Bellevue Gold appoints defence advisers

One of the Australian gold plays most frequently touted as a potential acquisition target has quietly appointed defence advisers.

One of the Australian gold plays most frequently touted as a potential acquisition target has quietly appointed defence advisers.

The Australian can reveal that Perth-based Bellevue Gold has signed up Canaccord on a defence mandate, broadening an existing equity and general advice mandate already in place.

The M&A talk surrounding Bellevue went up a notch following last week’s resource upgrade at its namesake gold project, just three months after it unveiled a maiden 1 million ounce gold resource. The company has now identified a resource of 4 million tonnes at a high grade of 11.8 grams of gold per tonne, with the deposit now hosting more than 1.5 million ounces of gold.

Bellevue managing director Steve Parsons would not comment on the identity of any advisers working with the company, but confirmed that the group had made appointments.

“We have a number of mandates with various groups for various things such as equity raising, debt scenarios and other scenarios as well,” Mr Parsons said.

Australia’s gold sector is widely seen as ripe for consolidation after several years of boom conditions. The Australian dollar gold price earlier this year hit its highest levels on record, and several established producers have spoken openly about their appetite for acquisitions.

Mr Parsons said the unusually high grade of the resource at Bellevue meant it was understandable that other gold companies would be taking a close look at the project.

“It’s only 13 months since the discovery drillhole, and it’s only three months since we had 1 million ounces of gold, so we would’ve only just come on the radar, but I’d imagine there’s a lot of companies wishing they had an orebody like this,” he said.

The grades at Bellevue would rank it as the second-highest grade orebody in Australia, he said, behind the Swan zone in Victoria currently generating buckets of cash for Canada’s Kirkland Lake Gold.

“The amazing thing about such high grade dirt is you just do not get these sorts of orebodies,” he said. “It’s a multi-million-ounce, 10 grams per tonne-plus orebody. There’s very few of them around the world.”

The high grades of mineralisation at Bellevue mean it is one of the few deposits that could help improve the portfolio of companies on the hunt for assets. The higher-grade ore could be blended with lower grade ore from established mines, potentially extending their mine lives.

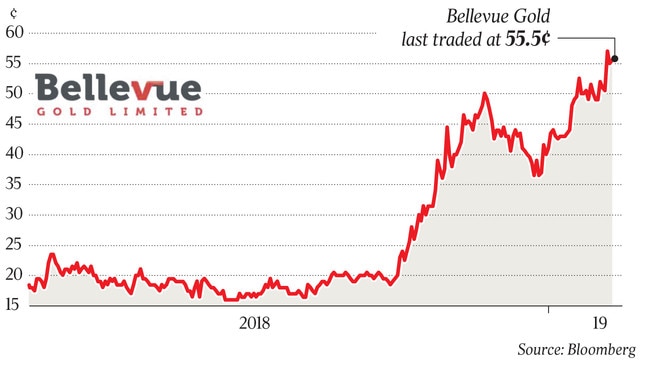

But the current valuation of Bellevue has raised eyebrows in the market, with the stock having soared from 19c a share in late September to 56c on Friday. That gives it a market capitalisation of $250 million, in line with some established gold producers.

Mr Parsons said the company would not be distracted by takeover talk. Instead, he is focused on delivering another resource upgrade in the next quarter — which could lift the resource to 2 million ounces or higher — and is looking into dewatering Bellevue’s old underground workings.

Such a move would allow the company to drill out the resource more quickly and effectively from underground, or even allow it to start mining easily accessible material, given the project is already on a granted mining lease.

Mr Parsons was formerly the head of West African gold play Gryphon Minerals, which flew high several years before faltering when gold prices slipped, and he told The Australian the experience had stuck with him.

“You need to make sure that when the windows are there, you jump through them and grab the opportunities when they happen. But being in WA and working with such high grades, time is on our side a bit more,” he said.

Analysts at Macquarie this year named Bellevue as their top and only exploration pick for 2019.

“Bellevue is a viable stand-alone development prospect but would also make a compelling addition to asset portfolio of nearby miners,” Macquarie said.