Virgin bondholders’ recapitalisation plan to throw spanner in the works

The battle for Virgin Australia is set to take another twist with the airline’s bondholders to launch a recapitalisation plan.

The battle for Virgin Australia is set to take another twist with the airline’s bondholders poised to launch a multi-billion-dollar recapitalisation plan for the airline this week, potentially as early as today.

There are 6000 retail investors who have their money invested in Virgin’s bonds and about 30 global institutions said to have about $11 trillion under management.

The Australian’s John Durie reported on Friday that the bondholders would use a provision in the Corporations Law allowing them to present a proposal to Virgin administrator Deloitte to swap their debt for equity to become the airline’s new shareholders and back the current management team’s restructuring plan.

Virgin has $7.1bn in debt, of which $2.1bn is accounted for by the bondholders.

The move comes as final binding offers for the airline, which went into voluntary administration on April 21, are due to be lodged with Deloitte’s Vaughan Strawbridge on Monday, before the winning bid is chosen on June 30.

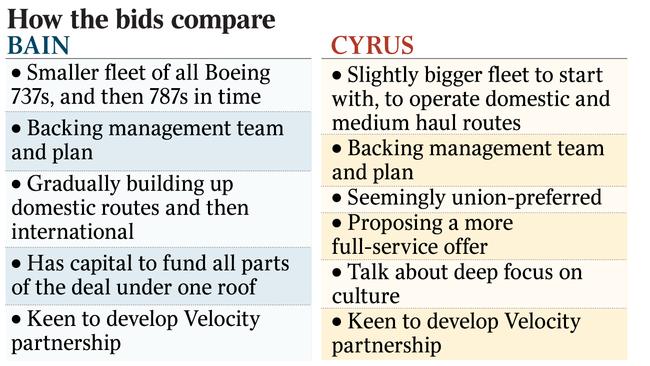

The two short-listed bidders, Bain Capital and Cyrus Capital, will lodge their offers by lunchtime on Monday after Cyrus won the support of two key unions last week. Both have pledged their support for the management team’s vision for Virgin 2.0 and chief executive Paul Scurrah.

Cyrus revealed on Sunday that it was planning a 50 per cent increase in IT spending by the airline if declared the winning bidder, giving a new Virgin a platform that put the customer first and offered a more personalised experience.

A Cyrus spokesman said it would draw on its experience as a shareholder in Richard Branson’s Virgin America and other airlines in prioritising these areas, “which will ultimately be what underpins Virgin Australia’s return to profitability”. He added: “Well-run websites and easy-to-use apps are a must-have in any modern business, and Cyrus agrees that Virgin Australia will benefit from investment in these areas.”

He said data-driven pricing and revenue management, improving the Velocity program to better reward customer loyalty and focused cost management would be priorities.

“Based on its many years of airline experience, Cyrus knows that price and the availability and scheduling of flights are important factors to consumers when choosing an airline,’’ the Cyrus spokesman said.

Cyrus has committed to funding Virgin operations through to the second creditors meeting on August 22 if it is selected as preferred bidder.

While Bain Capital has $25bn worth of capital across its global funds to call on for its bid, the Cyrus spokesman claimed “a bigger fund does not mean better”.

“Cyrus has no doubt that for Virgin Australia, industry knowledge and experience is much more important than the size of the fund. Cyrus will be drawing on deep airline industry knowledge and 12 years’ experience as a shareholder in a Virgin-branded airline (Virgin America),” he said.

“The nature of Cyrus’s fund means that its capital is ‘evergreen’; a private equity fund is usually under pressure to seek an exit after three to five years,’’ he said.

Virgin Group, which has stayed close to the administration process, is expected to make its own capital injection in the relaunched airline in return for a 10 per cent stake.

The Cyrus spokesman said: “A larger firm may not be able to dedicate experienced, senior resources for the long term.

“A smaller firm brings more senior attention and commitment. The Cyrus team is an experienced, focused team that has worked together for several years. Stephen Freidheim, founder and chief investment officer of Cyrus Capital, is personally involved in this deal and will remain personally involved if Cyrus is successful.’’

The bond holders are being advised by Faraday Associates, led by debt guru Lachlan Edwards and former Freehills lawyer John Nestel, with legal advice from Corrs Chambers Westgarth.

The Australian also reported on Saturday they had also brought in former Virgin Blue co-founder Rob Sherrard as part of a team of 50 people to help with their fight to recapitalise the airline.

Mr Sherrard was among those given access to Deloitte’s data room last week to help bondholders ascertain the true worth of the carrier before final bids were made.

While the bonds are trading at 10c in the dollar, the bondholders have consistently argued they are worth more as anyone buying the bonds would expect to sell them for more money.

Steven Wright from Morgans, which represents a group of retail bondholders, reiterated last week that they were not prepared to be bought off with a low-ball offer like 10 cents in the dollar.

“With domestic aviation rebounding as COVID-19 restrictions are lifted there is huge upside in Virgin,” he said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout