Instead, ASIC chair Joe Longo will let his actions do the talking and don’t be surprised if the next couple of weeks see some high-profile litigation from the corporate cop.

Recent reports of inquiries into the timing of ACCC investigations of Qantas hint at potential insider trading allegations.

Treasurer Jim Chalmers, who admittedly is better at words than action, may also finally deliver his long-promised statement of expectations for ASIC which will serve as a quasi endorsement of its work and structure.

Bragg and his fellow travellers want ASIC split into a regulatory arm and a financial conduct authority, rightly saying its remit is too broad. But whether his split is the best way forward is moot and then one must consider whether Australia really needs more regulators.

Certainly Longo would be glad if the registry arm slated for privatisation by the previous government went elsewhere – complete with its pending investment-heavy technology upgrade, as with his responsibility for running the nation’s $2bn in unclaimed funds from a range of sources.

Senator Bragg’s complaints about lack of enforcement action is plain wrong, as his comrade, Senator Paul Scarr, told the Senate in June: “I’m not in any way suggesting that ASIC is not very active in the criminal law jurisdiction.

“I think the figures which are presented on page 7 of the submission evidence that quite clearly, with 32 individuals charged by the CDPP in criminal proceedings, a total of 306 criminal charges in the 2022-23 year, and 35 criminal convictions, including 21 custodial sentences.

“Those are extremely serious offences to have resulted in custodial sentences.

“It looks to me as if the system is working as intended.”

In three years Longo has transformed the organisation and this task will continue in the next six months as he selects a new head of enforcement, head of regulation and CEO to replace Warren Day who is working with the DPP.

It’s not perfect and its task is not made any easier – on top of a myriad of parliamentary committee oversights it also fields 10,000 consumer complaints a year from aggrieved consumers.

In his past life Bragg worked as a policy adviser to the retail super funds, which explains why he is also a constant critic of industry super funds, even when the battle between the two has long ago been won by the latter.

ASIC, like all regulators, is easy to attack, often by the very same greedy people who invest their life savings in a scheme to buy the Sydney Harbour Bridge on the promise of a 58 per cent return.

When the scheme fails the cry comes “where was ASIC?”.

It also suffers from the scourge of being a convenient diversionary tactic for politicians who, when faced with an outcry, refer the matter to the regulator to investigate which makes it look like they are doing something.

In a dissenting comment in the recent Senate committee report, deputy chair Senator Jess Walsh noted there were some useful suggestions on how ASIC could improve, such as “boosting ASIC’s campaign approach to enforcement in its thematic reviews and an enhanced role for professional bodies in education, enforcement, and the reporting of misconduct”.

Better engagement being the issue.

The Bragg inquiry produced 400 questions on notice, five submissions and countless hearings which the senator may consider actually divert its attention from its day job.

The more Bragg attacks the more time he wastes and potentially its ability to perform, which is hopefully not his desired outcome.

ACCC boss stymied by inaction

ACCC boss Gina Cass-Gottlieb has returned from her recent OECD meeting in Paris frustrated by the inaction from the Australian government at its lack of action over her plea for new forward-looking powers against digital platforms.

She spent some time with her UK counterpart, Sarah Cardell, who has just won the controls Cass-Gottlieb wanted – which would be a code of conduct governing the individual platforms like Google, Microsoft, Apple and Amazon so any breaches would be actionable with immediate penalty subject to court review.

The just-concluded Epic Games case against Apple’s control of app payment systems is a case in point because the way Cass-Gottlieb sees it, Australian consumers are spending billions of dollars buying goods and services through apps which are not subject to competition.

CBA’s Matt Comyn and his banking friends would of course like some of the payments action.

Cass-Gottlieb has her sights set on her 2022 recommendations to government by the end of this year, which at best would mean legislation next year when an election is due.

Federal Assistant Treasurer Stephen Jones is consulting on more consultations.

Cass-Gottlieb’s team expects further directions from government on its digital platforms review which is presently slated to finish in March next year.

As the market waits for the long promised actions against Google’s search dominance, action rather than an extended review, would be better.

The platforms are not sitting around; they’re building bigger data bases to power more AI services and entrench their dominance.

Separately, Amazon is backing the Saks Fifth Ave $US2.7bn bid for Neiman Marcus to extend its network into high fashion.

The ACCC is also working on how best to regulate electric vehicle charging stations, with one model being the EU version which allows you to use any public charger – not just the proprietary charger installed by the car company.

In October the competition committee at the OECD will have its first consumer ministerial meeting.

Phone spectrum licence review

Telstra’s mobile phone price rises unveiled this week provide a backdrop to the looming debate over just how to handle the $8bn worth of expired spectrum licences – which will expire from 2028 to 2032.

New ACMA member and former News Corp executive Adam Suckling is handling the review, which will release an issues paper by year’s end pointing to its proposed plan of action.

The review has united the big three telcos in wanting the licences returned to existing holders at a reasonable price, reflective of the industry’s role as an essential service and the fact each $1 spent on spectrum is one dollar less invested in the service.

The question for a cash-starved government then is what to charge for the right to do business, how that business is done and whether the public is best served by the present model.

Annual spectrum costs have increased from $241m in 2015 to $818m this year and new technology means more base stations and equipment costs.

Since 2020 Telstra returns on capital have increased from 4.4 to 7.3 per cent, Optus from 1 to 1.7 per cent, TPG’s returns have fallen from 5.6 to 4.7 per cent and all are below the cost of capital.

On these numbers the industry is unsustainable so the government charges are passed on directly to consumers through higher prices, or investment is cut.

From there the unity breaks down and Telstra, which has about 45 per cent market share (Optus has 35 per cent and TPG 20) wants a “use it or lose it” model which would allow it to increase its spectrum holdings and entrench market power.

The others oppose it and then the door is closed on new entrants.

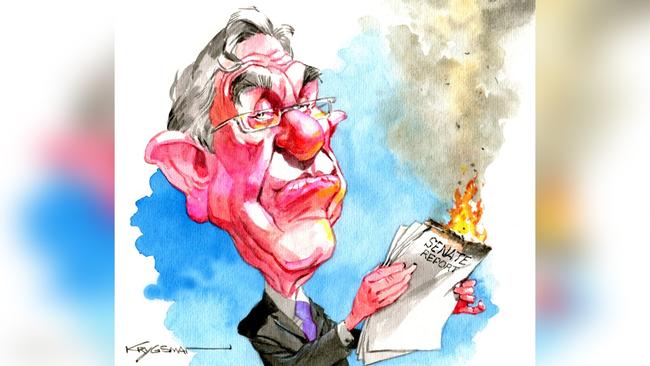

Senator Andrew Bragg’s ability to attract headlines sometimes correlates 100 per cent against the lack of substance in his remarks, which perhaps explains why his shock-horror attack on ASIC for the 132nd time failed to register with the government.