Jetstar’s market share drops after April holiday mayhem with air travel disruptions to persist through Christmas, says ACCC

The consumer watchdog has revealed Jetstar lost considerable market share after the April holiday chaos, and warns of more disruption over Christmas.

Jetstar gave up a chunk of market share after the April school holidays but the airline denies passengers are abandoning the low fares carrier.

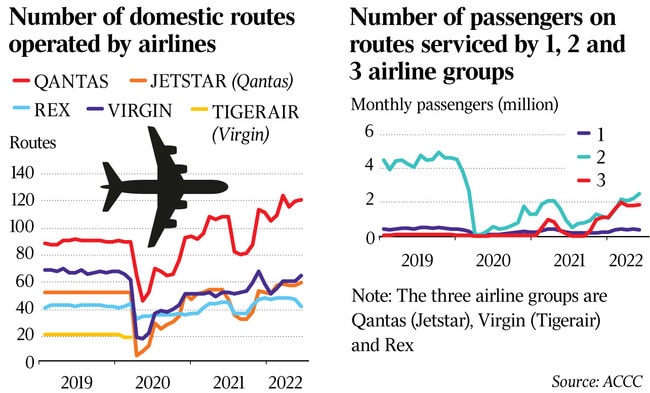

The Australian Competition and Consumer Commission revealed the 5 per cent drop in market share for Jetstar from 28 to 23 per cent in its latest quarterly report on domestic airlines.

Qantas and Virgin Australia were the main beneficiaries of Jetstar’s losses, both picking up an extra 2 per cent of market share to 39 and 33 per cent respectively.

Rex also climbed from 4 to 5 per cent, despite exiting several regional routes during the period. Overall Rex increased flying over the quarter by 5.3 per cent.

“The airline experienced an overall growth in passenger numbers, particularly on routes connecting larger cities,” said the report of Rex.

A Jetstar spokeswoman said the airline’s market share was impacted by a reduction in flying over the period in question.

“In April we were flying well above our pre-Covid schedule and in July we returned to operating approximately what we were flying before the pandemic,” said the spokeswoman.

Bureau of Infrastructure, Transport and Regional Economics data showed Jetstar scheduled 12 per cent fewer flights in July then April, and actually flew almost 16 per cent less.

Qantas also cut capacity 3.2 per cent and Virgin Australia’s actual flying reduced 2.8 per cent.

The capacity cuts were considered a factor in soaring airfares, along with high oil prices that airlines passed on to passengers.

ACCC chair Gina Cass-Gottlieb said the cheapest economy airfares were 56 per cent higher in August than they were in April when they hit an 11-year low, while business fares rose by 17 per cent.

“After about 18 months of historically low airfares, the cost of domestic flying has risen sharply in response to strong demand, temporary capacity reductions and very high jet fuel prices,” said Ms Cass-Gottlieb.

“In these circumstances, more than ever, the level of competition between airlines is incredibly important to maintain pressure on ticket prices and service levels across the industry.”

She said the ACCC was aware that for many consumers, travel fell well short of expectations across the July holiday period, with record delays, high rates of cancellations, lost baggage and long wait times for call centres.

“We have been engaging closely with airlines to understand the source of these problems,” Ms Cass-Gottlieb said.

The key reason was staff shortages with airlines and airports struggling to replace workers who were retrenched or retired over the last two years.

“Recruitment has not been easy,” the report said.

“Many sectors across the economy have struggled to fill vacancies with a low national unemployment rate. Some potential staff have also chosen work in other fields which may be able to offer working from home and which are less vulnerable to shut down from a possible new Covid-19 variant.”

Rex was singled out as performing “significantly better than other airlines in terms of punctuality and the rate of cancellations” which was attributed to the airline maintaining its staff throughout the pandemic.

It appeared unlikely staffing levels across other airlines would rebuild in time for the Christmas holidays, prompting the ACCC to warn of further travel disruptions into the New Year.

The threat of industrial action by groups including licensed maintenance engineers, baggage handlers and ground crews also loomed large in the months ahead.

“In this environment, reliability and good customer service may become growing points of competition between the airlines,” the report said.

“An airline that schedules a realistic number of flights based on their level of staffing, has a well-resourced call centre, and transparent and fair compensation policies on their website, has the opportunity to win new customers.”

In regards to the ACCC investigation into Qantas’s handling of travel credits, the report provided little enlightenment for consumers, other than to say it was ongoing.

Earlier this year, the ACCC surveyed consumers after a high number of complaints about Qantas forcing credit holders to buy more expensive airfares than they would if paying in cash.

“In recent months, Qantas has added further information to its website to note that lower fares may be available using payment methods other than credits,” said the report.

“Further, before using their credit to make a booking, Qantas now requires consumers to tick a box to acknowledge they understand that their credit can only be used to book fares that are equal to or higher than the value of their credit.”

Qantas had also installed a dedicated team in its call centres to help customers wanting to use their travel credits.

At the end of June, $1.3bn worth of travel credits issued during the pandemic remained unused, down from $1.6bn at the height of Covid-related border closures and lockdowns.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout