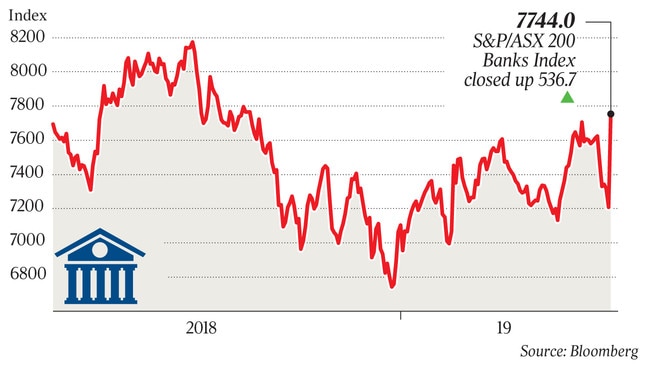

Bank stocks surge after Labor’s federal election loss

The value of the four big lenders has surged $27bn as investors celebrated the defeat of Labor and its anti-bank changes.

Investors have celebrated the shock defeat of Labor and its package of additional anti-bank reforms, adding $27 billion to the combined value of the four big lenders as the sector enjoyed one of its best days since the global financial crisis.

The return of the Morrison government triggered an immediate reassessment of the sector, with Morgan Stanley lifting price targets for the majors by an average of 2.5 per cent.

“For the banks, we believe tail risks have reduced in relation to credit quality, the mortgage market and the regulatory environment,” analyst Richard Wiles said.

Westpac led the sector higher, surging $2.34, or 9.2 per cent, to $27.75 — the stock’s biggest percentage gain in almost seven years. Its rivals were not far behind.

Shares in National Australia Bank jumped 7.9 per cent, which was almost matched by ANZ’s 7.8 per cent gain and Commonwealth Bank’s 6.3 per cent rise.

All the banks have been weighed down by eroding margins due to intense competition in the mortgage market, the end of an extraordinarily benign credit cycle as arrears rates and loan losses start to edge up, and a heavy program of investment in risk and compliance after the financial services royal commission.

Remediation costs for misconduct continue their steep rise.

In the half-year profit reporting season earlier this month, combined cash profit fell 4 per cent to $14.5bn, with the housing market under acute pressure after an average 8.4 per cent fall in capital-city prices in the year to April.

Reserve Bank jawboning of the major banks to cut their variable interest rates has fallen on deaf ears, with the RBA keen to preserve its firepower as official rates scrape along at a record low of 1.5 per cent.

The gloom, however, lifted in spectacular fashion yesterday.

UBS said in a note that the most important consequence of the election outcome was that Labor’s policy changes to negative gearing, capital gains tax and franking would not proceed.

Sentiment could stabilise, according to economist George Tharenou, and the risk of negative wealth effects from further falls in house prices was now lower.

Ord Minnett said in a report that the banks had performed reasonably well in a global context, but had been discounted in anticipation of a more hostile political environment. “That’s not to say banks are now in for an easy ride; far from it,” the broker said.

“Rather, they will now escape a more draconian implementation of the final recommendations from the royal commission.

“In addition, negative gearing and capital gains discounts remaining in place should be supportive of an already improving trend in housing sentiment.”

Bell Potter said it had remained positive on the major banks heading into the election, viewing the sector’s glass as half-full rather than half-empty.

“With increased certainty now in the political landscape, in addition to the majors’ underperformance leading up to the federal election, including the impact of the royal commission and customer remediation provisions, we believe some value has returned especially for the retail and home loan-oriented major banks,” analyst TS Lim said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout