Qantas burns $40m a week, boosts liquidity

Qantas is burning cash at a rate of more than $40m a week as the airline navigates the coronavirus crisis.

Qantas is burning cash at a rate of more than $40m a week as the airline navigates the coronavirus crisis that has slashed its flying operations to just 5 per cent of normal capacity.

In a third-quarter trading update to the ASX on Tuesday, the carrier revealed it had secured a loan of $550m against three of its Boeing 787-9s, on top of $1.05bn raised in March.

The funds increased total short-term liquidity to $3.5bn and would allow the airline to survive without flying until December 2021.

Chief executive Alan Joyce said at the start of the crisis Qantas acted quickly to wind down cash burn through employee standdowns and a pause on virtually all capital and operating expenditure as well as revised agreements with key suppliers.

As a result, Qantas expected to reach a “net cash burn rate of $40m a week by the end of June”.

“That’s a lot lower than most airlines around the globe, and we have a light at the end of the tunnel with domestic and trans-Tasman markets potentially opening up before any other markets,” said Mr Joyce.

In order to maintain the financial discipline, staff standdowns were extended to the end of June 30 “at least”, with international division employees likely to remain idle for considerably longer.

“That’s probably not surprising to hear, but it’s still very tough and it’s a very tough reality for thousands of people,” he said.

“The government’s JobKeeper program has made a massive difference and many of our people have large annual leave balances that are helping them get through this.”

He also pointed to “some great secondary jobs” being worked by Qantas employees at Woolworths right through to the Royal Flying Doctor Service.

“I’d like to thank corporate Australia and organisations for placing really good people in great roles but I’m hoping these people will soon be back flying with Qantas and Jetstar,” said Mr Joyce.

“All the hard decisions we’ve made in the past few months have been focused on ensuring the Qantas Group survives this crisis and we have to make sure it’s also well placed for recovery.”

It was to be expected that Qantas in 2021 and 2022 would look a lot different from the Qantas of recent years, with the international fleet under scrutiny, and Jetstar Pacific Airlines likely to be sold.

Mr Joyce confirmed talks had been under way for sometime with shareholder Vietnam Airlines about “what to do with that venture up there”.

Although Qantas would take a hit from its fuel hedging, due to the precipitous falls in the oil price, the cash impact combined with foreign exchange fluctuations was expected to be $145m.

“At the start of the crisis we said this was about survival of the fittest — in practical terms that means the carriers around the world that can survive for long periods with very little cash coming through the door,” Mr Joyce said.

“By that measure, Qantas is one of the fittest airline groups in the world. We started with a high cash balance and low net debt. We have another $2.7bn in unencumbered assets that we can secure finance against and we have divisions like Qantas Loyalty and Qants Freight that are operating mostly as normal.”

His optimism was not entirely shared by Qantas pilots, who called on the federal government to extend its support for a minimum domestic network beyond the initial eight weeks.

Australian and International Pilots Association president Mark Sedgwick said without ongoing support for the network, the aviation industry risked going into free fall.

“Commercial aviation is not feasible in the short term if restrictions on non-essential travel remain in place,” said Mr Sedgwick.

He said an extension to international flights subsidised by the government was providing pilots and cabin crew with valuable work.

It followed approval for Qantas for an additional four weeks of flights to London and Los Angeles.

“These flights keep our skies open, keep Australian workers in jobs and ensure our fellow Australians can get home safely,” Mr Sedgwick said.

“Ongoing support also ensures key international markets for fresh Australian produce remain open, maximising the benefits to the economy.”

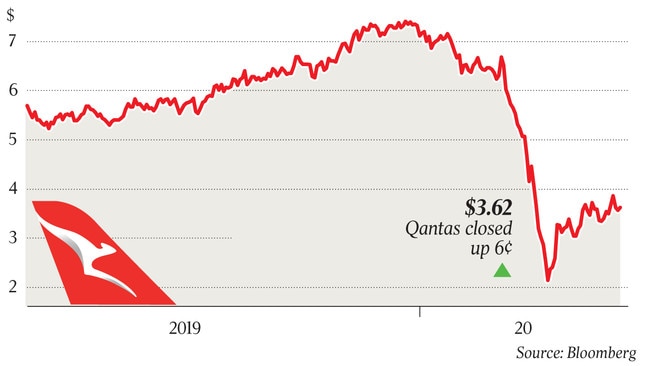

Qantas shares finished the day 1.68 per cent higher, at $3.62.

Credit ratings agency Moody’s said the announcement of an additional $550m of funding demonstrated the “airline’s ability to raise new financing despite unprecedented circumstances in the industry”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout