Yes sparks will fly if Trump wins but AUKUS is safe, says Austal’s chair

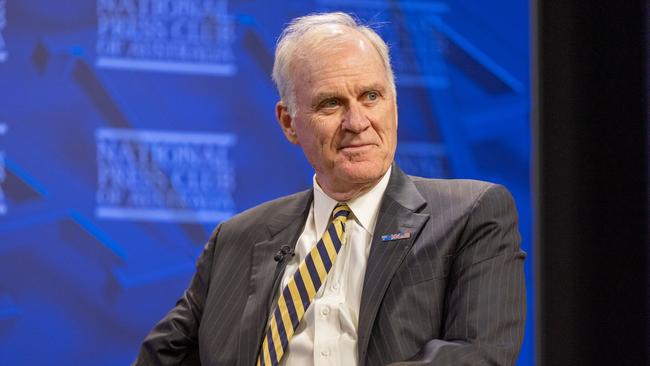

He was appointed, and then sacked, by Donald Trump as US Navy secretary but Austal chair Richard Spencer is comfortable the future of the alliance is safe.

The chairman of navy shipbuilder Austal predicts sparks will fly over AUKUS if Donald Trump wins the US election but sees no risk of the security pact collapsing.

Richard Spencer knows what it is like to be sacked by Mr Trump. He was dumped as secretary of the US Navy by the Republican leader in 2019 after a disagreement over the disciplinary process for a Navy SEAL who was eventually convicted of posing with the corpse of an Islamic State fighter in Iraq.

Mr Spencer, who is also global chairman of former Australian treasurer Joe Hockey’s Bondi Partners, said his history with Mr Trump would have no bearing on Austal or on Bondi.

He views AUKUS as the best piece of “statecraft” in 50 years and completely rejects criticism by former prime minister Paul Keating of the military alliance between the US, the UK and Australia.

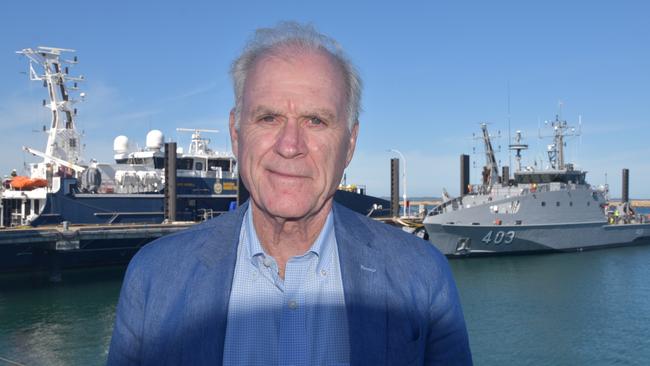

The former US marine and Wall Street veteran hosted his first annual general meeting as Austal chairman in Perth on Friday. The company has already been anointed by the Albanese government as its monopoly navy shipbuilder in the state.

Austal expects to lock in that status with the signing of a strategic shipbuilding agreement in a deal that could open the door for the company to secure about $20bn of work building heavy landing craft, frigates and other warships at Henderson, south of Perth.

Meanwhile, at its shipyard in Alabama, Austal is set to have a big role in building nuclear-powered submarines for the US Navy, on top of billions of dollars in orders for surface vessels.

Mr Spencer said AUKUS would stay on course regardless of whether Mr Trump or Kamala Harris won the US election.

“That’s for a bunch of reasons,” he said “One, just the national security aspect of it, as it pertains to both the US and our closest ally over here in Australia.

“Two, it has so much more far-reaching consequences than just national security. It really is a one plus one equals three piece. statecraft, which I think is the reason that it has such bipartisan support in the US. There’s very little downside. Whether Trump or Harris gets in, I don’t think AUKUS is in threat.”

Mr Keating argues that Australia had made itself a target by signing up for the military alliance in what is a response to China’s growing power in the Asia Pacific.

Mr Spencer said he disagreed with everything Mr Keating said apart from his point that AUKUS could not become a wealth transfer from Australia to the US.

“When you look at China it’s not a binary Cold War such as the USSR, because they are ingrained in our supply chain and our trading profiles. We’re going to have to manage China in a very different way than we ever faced before,” he said.

“But the fact remains that you have to have a strong defensive posture in order to negotiate at the table. Jim Mattis (former US secretary of defence) used to always say the reason you want a strong Department of Defence) is to give the State Department one more day.

“You want to negotiate from a position of strength. You also want to have assets out in the theatre protecting the maritime channels of trade and the undersea cables. And at the same time, you have China being quite belligerent to some of our smaller allies, and we cannot abide by that.

“We have to manage China diligently because they are a trade partner but we have to make sure that their aggressiveness in different areas doesn’t go unchecked.”

Mr Spencer said there were likely to be more flashpoints with AUKUS if Mr Trump returned to the oval office.

“You can never second guess Donald Trump. If he gets elected president I’m sure at some point sparks and arcs will fly with the Australian relationship as it will with every single allied relationship at some point,” he said.

“But I think it’ll be at the edges because the fact of the matter is AUKUS is so baked into our national security program that it could be near impossible to undo.”

Andrew and Nicola Forrest, who became billionaires on the back of iron ore sales to China, are Austal’s largest shareholders with a 19.9 per cent.

Company founder John Rothwell, who was chairman for 37 years, recently reduced his stake to 8.8 per cent with the sale of a million shares worth about $3m at the time, to Mr Spencer.

South Korea’s Hanwha abandoned its $1bn takeover tilt of Austal in September, accusing the board of blocking its attempts to carry out due diligence.

Hanwha’s last non-binding approach was at $2.85 per share and Austal shares are now trading at $3.31.

Nine days before Hanwha officially abandoned its pursuit, Austal was awarded a $US450m ($684m) contract to build a giant shed and other infrastructure at its Alabama shipyard to support the US Navy goal of delivering one Columbia-class and two Virginia-class nuclear submarines annually.

The contract entrenches Austal as an important cog in the supply of nuclear submarines for a long time. The company aims to have the facilities built by 2026 – 12 months before the Australian Navy’s Garden Island base south of Perth is due to become a home port for Virginia-class submarines under AUKUS.

Mr Spencer said he thought the market was still digesting the significance of the submarine contract, which is essentially a grant of $US450m by the US government via General Dynamics Electric Boat – the US Navy’s trusted builder of submarines for a century.

“Does the market fully appreciate the fact that a corporate entity just received almost two thirds of its market cap as an injection from the government with no strings attached? I don’t know.” he said.

“The most important thing is it really underscores the endorsement of not only the US Navy, but of General Dynamics Electric Boat that Austal is a credible enough partner to receive this and be part of the ship building infrastructure.”

Mr Spencer said he did not see any personal conflict between taking up the role of Austal chairman on July 1 and his position at Bondi, even though Bondi had worked on a takeover offer for the shipbuilder.

“Austal engages advisers to help them out with different financial aspects of the market and the lay of the land in the market. Bondi was hired along those lines,” he said,

“And on an unsolicited basis, Joe (Hockey) and Bondi tried to put together a package to see if it would be attractive for us. It was a bridge too far for Bondi.

“They remain a very credible entity and Joe Hockey has an amazing Rolodex if, in fact, the company was to ever use Bondi again. Obviously, I’d recuse myself from any appointment.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout