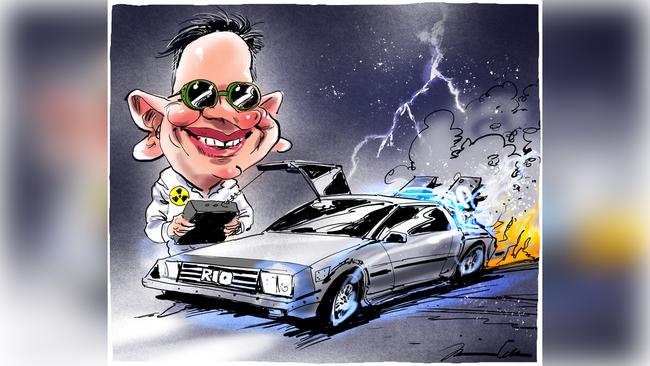

BHP has hit the climate change debate with a megaphone and Rio Tinto’s Jean-Sebastien Jacques is on the same bus, as shown by yesterday’s speech to the London metal Exchange.

In the process he highlighted how technology has opened new ways for Rio to do business, which would mean scale for the sake of it was no longer paramount.

BHP’s Andrew Mackenzie has told everyone the miner wants to tackle climate change for the simple reason that he wants the company to be able to sell more iron ore, coal and copper to more people for longer.

His external affairs chief Geoff Healy spoke at a Citigroup meeting in Sydney last week, fleshing out the BHP policy as outlined earlier in London, with the simple fact being 80 per cent of BHP’s products emitted carbon dioxide and the steel industry accounted for 65 per cent of emissions. JS took up the theme: “The only way we can truly tackle climate change is through partnerships across the value chain.”

Origin’s Frank Calabria was banging the same drum in a speech last week, pointing to an additional complication in the game where government not only can’t get its head around long-term policy, but it is talking about underwriting unspecified new projects which could throw business plans up in the air.

It is far better for Canberra to set the parameters and let business get on with it because on climate change the politicians are 100 light years behind.

In case the lunatics in Canberra think BHP, Origin and Rio have turned into tree huggers they will come to understand the mining giants just want to make more money for longer.

“We must continue to be part of the solution,” JS said, noting “we are developing a breakthrough process to generate battery-grade lithium carbonate from waste rock at our Boron site in California.

“Our approach needs be based on a pragmatic kind of sustainability with profitability at its heart. Only a profitable business can provide sustainable benefits to shareholders, to communities, and governments.

“Society expects more of our industry, which in turn brings with it a sea-change in shareholder expectations and more and more questions on our business model,” JS said.

“It is already starting to happen. There is absolutely no doubt we must play our part in reducing emissions for future generations. This requirement is already driving structural changes across our industry, limiting investment in commodities such as thermal coal, or investment in companies who mine coal.”

JS talked up cash flow per share rather than simply more cash, growth through development of new resources and growth in new profit pools, such as recycling or mining waste tailings, to name but two.

Westpac ‘failed’

ASIC has won a welcome victory when the full Federal Court overruled an earlier decision in Westpac’s favour on the pivotal issue of personal v general advice for superannuation.

The former requires a much higher standard of care, and the industry from AMP’s Francesco De Ferrari down have begged for some leniency on the issue with perhaps a third test in the middle of the two.

His argument being customers will be hit with more complexity and less advice if the law stands as it is.

Based on the full court decision, what is needed first is a more careful acceptance and conformity with the law by the industry than was evident here.

In this case between 2013 and 2016 Westpac successfully convinced some 30,000 accounts to consolidate in its favour to boost its business.

The tactic in question was advice to consolidate accounts to save money but in this case Westpac took the running, aiming to ensure the accounts consolidated in its favour.

Justice Jayne Jagot described Westpac’s conduct as “systemic sharp practice about what must have been one of their clients’ major financial concerns, their superannuation”.

Justice Jagot’s comments were particularly welcome given she slammed APRA for its failed IOOF litigation.

Chief Justice James Allsop said, ‘‘Westpac attempted, assiduously, to get the customer to make a decision to move funds to BT without giving personal financial product advice as defined in the legislation. It failed.”

He continued, “Westpac took unfair advantage of that asymmetry (between it and the client) by implementing a carefully crafted telephone campaign.

“The telephone campaign was directed to persons with whom Westpac had an existing relationship and in a real sense occupied a position of trust with respect to the customer’s superannuation fund.

“Despite knowing that the decision was not straightforward, Westpac did not advise its customers about the matters that they should consider before deciding to consolidate their superannuation.”

Bellamy’s takeover

It’s nearly two months since Mengniu Dairy unveiled its $1.5bn bid for Bellamy’s Australia and 17 per cent shareholder Jan Cameron is still to declare her hand.

On Thursday Bellamy’s chair Jo Ho will preside over what may be the company’s last annual meeting assuming the deal proceeds.

The Chinese bidder owns 60 per cent of Burra Foods and FIRB, based on past form, will not be a problem.

Then again, on past form, the FIRB is unpredictable.

The bid, subject to a scheme of arrangement, is at $13.25 a share, which includes a 60c dividend and yesterday the stock was around $12.87.

This is where its been since the mid-September announcement.

Cameron is sitting on a potential circa $255m payout and the company is confident she’ll accept, but she is waiting for the bid documents which could come as soon as this week.

The FIRB ruling is expected in the next couple of weeks.

Another IPO flop

Some day financial sellers will realise the IPO market is not weak but their expectations are too high and that explains why another IPO, Onsite Rentals, was pulled on Monday.

The equipment hire shop to the mining and construction industries was at a glance conservatively priced at around nine times earnings against an industrial market which sells at a price-earnings ratio of double that level.

The sector is running hot, so to some extent, the market thought the $245m float was opportunistic.

At a time when the market is selling at record high valuations, it seems strange to say buyers are cautious, but in reality they are when it comes to new listings.

This is also strange when a Goldman Sachs table shows new floats in the past three years are up on average 44 per cent, in part reflecting the boom in technology stocks like Afterpay.

The bourse is shifting more to so-called passive investors who buy the index rather than new ideas and that raises the hurdle for floats.

Financial sellers are seen to have extracted all the upside before selling and past duds like Dick Smith and Myer add to consumer caution.

A float requires a manager to lay a bet virtually on the spot, which is risky compared with a review of stocks that have traded on the bourse for a while.

The Goldman study showed that in the past 20 years, new IPOs traded at 4.2 per cent premium on day 1 and since 2015 some 56 IPOs have traded at 9.6 per cent above market after six months.

There is value there. It’s just a question of which one. The market might be testing record highs, but that doesn’t mean fund managers will buy every stock that lands on their doorstep.