Boral director under siege for track record at Origin

Boral director Karen Moses has suffered a sizeable protest vote against her re-election to the company’s board.

Boral director Karen Moses suffered a sizeable protest vote against her re-election to the construction materials giant’s board after shareholder advisory firm Ownership Matters raised concerns over her record as finance chief of Origin Energy.

The investor backlash came just two days after Boral chief executive Mike Kane was forced off the board of Sims Metal Management after institutional investors questioned the value of Boral’s blockbuster $3.5bn acquisition of Headwaters back in 2016.

Both moves have highlighted a growing tendency among big shareholders to hold directors to account for their records with other companies, years after deals or financial moves were made.

Over 31 per cent of votes were cast against Ms Moses’s re-election to Boral’s board at its annual general meeting on Wednesday. That compares with her original election as a director in 2016 when just 1.5 per cent of shareholders opposed her appointment.

While no questions were asked by shareholders about her re-election at the AGM in Sydney, Ownership Matters had flagged concerns in a report lodged prior to the meeting over the accounting treatment of electricity hedges during her tenure at Origin.

Ms Moses stepped down from Origin in 2016 and the power giant changed its hedge accounting practices in August 2018, amounting to a $160m hit which raised the ire of some investors.

Ms Moses explained in the Ownership Matters report she had inherited the Origin accounting treatment when assuming her financial role in 2009 and noted the treatment and disclosure had not changed during her tenure.

Still, nearly a third of Boral shareholders took the opportunity to lodge a protest vote continuing the reverberations of financial decisions made by the power company years ago.

Former Origin boss Grant King withdrew from BHP’s board in 2017 after an investor backlash over big writedowns at its Australia Pacific LNG project.

Ms Moses quit Origin to pursue a career as a non-executive director and holds board roles at Boral, Snowy Hydro, Orica and Charter Hall Group.

Boral chief Mike Kane’s track record has also been called into question this week.

The US businessman decided on Monday he would not stand for election as a Sims Metal director following pressure from Sims shareholders concerned about his landmark Headwaters deal.

The Australian understands investors approached the Sims board to express their doubts over the Headwaters deal and the suitability of Mr Kane after he was appointed as a Sims director in March this year.

The Sydney-based company on Wednesday faced a series of questions over its deal to buy the Utah-based Headwaters amid speculation from some analysts that it could sell some of its US assets given middling performance.

But Boral chair Kathryn Fagg gave a stout defence of the deal.

“Given the challenges we have seen in the US, I have been asked by some shareholders if the board is still comfortable with the decision made in 2016 to acquire the Headwaters business. My answer is a strong yes,” Ms Fagg told the AGM. “The board remains confident and positive about the rationale and the strategic fit of the Headwaters businesses.”

Ownership Matters and Ms Moses declined to comment. Sims Metal was not immediately available for comment.

Boral earlier yesterday said it expected first-half earnings to slip by 5 per cent due to a soft Australian housing market, infrastructure delays and unplanned production outages.

Earnings before interest, tax, depreciation and amortisation for the first half of the 2020 financial year will fall 5 per cent, with a $30m contribution from its property division only partly offsetting lower volumes and higher costs.

Boral also said it would take a $10m earnings hit after losing two weeks of production at its Berrima cement plant and an unplanned “business disruption” at its Peppertree quarry, but plans to recover costs through the balance of the year.

Its North America unit was also mixed, with first-quarter earnings slightly lower than the prior year with early signs of improvement in the US housing market yet to flow through.

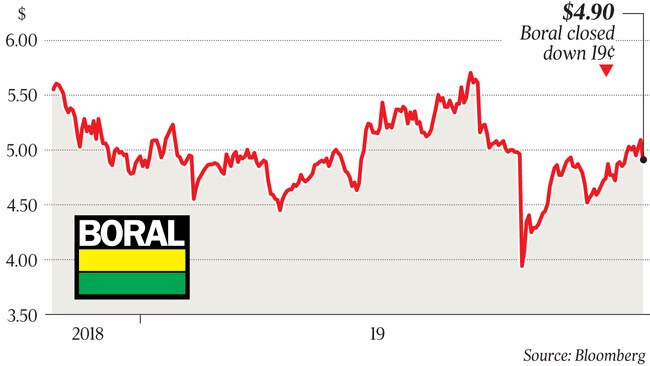

Boral shares fell 3.73 per cent to close at $4.90.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout