Kearney survey showed 68 per cent of respondents are worried about the impact of new tariffs, with 26 per cent naming the potential for new export controls as their main worry and 26 per cent most worried about new tax policies.

Australian businessman Bruce Buchanan, chief executive of e-commerce software company Rokt and former chief executive of Jetstar Australia — who has been living in the US since 2016 — told The Australian he felt the US was feeling “more divided this election cycle” than in previous elections.

“I think there will be a greater divide along gender this election — whilst on the positive side it looks as though there will be less division along race,” he said.

“Republicans are promising greater cuts in regulations and government spending, which could help spur new roles for the private sector and greater innovation — in a similar way that SpaceX and others are doing in an area that used to be dominated by the government through NASA.

“Democrats, on the other hand, are committed to supporting industries like renewables and healthcare.”

He said a Harris Administration “would probably represent more of the same, in terms of what we have seen over the past four years”.

Several other Australian businesspeople with an exposure to the US have refused to comment ahead of the election, given the closeness of the political race.

James Thornton, chief executive of Melbourne-based international travel company Intrepid, whose customer base is 30 per cent American, said he expected a spike in travel bookings from the US after the election was over.

“Americans tend to hold off making decisions about travel ahead of a major election like this one,” he said. “Once it is over, we are expecting our US customers to start making travel bookings again. They are big travellers to Asia, Central and South America and Europe. We are expecting bookings from the US to spike up by 20 to 25 per cent, year on year, after the election is over.”

Expansionary policies either way

Westpac chief economist Luci Ellis, former assistant governor (economic) with the Reserve Bank, said both Trump and Harris had expansionary fiscal policies.

But, she said the “nature of the largesse will be different depending on who wins”.

Mr Trump has promised to continue the income tax cuts introduced under his presidency which are set to expire at the end of next year.

She said a Trump administration could expect to get more revenue from trade tariffs but lose much more from the move to continue the income tax cuts.

A Harris presidency was expected to see a continuation of many of the policies of the Biden administration, including targeted spending to support specific policy goals.

“Harris is likely to do something similar to what Biden has done, including interventionist spending measures such as college debt relief and subsidies for the climate transition,” she said.

“The nature of the fiscal stimulus will be different under each potential president, but both will have relatively loose fiscal policies.”

She said whoever won the White House was expected to continue a policy of treating China as a strategic rival “rather than a factory”.

While President Trump began a tariff war against China, she said President Biden had continued the battle, imposing tariffs on the import of electric vehicles from China and new controls on selling US technology to the country.

She said a Trump administration was expected to be more inflationary, with a combination of lower taxes and wide-ranging tariffs on imports.

Concerns about higher inflation in the US were already feeding into bond markets last week, with Mr Trump slightly ahead in the polls.

Ms Ellis said stricter immigration control under a Trump administration would also put pressure on inflation by limiting the supply of labour for business.

“If Trump were to get his full agenda through the congress, it would mean a significant reduction in labour supply in the US,” she said.

“While Harris would be less inflationary, her administration would still be very fiscally expansionary. It’s all a matter of degree.”

She said a Trump administration could see a slowdown in the US commitment to head to net zero by 2050, given his move to dump the commitment when he became president in 2016.

But, she expected US companies would continue to decarbonise their operations.

“Trump doesn’t care about the climate transition, but corporate America does,” she said.

“America due for a crash”

Former Sydney stockbroker and founder of Sirius Fund Management, Kieren Kelly, who also has business interests in the US, said the current mood in the US felt like the year before a major stockmarket crash.

“Given the slaughter in start-up valuations since January, the froth in private credit markets and overstretched valuations in some listed equities, it feels like late 1986 to me,” he told The Australian after a visit to the US.

He was concerned neither candidate had any experience or any “apparent interest in market regulation and supervision or in properly managing a bust”.

“America is due for a bust,” he said. “The last one of any significance was in 2008, and the present signs are not good. The tech sector is grossly overvalued, and the earnings have to skyrocket or the prices have to come back.

“My travels around the US in September 2024 reminded me of 1999, and the days before the tech bubble burst. Market volatility could be extreme in the first term of the coming administration.”

Mr Kelly said there was a potential for “economic gridlock” whoever wins the White House as chances were they would not control the two houses of congress.

This means some of the more dramatic policies of a Trump presidency, including major new tariffs, lower taxes and environmental deregulation “may never see the light of day”.

But, he said he was also confident in the long-term future of the US, given the capacity for innovation across the country.

“On a recent month-long trip to the United States, I visited many companies and was astounded by the creative energy that continues to bubble through all parts of the US economy,” he said. “Once the exclusive domain of big city specialist hubs like Palo Alto, and the financial district in New York, innovation is now everywhere.

“Tech hubs have emerged throughout the Midwest and the mountain states, in areas as diverse as Columbus, Ohio, Denver, Colorado, and even in small towns like Park City, Utah.

“The American creative drive and entrepreneurial spirit will thrive, undaunted by economic growth, political policy or the occupant of the Oval Office.

“John Pierpont Morgan said: ‘You will go broke shorting America’. It is still true today.

“Neither Trump nor Harris, if elected, will have the power to quench this insatiable appetite for wealth creation, creative innovation, ruthless competition and ability to mobilise capital.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout