Qantas chief Vanessa Hudson keeps focus on restoring trust as profit dips

The cost of fixing the airline’s damaged reputation has weighed on its bottom line, as chief executive Vanessa Hudson spends heavily on customer and fleet renewal.

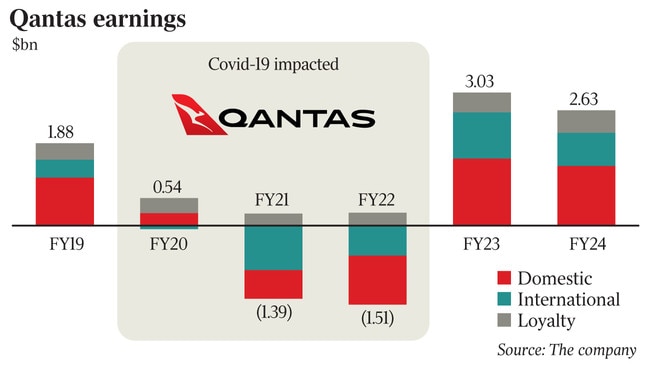

Qantas has copped a 28 per cent drop in net profit in order to rebuild its battered reputation, with the lower result attributed to cheaper airfares and increased spending on customer and fleet.

The underlying before tax profit of $2.08bn was described by CEO Vanessa Hudson as “getting the balance right” after the previous year’s record $2.47bn gain was achieved by high fares and brutal cost cutting under her predecessor Alan Joyce.

Statutory net profit fell to $1.25bn from $1.74bn, and included the impact of Qantas’ $128m settlement with the consumer watchdog over the sale of tickets on cancelled flights.

Ms Hudson said the focus on customers would continue in line with her ambition to “restore trust and pride in the airline”.

In the year to June 30, Qantas splashed out $230m on “customer initiatives” focused on better food and beverage, on time performance, lounge facilities and an improved app.

Qantas’ “reputation score” suggested they were on the right track, lifting 12 points in the year to June 30, and a further 4 points in July to 67 out of 100.

Although that still seemed quite low, Ms Hudson said it was within 13 points of their highest reputation score of 80 when Qantas was the most trusted brand in Australia.

“They say actual reputation takes three years to rebuild because you go through cycles across the journey, so we’re in it for the long haul,” she told The Australian.

“We know that consistency of delivery will be a really big part of that.”

As well as lifting on-time performance and empowering cabin crew to recover bad situations more quickly, customers had benefited from an 8 per cent fall in domestic fares, and 10 per cent drop in international in the last year.

But Ms Hudson was not convinced lower airfares were that important to their customers.

“I can’t say one way or another whether lower fares make people feel happier about Qantas, I don’t think it’s the biggest driver,” she said.

“I think it’s about the way they feel when they’re in our care, the way we look after them, the way our people show up, and the way we step up when things don’t go to plan — like serving as the national carrier to repatriate Australians in need and stepping up to support Bonza and Rex customers.

“There’s a whole lot of elements that go into reputation because it’s a feeling, it’s about how they feel about the business.”

In the year ahead, Qantas planned significantly more international flying as the last two A380s returned to the fleet, lifting capacity to above pre-Covid levels for the first time since the pandemic.

Ms Hudson said the extra seats would go on existing and new routes, with Qantas believed to be weighing up the business case for flights to Chicago, Seattle and Athens.

Despite continuing cost-of-living challenges, travel demand was “stable” and Ms Hudson hoped the long-awaited rollout of Wi-Fi on international flights would please customers.

“We are seeing an increase in customers even in the current difficult times, prioritising their holiday over other discretionary items of expenditure,” she said.

“For us that provides a really optimistic outlook for the 2025 financial year.”

There was no shortage of headwinds, one of the biggest of which was a new deal with long haul cabin crew that meant the cost of flight attendants would be triple that of Qantas’ international competitors.

Taking effect from November 1, the deal allowed cabin crew contracted from labour hire firms to move onto Qantas agreements, driving up wages as much as 30 per cent.

Ms Hudson said it was a necessary move and Qantas would seek to offset the additional cost in other ways.

“We had a disadvantage to start with, (cabin crew cost) was about double that of our competitors now it’s going to be triple,” said Ms Hudson.

“It will put more pressure on fares in the short term, but we’re going to look at every aspect of the business to ensure we maintain international competitiveness.”

New, more fuel efficient aircraft would help with the transformation and Qantas expected to take delivery of 20 new planes by mid-2025 including the first A321XLR from April.

Boasting 20 business class seats, and 180 in economy, the A321 was intended to replace ageing Boeing 737s on high traffic domestic routes and operate short haul overseas flights.

The post-Alan Joyce era profit was generally well received by analysts, who noted the result was largely in line with expectations.

Despite lower operating margins for Qantas Domestic and International, the segments were the most profitable parts of the group, with earnings before tax of $1bn and $556m respectively.

Jetstar achieved a record result of $497m, up from $404m, and increased its operating margin from 9.5 per cent to 10.1 per cent.

Qantas Loyalty also continued to expand with frequent flyer membership growing from 15.2 million to 16.4 million and 300,000 new points-earning credit cards acquired in the year to June 30, up 21 per cent on the previous year.

Shares in Qantas closed up 0.8 per cent on Thursday at $6.37, in a slightly lower market.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout