Billionaire backing for Qld gas project

Billionaire Brian Flannery is bankrolling a potentially huge oil and gas reserve in the Surat Basin amid growing global uncertainties over energy supplies.

Billionaire Brian Flannery is bankrolling a potentially huge oil and gas reserve in the Surat Basin amid growing global uncertainties over energy supplies.

The Flannery family has tipped $4.18m into an initial public offering of Omega Oil & Gas, a little known company that holds exploration permits and petroleum leases in the basin.

The permits held by Omega, which plans to list on the ASX later this month, potentially hold up to three trillion cubic feet of gas and 233 million barrels of oil, a reserve that could last for a decade.

The Flannery clan are not the only richlisters backing investments in gas as Russia’s invasion of Ukraine raises the stakes on energy security.

Last week, Trevor St Baker announced he was taking a strategic stake in Queensland-based State Gas as he pivots out of his coal investments to take advantage of soaring gas prices.

Brian’s son Quentin Flannery, who is an experienced energy sector executive, has joined the Omega board ahead of the IPO.

Quentin Flannery said his family was bullish on energy with continuing upward pressure on gas prices, especially following Russia’s severe curtailment of supply to Europe.

“It is going to be a tough winter in Europe and (Russian president) Putin does not appear to be backing down,” said Mr Flannery.

Mr Flannery joined the family investment firm Ilwella in 2015 after serving as global head of thermal coal sales at Yancoal, which he helped build into one of Australia’s largest pure-play coal producers.

A fluent speaker of Mandarin following a stint in China, Mr Flannery said his father remains a key supporter of the energy sector. “He personally is a great mentor to me and we talk two to three times a week,” he said.

Mr Flannery said it was hoped Omega could commercialise its gas project within a reasonable time frame following the stock market listing.

Omega’s permits span over 110,000 hectares of the energy rich Surat Basin and are located about 50km from existing pipelines that feed into the Australian east coast gas market.

Some of the world’s biggest energy companies already have a foothold in the region, with Shell operating about 50km from Omega.

Omega managing director Lauren Bennett said Omega was listing at a time of rising concern over global energy shortages. “Europe is going into what will be a very cold winter,” said Ms Bennett. “They are already talking about blackouts in the United Kingdom. Energy security is becoming increasingly important as people realise they cannot move to renewables overnight.” She said the backing of the Flannery family had been crucial for Omega.”We are grateful to have the support of the family,” she said. “They have diverse experience in resources and Quentin brings so much credibility to the role.”

Queensland Resources Council chief executive Ian Macfarlane said high energy demand was sending the prices of coal and gas soaring. “People are desperate for coal,” Mr Macfarlane said. “We are seeing Russian coal taken out of the demand for thermal coal in Europe while the UK and Germany are restarting their coal fired power stations.”

Last month, Senex announced a $1bn expansion of its Surat gas field in a plan to pump enough of the resource into the domestic market to cover 40 per cent of the state’s needs.

The announcement by Senex came the same day Federal Resources Minister Madeleine King was set to urge Queensland to open up more gas fields to help keep the nation’s lights on.

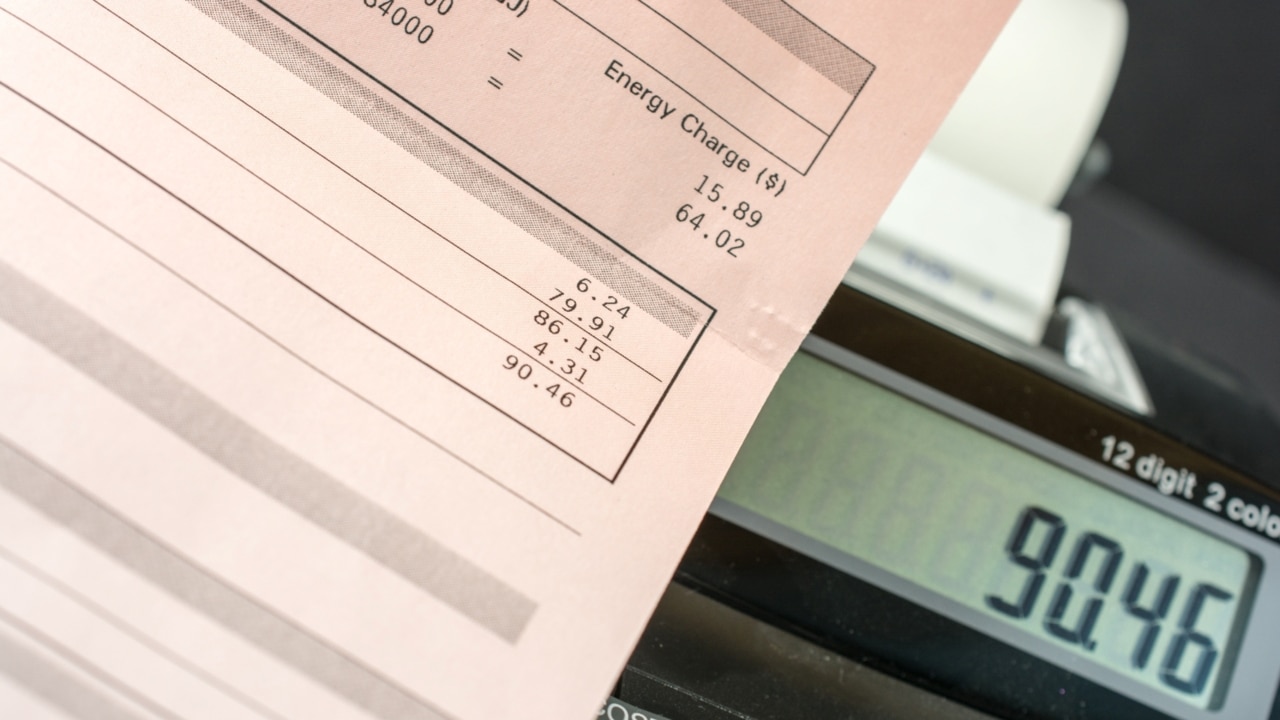

Omega has raised $15.07m from the offer, giving it a market capitalisation on listing of $27.8m. The company intends to drill two wells to determine the gas reserves located more than 3.5km underground.

Omega adds to a slew of small cap investments by Brian Flannery, one of the country’s most prolific — and successful — investors in such firms.

Mr Flannery Snr has shares in several small but strongly performing gold stocks, a range of other mining investments as well as property and aged-care holdings He made his first fortune from the sale of Felix Resources to Yanzhou Coal in 2009, from which he made about $530 million, and has since had a range of resources and property investments.

Last month, Mr St Baker and Mr Flannery Snr sold their joint investment in NSW’s Vales Point coal power station for more than $200m to a Czech company.

The two executives bought the 1320MW power station on Lake Macquarie for $1m from the NSW government in 2015. It was revalued at $722m just three years later and finally sold for more than $200m, sources said.

More Coverage

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout