Airlines Qantas, Virgin battle it out in lucrative loyalty arena

Competition between Qantas and Virgin has shifted from the skies to the ground, and their loyalty programs. But which one is better?

Competition between Qantas and Virgin Australia is no longer focused on the airways, with the two airlines now fighting their fiercest war on the ground.

Loyalty programs have become the new battlefield for the carriers, due to the enormous revenue generated by the sale of “points” and valuable personal data collected from members.

Shielded from the threats that airline operations are typically exposed to, from bad weather to industrial disputes and even pandemics, loyalty schemes provide some degree of certainty, as demonstrated in the Covid crisis.

In the 2020 financial year, Qantas Loyalty and its frequent flyers program was the most profitable segment of the airline, recording $341m in earnings before interest and tax from $1.2bn in revenue.

Velocity managed to generate revenue of $350m for Virgin Australia in a year when the airline went into administration.

With more than 13 million members, Qantas Frequent Flyers has the edge on Velocity, with just over 10 million members, and it is keen to keep it that way.

Twice in six months Qantas has offered a “fast-track to gold status” for other airlines’ most loyal customers, in a move seen as targeting Velocity members.

Virgin Australia suffered a further blow with the loss of service station partner BP to Qantas, but those spats paled in comparison to the fight over new Velocity chief executive Nick Rohrlach. The former Jetstar Japan chief had just been appointed to a senior role at Qantas Loyalty when he was poached by Virgin Australia this year to head up their frequent flyer program.

Fearing he would spill the beans on sensitive commercial information about Qantas, the airline has successfully sought an injunction to delay his start at Velocity until a contractual dispute can be heard.

With the court hearing not expected until July, Mr Rohrlach is unlikely to be able to begin his new role until September at the earliest.

Loyalty expert Daniel Sciberras, managing editor of Point Hacks, said there was a real battle under way for engagement of members. “I think Qantas has always been very strong in terms of ensuring members are engaged in the process and know how to use their points,” Mr Sciberras said.

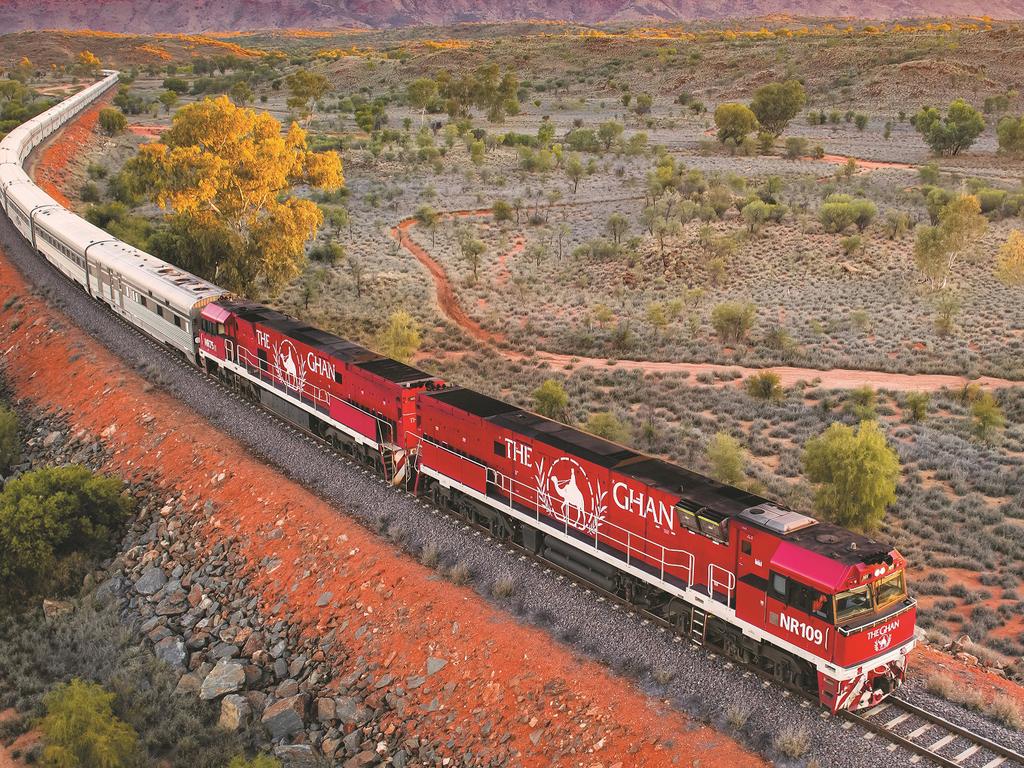

“Even with flying curtailed due to Covid, there’s their tie-up with The Ghan (luxury rail travel), the online stores, and the classic hotel rewards.”

But he said despite the challenges of administration and re-emerging as a mid-market rather than premium carrier, Virgin Australia was still in the hunt.

A smaller network of lounges was “fit for purpose for their current demand and well-located in the major capitals” and Velocity membership was free. “They’re making a strong play for new partnerships with 7-Eleven, Medibank and Youfoodz,” Mr Sciberras said.

“I think we’ll be seeing more partners announced pretty soon, providing more and more opportunities for members, which will lead to more engagement.”

A Velocity spokesman confirmed it was focused on creating more ways for members to earn and redeem points.

“Members are also beginning to dream about travelling overseas, which is why we’ve put a lot of work into locking in continued benefits with many of our international partners such as Singapore Airlines, Delta and Etihad,” said the spokesman.

Mr Sciberras said the big unknown in the loyalty tug of war was Rex, which was understood to be working on its own frequent flyer program to compete with Qantas and Virgin.

“Loyalty programs are a fact of life in almost every industry now and when you’ve got airlines offering very similar fares and products, (loyalty) becomes critical,” he said.

“You need one if you want to be competitive.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout