Behind the race to save fallen Virgin Australia

An unremarkable building about 5km from Melbourne airport serves as a reminder that some collapsed airlines never die.

An unremarkable building about 5km from Melbourne airport serves as a reminder that some collapsed airlines never die.

The low-rise building — with a giant, fading logo painted on the side — sitting off the Tullamarine Freeway is the home of Ansett Aviation Training.

This is all that remains of Ansett Australia after administrators switched off life support on March 4, 2002.

In one of those striking twists of fate for which the aviation industry is renowned, AAT, which offers simulator training for pilots in Melbourne, Brisbane, Taiwan and Milan, is now run by executive chair, part-owner and former Qantas chair Margaret Jackson.

Jackson, who led Qantas at the time of Ansett’s implosion and counts Virgin and its no-frills brand Tigerair as AAT customers, says she’s “just an interested observer” of Virgin’s crash-landing.

“Structurally, I think there’s an opportunity for a second major airline, as is the case for most markets,” she tells The Weekend Australian.

“So I hope there’s the capacity for an appropriate solution.”

An assortment of governments, private equity players, distressed debt investors and superannuation funds have descended on Virgin since the board, chaired by Elizabeth Bryan, called in administrators Deloitte on Monday night.

For a month or so, chief executive Paul Scurrah had sprayed Canberra with eight rescue proposals, all of which were rejected as the Morrison government coalesced last week around the need for a “market solution”.

In reaching that point, it said to Virgin’s legion of advisers that it had no intention of bailing out the airline’s foreign investors — Singapore Airlines, Etihad Airways, and China’s Nanshan and HNA, each with 20 per cent, and British billionaire Richard Branson’s Virgin Group with 10 per cent.

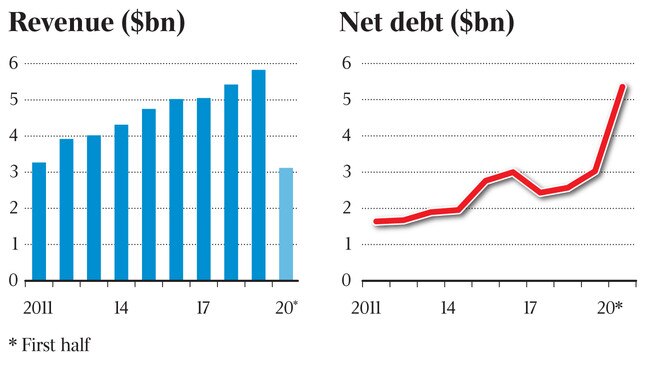

It was hard to fault the government, if it hadn’t been such a stretch. The truth is that Virgin, labouring with almost $7bn in gross debt, wanted help to access $1.4bn in capital, either in equity or a convertible note.

Under either scenario, the current shareholders would have been wiped out, not bailed out.

“The government knew that and the shareholders were fully aware of it too,” a well-informed source said.

The same Virgin shareholders had also tipped $6bn into Virgin — a lot of it, admittedly, in a deeply flawed strategy to go head-to-head against Qantas — without repatriating 1c of it.

Despite this, and Singapore-controlled Regional Express Holdings taking a generous share of the government’s regional aviation rescue package, Virgin got a free pass to the graveyard.

If there was a consistent policy on taxpayer bailouts, Virgin would have no argument.

Consistency, however, is a rare commodity in Canberra.

Virgin also knows that Qantas is never going to do it any favours.

“The competitor is very influential; they’ve got their hooks in everywhere,” an insider said, unable to even breathe the dreaded Qantas’s name.

Four days after Deloitte took control of Virgin, chief executive Paul Scurrah is even more convinced than he was on Tuesday that the airline will be resurrected.

He maintains Virgin is a different beast to Ansett and was “headed towards profitability in the not-too-distant future”.

“We didn’t trade our way into these circumstances; our oxygen supply, or our revenue, was cut off (by the COVID-19 pandemic),” Scurrah says.

The Virgin chief, who succeeded John Borghetti in March last year, is too diplomatic to criticise his predecessor.

Borghetti, though, is largely to blame for the “gold-plating” of Virgin, as it tried to knock his former employer, Qantas, off its perch.

The strategy came close to mutually assured destruction, costing both airlines billions of dollars, after Qantas boss Alan Joyce famously drew his line in the sand at 65 per cent of the domestic aviation market.

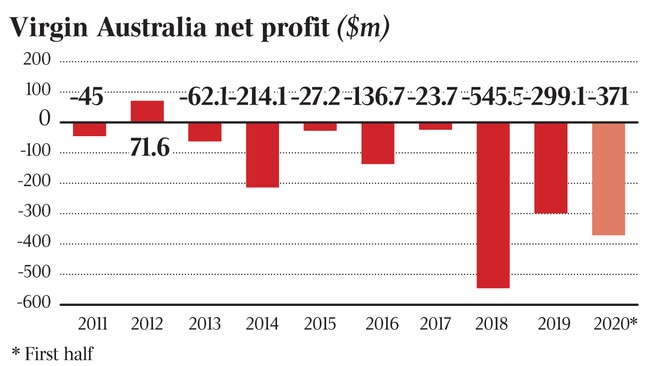

The commitment meant that for every extra Virgin aircraft in the skies, Joyce would have to add two of his own to maintain his position. The competition was ferocious, and one of the key reasons Virgin has been profitable in only one of the last 10 years.

If Virgin does take off once again, it will have to be much more disciplined in its approach to the market.

One of the reasons why Scurrah is sanguine about the future is the multitude of investment options that are capable of resurrecting Virgin, leaving aside traditional airlines.

