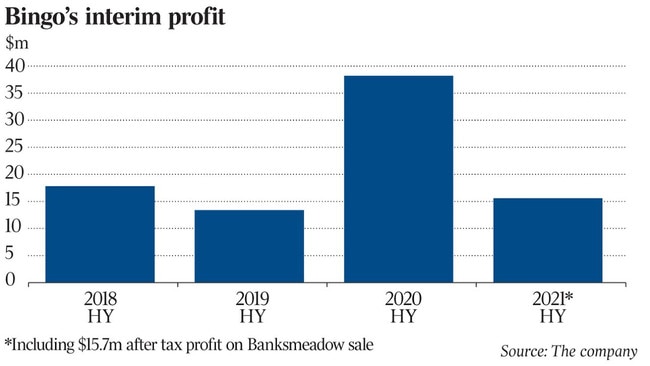

Bingo holds on to JobKeeper payments; eyes strong pipeline of work after interim profit halves

The waste manager, which made a profit and paid millions in dividends, will decide at year’s end whether to repay JobKeeper.

Waste management company Bingo Industries says it has no immediate plans to pay back the $800,000 it has received in JobKeeper payments, despite posting a $15.85m profit in the first six months of the financial year and paying out millions of dollars in dividends to shareholders.

“We’ll revisit and make a decision at the end of the financial year to see where our results for the full year end up,” Bingo managing director and CEO Daniel Tartak told The Australian.

“But our profits are down so we’ve definitely taken a hit this past six months compared to where we were 12 months ago, and the market is still volatile.”

While first-half profits were down 58.5 per cent on the year prior, revenue slipped just 1.5 per cent to $239.6m over the same period.

With its revenue holding up through the crisis — and even rising strongly in the 2020 financial year — Bingo as a whole was not eligible for JobKeeper. But 90 employees in two of its subsidiaries did qualify. This “generated some minor relief for the group, totalling $800,000,” Bingo said.

Of the $800,000 it received in COVID-19 government assistance payments, $500,000 was paid in the 2020 year, with the remaining $300,000 paid out between July and September.

Its top executives, meanwhile, were paid a combined $892,000 in bonuses in 2020, with Mr Tartak pocketing a little over $300,000.

The company also declared an interim dividend of 1.5c per share, down from 2.2c in the prior corresponding period.

Handing down the first-half results on Monday, Mr Tartak said the company was well positioned to benefit from government stimulus measures.

“We expect to benefit from the strong infrastructure pipelines in NSW and Victoria, before a recovery in the residential and non-residential markets over the medium term. C&I volumes are also set to increase with reduced restrictions and the wider workforce moving back to offices in the short term,” he said.

The waste management company is also starting to see some new business filter through from the government’s HomeBuilder program and expects that to ramp up in the coming months.

“Our alterations and additions revenue has increased over the last six months, which is a great sign, so we expect we’ll continue to see the benefits come through from that.

“In terms of the residential sector more broadly, we’re seeing some positive signs; we’re seeing some more in the pipeline in the coming six or so months, but we don’t think that will completely take off for another 12 months or so until there’s more longer-term confidence in the market.”

Bingo last month told the market it had received a $3.50 per share offer from private equity firm CPE Capital and Macquarie Infrastructure and Real Assets, valuing the company at $2.3bn.

The consortium has spent recent weeks carrying out due diligence, with rumblings in the market that a second suitor may soon come forward with a rival bid.

While declining to provide an update on CPE Capital’s takeover offer, Mr Tartak said he believed a decision would be made within a month.

When asked if Bingo had been approached by a second suitor, he pointed to his disclosure obligations: “When the time is appropriate, if something has happened we will inform the market,” he said.

Shortly after news of the takeover offer hit the market, mysterious short seller Snowcap pounced on the waste management business, criticising its environmental record, questioning the amount of waste it recycles and accusing it of misleading the market.

“In an age of responsible investing, we believe Bingo’s historical and ongoing disregard for environmental regulations is unacceptable, and we do not consider Bingo, in its current form, to be an appropriate investment for any responsible fund or index,” the Snowcap report said.

“This is significant for the current bid because both Macquarie and CPE pledge commitment to ESG principles on their websites.”

Mr Tartak said Bingo had attempted to reach out to the anonymous group, without success.

“I think their report lacks complete credibility and to be honest I haven’t taken quite seriously,” he said as he urged more regulation of short sellers.

I don’t think you should be allowed to come out and write a report without the business itself being able to talk to them. I think that needs to change; there needs to be more regulation around how these things happen.”

Bingo intends to engage with the regulators on the tactics used by short sellers, including reports aimed at driving down share prices.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout