Airports still raking in profits, despite weaker passenger growth

Australia’s big four airports have defied weaker passenger growth to increase profits from activities in terminals.

Airport users are paying less for carparking but could be forking out more in airfares to cover higher aeronautical charges, the consumer watchdog has found.

The Australian Competition and Consumer Commission’s annual Airport Monitoring Report, revealed the big four airports of Sydney, Melbourne, Brisbane and Perth were all rated “good” by passengers.

It was only the second year all of the airports achieved that rating, and ACCC chairman Rod Sims conceded the gateways must be doing something right.

“I’m very conscious always that the incentive to invest and look after passenger needs is a constant worry when you have a monopoly and certainly we’ve seen some delayed investment over the years,” Mr Sims said.

“But I’m very happy to celebrate the fact that all airports now have a rating of ‘good’, that’s extremely pleasing.”

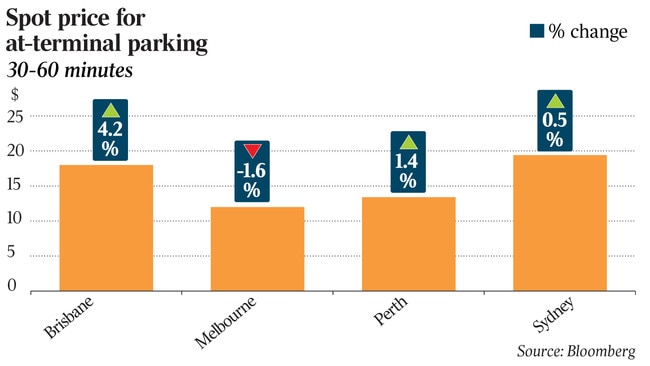

Earnings from carparking fell 2.5 per cent to $276.1m in 2018-19 but the airports still managed to increase aeronautical earnings collected from airlines to $863.5m despite weaker passenger growth.

Mr Sims said the real test would be whether they could again increase profits after a fall in passenger numbers, as was expected to be the case in the current financial year.

“It’s something we will keep an eye on,” he said.

Executive director of the Board of Airline Representatives of Australia, Barry Abram, said services provided by airports did not match the prices international airlines were charged.

He said problems with aerobridges, baggage systems and aircraft parking areas were reflected in the low on time performance for flights from Sydney and high rates of mishandled bags across Sydney, Melbourne and Brisbane Airports.

“It’s important to recognise these airport services failings don’t just affect international airlines but also directly disrupt the travel experience of international passengers,” he said.

“Airports should reduce prices, especially when airport services agreements are being progressively renegotiated.”

The Productivity Commission inquiry into the economic regulation of airports last year, found no evidence the gateways were abusing their market power, despite concerns raised by airlines and the ACCC.

The federal government agreed with the inquiry’s findings but Airlines for Australia and New Zealand chairman Graeme Samuel said the ACCC’s report told the true story.

“The report’s findings show that the PC Inquiry had no impact, with travellers left to wear the costs of the airports’ monopoly behaviours,” Professor Samuel said.

“The fact remains that there is no other monopoly infrastructure in Australia which is exempt from processes to protect consumers against the exercise of market power.”

Australian Airports Association chairman Tom Ganley said the report confirmed passengers were benefiting from the investment made by airports in services and facilities.

“More than 203 million passengers will pass through our four largest airports each year by 2040 and that represents enormous potential for Australian tourism into the next decade and beyond,” Mr Ganley said.

“This year’s opening of Brisbane Airport’s new runway will be just the start of the next wave of capacity building projects, bringing new opportunities for both airlines and passengers.

“New runways in Melbourne and Perth, and Sydney Airport’s plans to continue investing $1 million a day in capacity and efficiency improvements, will also underpin decades’ worth of aviation growth.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout