Qantas reveals plan to tackle flight delays and lost bags

Qantas will change the way it boards its aircraft from October and introduce baggage tracking technology for passengers.

Qantas has unveiled plans to overhaul its boarding process and rollout baggage tracking technology by the end of the year.

Details of the customer-focused changes were revealed at the Qantas investor day in Sydney, to highlight how the airline was listening to passengers’ concerns and responding.

From October, passengers will be assigned to groups depending on where they are sitting in the aircraft, and boarded in those groups to avoid congestion in the aisle.

The system is already used by many US and European carriers to help flights get away on time.

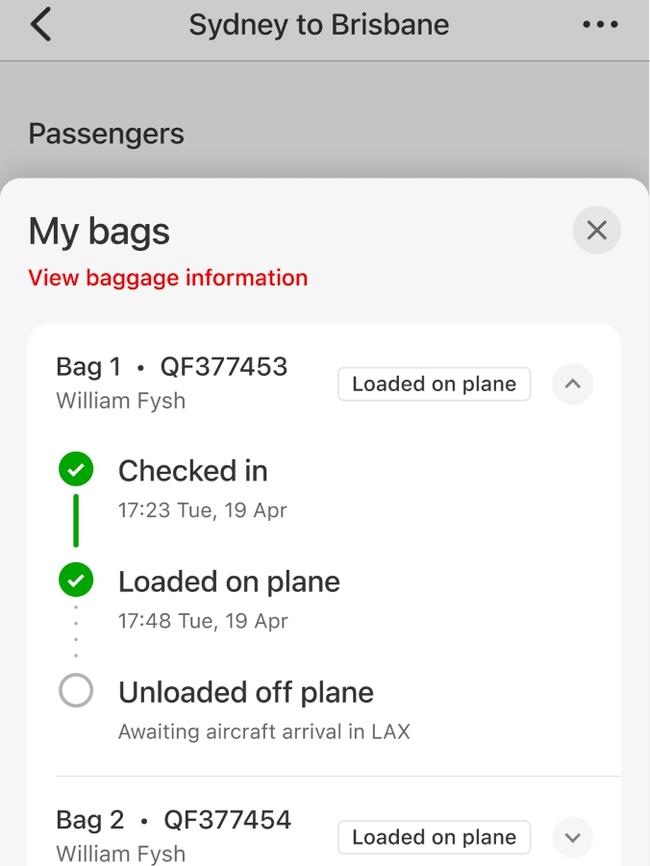

Baggage tracking technology will also be introduced as part of a Qantas app upgrade, to inform travellers of the whereabouts of their bags.

The technology will be linked to barcodes on checked luggage and send notifications to passengers at various points of their trip such as after boarding, during transit and on arrival at their destination.

Qantas domestic and international CEO Andrew David said research had shown the majority of passengers wanted to track their bags and the technology would help reconcile lost bags with their owners more quickly.

The feature was expected to become available by the end of the year, following on from Virgin Australia which announced similar technology a couple of weeks ago.

Investors also heard that demand for travel was showing no sign of easing in the wake of the Covid pandemic with domestic travel intent twice that of 2019 levels, and international travel intent up 80 per cent.

At the same time, supply remained constrained with airline capacity not expected to match demand until the end of the decade.

The imbalance meant airfares were unlikely to fall significantly anytime soon, with Qantas targeting even bigger margins for international travel and seeking to maintain domestic margins of 18 per cent.

Ultra-long-range Project Sunrise flights due to takeoff in 2026, were set to add $400m a year to Qantas’ bottom line straight off the bat, thanks to a higher proportion of premium cabin seats and the lack of competition on routes such as Sydney-London non-stop.

Mr David said the airline’s Perth-London flights had shown the strategy of flying routes no-one else did was a winner.

“We’ve seen that passengers are willing to pay a premium for non-stop services,” Mr David said.

Jetstar CEO Steph Tully outlined how passengers of the low cost carrier were shelling out more for “extras” like baggage and seat selection post-Covid, with ancillary revenue up 38 per cent on 2019 levels.

That translated to an average spend of $35.60 for domestic passengers, up from $26.10 pre-pandemic, and $93.50 for international travellers, compared to $77.20 four years ago.

Looking ahead Jetstar aimed to grow ancillary revenue a further 36 per cent growth with more opportunities being explored such as “paid security fast track”.

Qantas Loyalty CEO Olivia Wirth also addressed investors about the success of the frequent flyer program, revealing membership was now more than 15 million.

The incredible growth meant that by 2030, 230 billion points would be earned and redeemed in a year, translating to earnings of $1bn a year for the airline.

“We make a margin on the points we sell (to partners) and we make a margin when points are redeemed,” Ms Wirth said.

She said high levels of engagement with members set the scheme apart from other programs, with 25 per cent nominating Qantas frequent flyers as their main loyalty scheme.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout