Virgin Australia goes into second trading halt as CEO Paul Scurrah makes $1.4bn Canberra loan lifeline call

Meeting of Virgin’s international shareholders precedes decision to again suspend trading as CEO pushes for $1.4bn loan facility.

Virgin Australia will go into a trading halt this morning following a board meeting last night of its international shareholders.

It is understood the airline alerted the ASX this morning of its decision to suspend trading for the second time in a fortnight.

It comes as the Morrison government comes under increasing pressure to help the airline stay afloat and maintain a competitive airline market for when the Covid crisis lifts.

Virgin Australia chief executive Paul Scurrah spent the Easter weekend calling federal government ministers and opposition frontbenchers in a bid to secure support ahead of a cabinet meeting today that could decide the debt-heavy airline’s future.

Just over a year into the job, Mr Scurrah is fighting to keep Virgin afloat and has asked for a $1.4bn loan facility from the government to get through the coronavirus crisis.

Billionaire shareholder Richard Branson, who owns the Virgin brand, is understood not to have made approaches on the Australian airline’s behalf, staying on the sidelines.

The move comes as The Australian can reveal Virgin has been working on a restructuring of its $5bn debt load, appointing advisory firm Houlihan Lokey.

Market sources said the carrier was moving fast with its debt restructuring plans, which were in advanced stages, although it remained unclear what shape they were taking.

If Virgin fails to secure support from Canberra, it is understood a creditor’s scheme of arrangement is possible, with debt swapped for equity.

Such a move could wipe out Virgin’s existing owners, including Singapore Airlines, Etihad and Chinese carriers.

A creditor’s scheme needs to be approved by a court and involves a vote, whereas a deed of company arrangement requires a company to be placed into receivership or administration.

Some say that a DOCA can be preferable because it removes all unwanted liabilities and requires all parties to follow it through.

Banks, US bondholders owed $425m and Australian bond holders would be involved in the debt restructure.

Asked on Monday if the government would assist Virgin Australia, Deputy Prime Minister Michael McCormack said discussions were continuing.

“They’re having discussions with their own shareholders about how they can raise capital and we’ll continue our discussions,” Mr McCormack told the ABC on Monday.

“I’m not ruling anything out.”

Virgin’s Mr Scurrah has made it clear an answer from the government was needed urgently, and warned Australia’s economy would suffer significantly if the airline collapsed.

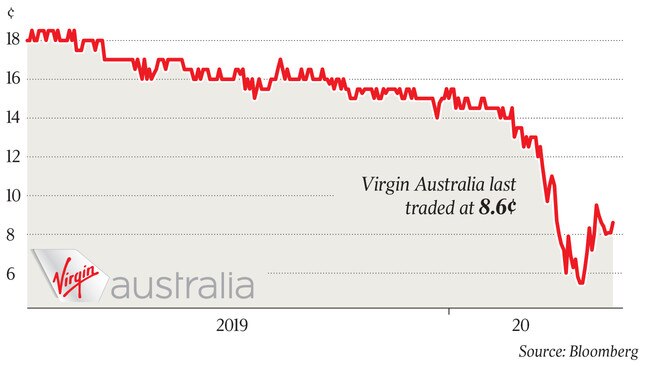

Since last January, Virgin Australia’s share price has crashed from 15c to 8.6c, shrinking the company’s value to $726.8m.

The Australian understands the Morrison government is considering tens of millions of dollars in funding to support Qantas and Virgin.

The government is seeking to ensure there is secure and affordable access for passengers and freight on essential domestic air routes, focusing on Adelaide, Canberra, Brisbane, Darwin, Alice Springs, Hobart, Melbourne, Perth and Sydney.

The new funding, which is close to being finalised, would complement the more than $1bn in assistance being provided by the government through its Regional Air Network Assistance Package, the refund and waiver of aviation fuel excise, waiving Airservices charges on domestic operations and the International Freight Assistance Mechanism.

Mr McCormack said he had spoken to Mr Scurrah and Qantas CEO Alan Joyce about what a minimal domestic network should look like and how much taxpayers should contribute.

The talks followed extensive cutbacks by airlines that have left people returning to Australia from overseas with very few options to get to their home town or city after 14 days of enforced quarantine.

Virgin Australia is operating just one return service a day between Melbourne and Sydney, while Qantas has drastically reduced frequencies on its network covering capital cities and up to 25 regional destinations.

Despite the reductions, a Qantas spokesman said some flights were carrying just a handful of passengers, which was “not sustainable”, and further adjustments may be needed.

Mr McCormack said it was vital that flights around Australia continued.

Labor backed moves to subsidise the cost of domestic flights, saying it was “the least the government could do” for Australians after two weeks of quarantine.

But opposition transport spokesman Catherine King said those subsidies alone would not help Virgin Australia survive the coronavirus crisis. “Australians need Scott Morrison to step up and urgently extend a lifeline to support Virgin and its 10,000 staff through this crisis,” said Ms King.

“Failure to do so is an active decision to see one of our major airlines fail, leaving thousands of Australian aviation workers out of a job and damaging our entire economy.”

She said while Labor had supported the government’s aviation packages to date, more help was needed.

“Such support could include extending or guaranteeing lines of credit and taking an equity stake, which will ensure that when the industry bounces back — and it will — government can recoup its investment,” Ms King said.

Virgin Australia is buckling under adjusted net debt of $5bn when its market value is only $675m. It posted an $88.6m half-year loss.

Its Australian bonds have been trading between $30 and $40 only months after investors took up the offer.

Houlihan Lokey counts former UBS restructuring expert Jim McKnight within its Sydney ranks. He has worked on some of Australia’s highest-profile corporate collapses.

The carrier is understood to have a data room open for parties to assess potential options.

Additional reporting: Geoff Chambers

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout