Bauer acquires Pacific Magazines in $40m deal

Rivals will unite after Seven West Media announced the sale of Pacific Magazines to Bauer for $40m.

Seven West Media has confirmed the sale of its Pacific Magazines division to Bauer Group for $40 million, the third deal under new boss James Warburton as part of his efforts to overhaul the media company.

The announcement, which was flagged by The Australian, comes three days after Seven unveiled its merger with regional broadcaster Prime Media and the sale of West Australian regional radio broadcaster Redwave to Southern Cross Media Group.

Mr Warburton said the sale of Pacific Magazines is “another major initiative aligned with our strategy to improve balance sheet flexibility and simplify the operating model to enable greater focus on growth initiatives”.

“The team at Pacific have been at the forefront of our group’s transformation and have done a tremendous job at repositioning their business, but there can be no doubt that there is a greater future within a larger scaled magazine group,” he said in a statement.

Seven West said the sale proceeds will be used to pay down debt, improving “balance sheet flexibility and simplifying the organisation to focus on its content-led growth strategy”.

Seven West and Bauer Media have also struck commercial arrangements, including advertising spending commitments, the ongoing production of the Better Homes and Gardens television program, and sharing lifestyle content under a long-term agreement.

Seven West will receive $6.6 million of advertising on Bauer Media assets over three years.

Confirmation of the deal comes after Bauer executives for years considered the acquisition of arch rival Pacific Magazines as “water-cooler” conversation — rumoured and discussed, but never a reality.

Even when The Australian asked Bauer’s new chief executive Brendon Hill earlier this year about such a deal, he joked it off.

“There’s been talks for 10 years,” Mr Hill said.

The new deal will see fierce magazine competitors from Bauer’s The Australian Women’s Weekly, Woman’s Day and Elle, and Pacific’s New Idea, Marie Claire and Women’s Health and Men’s Health together under one roof.

“It’s a very sensible deal,” a former Bauer executive told The Australian before the official announcement. “It’s an important deal for the magazine industry in Australia because what it will do is allow them to stop seeing themselves as competitors and see that there is a broader media market that they compete against.”

It has been seven years since the German family-owned publisher landed on Australian soil and bought Kerry Packer’s ACP Magazines for $500m, a deal described by the then Bauer chief executive, Matthew Stanton, as a “long-term commitment” for the “brands” and “people”.

But a misunderstanding of the value of some of ACP’s best brands, poor management decisions and a brutal magazine advertising market have raised concerns for some about the impact Bauer has had, and could have, on the industry.

A number of executives who have worked for Bauer have described the acquisition of Seven’s magazine arm Pacific as necessary and logical, but one that if poorly managed could do more harm than good.

Since 2012, Bauer has worked through six chief executives, multiple restructures, lost a landmark defamation case against actor Rebel Wilson, and axed magazine titles including Cleo, Cosmo, Men’s Style and Yours+.

Bauer also lost a lot of talent — including publishing executives Helen McCabe, Kellie Hush, Justine Cullen, Paul Merrill, Peter Holder and Marina Go, to name a few.

One of the few executives to survive the tumultuous years at Bauer is chief financial officer Andrew Stedwell, who helped facilitate the original ACP deal.

“Fundamentally the people in charge didn’t understand the value of what they were producing,” one former Bauer executive said of the last seven years.

“They never understood the market and expense of magazines here,” another executive said. “They never invested in the future, profits funnelled to Germany and good people were made redundant.”

But the business have also had periods of growth, which included the creation of monthly additions for weekly magazines including Take 5 and TV Week and the acquisition of News Corp’s Inside Out, Country Style and Homelife.com.au.

And when Mr Hill came on board to replace the latest chief executive, Paul Dykzeul, earlier this year, he was optimistic. In an interview alongside Bauer Media chief operating officer, Veit Dengler, Mr Hill said he had no plans for magazine closures or merger unless there was a “good deal”.

“We have the portfolio mix really good now and … we’ve got all our portfolio structured around the five lifestyle pillars — so it all works really well now,” Hill told The Australian in May.

“When I first learnt publishing from Phil Scott 13 years ago, he told me magazines have always been up and down, declining, closing, re-imagining. That’s happened for 50 years, it’s not going to change. We’re always evolving, we’re looking for new opportunities to launch products just as much as you often rationalise.”

Declining circulation and advertising revenue over the last decade has caused countless rounds of cost cuts that have challenged both Bauer and rival Pacific. Indeed the entire magazine market has been among the hardest hit by the shift to digital with circulation and advertising squeezed.

In 2018, after a major cost cutting effort, Bauer Media Australia swung to a net profit of $6.3m. But that was despite a 13.7 per cent drop in revenue to $224.3m. It compared to a net loss of $11.3m in 2017.

Of the group’s $224.3m of revenue, about $142.1m came from the magazine cover price and $48.88m from advertising.

In financial year 2019, Seven’s Pacific had a profit before significant items of $8.25m, a fall from the previous year. Revenue fell 7.2 per cent from $139.5m the year prior to $129.4m, also by falls in advertising spend and circulation.

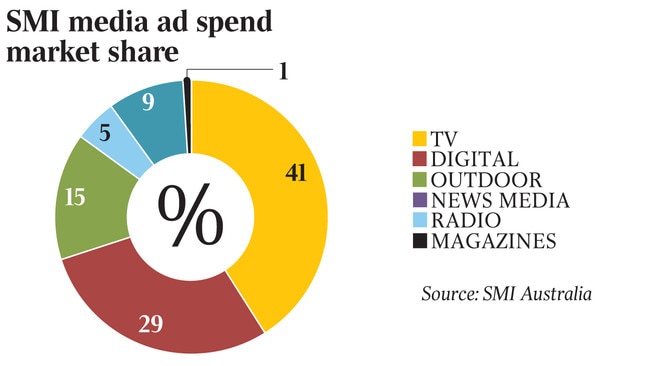

In 2009, SMI data reported magazines made up 7 per cent of advertising revenue, a figure that now sits at just 1 per cent. However, some believe the pressures now being felt by Bauer were accelerated by management missteps.

One former executive told The Australian that as the business faced industry challenges, Bauer’s global offices blamed the magazine brands and editors.

It has been suggested that one of the reasons for this was a lack of understanding of the difference between mass reach weekly titles and premium titles with lower circulation that were of more value to advertisers.

“We were the premium magazine title at ACP … Bauer is a mass market utility publisher,” the former publishing executive said.

“Publishers of magazines … had to make changes to colour, to the quality of paper. It works overseas, but not here.”

Bauer’s model proved effective for some brands, but its view of how to sell magazines has affected others.

The falling circulation and advertising spend remained a disappointment for global Bauer Media boss Yvonne Bauer and other key executives, given the high price point they had acquired the Australian magazines.

There are some former leaders who spent time working with Bauer that believe the family could never justify the price they had paid for ACP.

“Most of frustrating parts of dealing with the Bauers … they made the mistake, they kept wanting somebody to fix this,” one former executive said.

Another former Bauer executive described the business as being in constant “state of lethargy” — it was a business that talked about change and needing to evolve, but couldn’t.

And the blame was put on the brands rather than a broken distribution model, marketing that wasn’t reaching new audiences, and a failure to evolve effectively into a digital world.

“The distribution model was broken but there was no incentive to fix it,” said another former senior member of Bauer’s local management team.

“No one was forcing each other to think differently, except the editors. The strategies for reaching new audiences and marketing were done in the same way … and they’d blame the cover.”

But there was also the challenge of evolving and adapting the magazine brands to digital.

In 2015, Bauer outlined plans to separate its print and digital divisions, and in 2016, the publisher aggregated its titles into websites under the brand Now To Love. But it came up against other women’s digital lifestyle brands, such as Mamamia and 9Honey.

“What they didn’t understand was how powerful these individual magazine brands were … and it did cost a bit more money to have your own URL,” a former executive added.

Meanwhile, the segregation of print and digital left the two teams throwing grenades at one another and competing internally over images and budgets, as opposed to fighting the broader industry. Early last year, the teams joined together.

As of June, the digital audience for Pacific Magazine’s New Idea was 1.189 million, almost on a par with Now To Love, Bauer’s digital operation which covers all of its magazines. Now To Love’s figure at June was 1.29 million.

The latest attempts by both publishers to cut cost and merge editorial teams of multiple brands could be problematic in the long term. Homogenisation of magazine brands leave them without a defined proposition and gives consumers no incentive to buy the products.

“Integration of teams is a self-fulfilling prophecy,” one of the former publishing executive pointed out. “It devalues the value of a brand.”

Bauer Media executives The Australian has spoken to are concerned about the implications of the deal for Pacific and its staff moving forward. But those close to the deal do not believe a merger would substantially lessen competition.

According to the SMI Trans Tasman Advertising Investment Report, the magazine industry makes up just 1 per cent of media market share in Australia. Regardless, a combined business would give Bauer powerful verticals across celebrity, home, food and health categories. It would allow the magazine industry to fight for a share of the entire advertising pie.

Others are wary it could lead to the closure of more titles and further erosion of strong brands.

“(Bauer) don’t have … that absolute creative drive and passion for magazines that (US publisher) Hearst’s have or the Conde Nast’s have, of creating these incredible brands and magazines,” an executive said.

“They are a cookie cutter low- cost model and I would hate that to be applied to all the magazines. They’ll talk about innovation and creativity and respecting that, but when it all comes down to it, they get more excited about re-use of editorial.”

Regardless of concern, most would agree the deal is critical for the businesses to have a sustainable future. And while there are suggestions that Bauer needs this acquisition to take place in order to make the business attractive to prospective buyers, including private equity, it will take time to turn around the business it bought all those years ago.

“The two businesses are at a critical point where they can’t continue. The urgency button has been pressed,” reflected one of the former Bauer executives.

“It’s sad for the sector. It’s needed innovations and there has not been innovative leaders. Something has to change.”