“There’s not an airline in the world at the moment with the balance sheet to expand into Australia,” he says.

“Most governments, including the US and about 20 other countries, are providing financial aid but it comes with very tight restrictions about how it can be used.

“So if you have access to liquidity, it’s actually a very good time to buy an airline.”

Scurrah declines to comment on the list of Virgin tyre-kickers, which seems to lengthen every day.

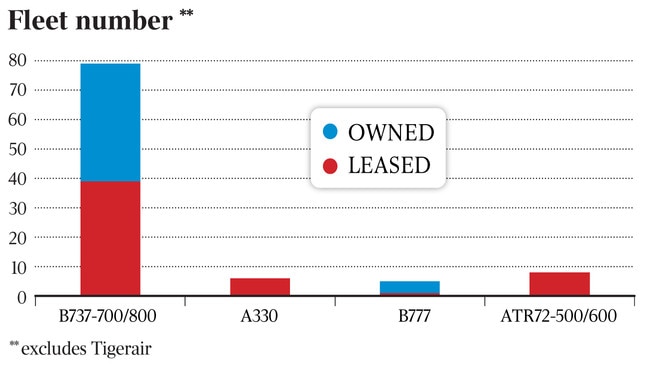

His task is to continue the restructure, simplify the fleet, concentrate on the more profitable routes, become leaner, and improve the balance sheet, all in readiness for the new owners.

The administrators have made it very clear they want any rebirth of Virgin to be completed by the end of June, with non-binding indicative offers by mid-May, binding offers by mid-June, and signed contracts by the end of June.

It’s a tight schedule, which is why Virgin’s internal mantra has become “three years in three months” — an opportunity presented by the administration to compress a three-year restructure into rapid-fire three months.

In the meantime, more than 10 parties are circling the airline, including private equity firms BGH Capital and Kohlberg Kravis Roberts, distressed debt investor Oaktree Capital, airline investor Indigo, and even Branson himself.

Various state governments — the carrier’s home state of Queensland as well as NSW and Victoria — are also keen on a bit of Virgin brand magic to help reawaken their dormant tourism industries.

The local PE firm BGH is widely seen as an early frontrunner, having teamed up with the nation’s biggest super fund, AustralianSuper, with $170bn in assets under management. Elsewhere, former top Qantas executive Jane Hrdlicka, whocfor years ran the airlines Jetstar arm, has teamed up with Bain Capital.

While alliances are fluid in the early stages of the administration, there is strong speculation of an emerging consortium of sorts featuring BGH/AustralianSuper, the Victorian government and possibly Lindsay Fox, who launched an aborted bid for Ansett with rag trade billionaire Solomon Lew.

Victorian Treasurer Tim Pallas confirmed this week that the government considered a $500m injection into Virgin before Deloitte arrived on the scene.

Fox was reportedly part of the discussions. Pallas said the state would continue to explore its options, but ruled out a taxpayer-funded bailout and said its involvement was conditional on support from Canberra and Virgin’s shift to Melbourne.

“But this is only the beginning,” an insider said.

“You might be riding on one horse in the early rounds but you end up riding another.”

Lest everyone gets carried away and sees Virgin as the only airline worth owning, former British Airways chief executive Rod Eddington observes that businesses going into administration don’t always come out the other end.

Negotiations with Virgin’s debt holders, he says with some understatement, will be “interesting”, as bidders seek to transform the airline’s balance sheet by enforcing extreme haircuts.

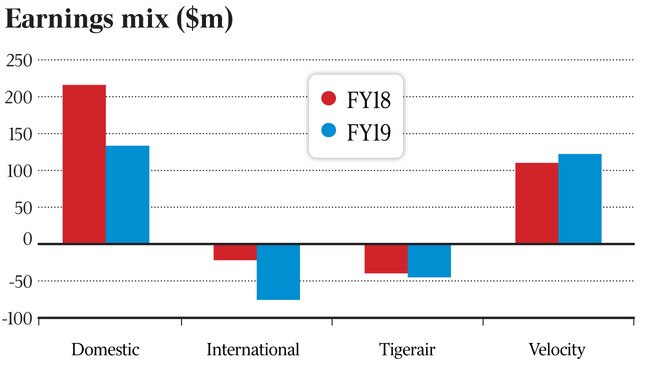

If Virgin were to come out of administration, Sir Rod expects the new owners to jettison the costly international business and Tigerair.

The core question would then be whether the airline returns to its Virgin Blue roots as a discount operator, or chooses the full-service option and competes with Qantas in a much more disciplined way.

“That’s the big strategic decision,” he says. “But I believe something will emerge from the administration: the feds want two players, and so do the states and the tourism industry.

“We have one strong player in Australia (Qantas), but the consequences of this global shutdown are so far-reaching that some countries won’t even have one.”

With Virgin, it wasn’t even clear that incredibly deep pockets were required.

The cash burn would depend on the ambitions of the new owners, and how much governments, airports and other entities were prepared to “tip in the kitty”.

The administrators, meanwhile, were straight out of the blocks, getting Federal Court approval on Friday for the first creditors’ meeting on Thursday.

They also finalised an early pitch to investors. Virgin operated in an attractive two-player domestic market with “proven profitability”; there was strong, ongoing demand for domestic air travel; valuable routes and slots in the Golden Triangle axis of Melbourne, Sydney and Brisbane; the Velocity frequent flyer program with 10 million members; and key assets and infrastructure built over 20 years. In other words: “Come on everyone. Where the bloody hell are you?”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout