Australian exports to China surge to new high

The thumping new record, set in the first six months of 2021, underlines the ‘strategic nightmare’ facing Beijing.

Australia’s exports to China have set a thumping new record in the first six months of 2021, underlining the “strategic nightmare” of Beijing’s dependence on West Australian iron ore.

Elevated iron ore prices motored Australia’s goods exports to $US76.8 billion ($103bn) for the first half of the year — up 36 per cent, or more than a third, on the previous record first six months in 2019.

Australia’s share of China’s total goods imports also hit a record high at 6.1 per cent, according to data released by China’s customs officials.

“The total value of goods exports to China hasn’t just eclipsed the previous record high — it has smashed it,” said James Laurenceson, director of the Australia-China Relations Institute at Sydney’s University of Technology.

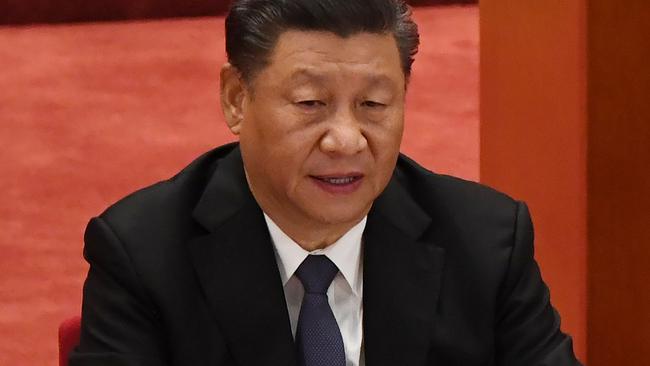

Australia’s surging exports to China were achieved despite a 15-month-long trade coercion campaign by Xi Jinping’s administration after the Morrison government last April called for an independent inquiry into the origins of the coronavirus.

Beijing targets have included Australian coal, wine, lobsters, timber and barley, exports together worth almost $20 billion-a-year before they were black-listed.

Imports of iron ore, a key ingredient in steelmaking, have continued to enter China without any trouble at customs.

Huge demand from China’s steelmakers — along with supply problems from rival iron ore producer Brazil — have seen Australia achieve record export levels during the worst period in the bilateral relationship in half a century.

China imports more than 60 per cent of its iron ore from Australia, a situation Australia’s former Ambassador to China Geoff Raby has called a “nightmare” for Beijing’s strategic and defence planners.

The party-controlled tabloid the Global Times said the new trade numbers showed there was an “urgent need for the country to diversify” from Australian iron ore.

“The rapid increase in iron ore prices has greatly boosted the costs of steel production in China, driving up the steel prices and other downstream production costs, which is not conducive to the country‘s economic development,” the Global Times wrote in an editorial.

Beijing’s unofficial ban of Australian coking coal — previously its dominant supplier — has sharply increased the cost of the other main ingredient for China’s steelmakers.

China’s officials have complained about the high price of iron ore and the country’s dependence on Australia as a supplier for more than a decade.

The Rudd government in 2009 blocked an attempt by the Chinese state giant Chinalco to buy Rio Tinto, which along with BHP is the biggest iron ore producer in Australia.

Chinalco still owns 15 per cent of Rio Tinto.

The two companies are together developing the Simandou iron ore mine in West Africa, an ambitious project which Beijing hopes will reduce iron ore prices.

Australian iron ore is far from the only import of concern for Xi’s leadership team.

China’s top source of imports is Taiwan, which it considers a wayward province and was the source of 9.1 per cent of China’s goods imports in the first half of 2021.

Taiwan’s semiconductor industry is the dominant supplier for mainland Chinese tech giants.

The new customs data shows that China’s next five biggest sources of imports in the first half of 2021 were allies of its biggest strategic rival the United States and the US itself.

Japan was in second place with an 8 per cent share, followed by South Korea (7.9 per cent), the US (7 per cent), Australia (6.1 per cent) and Germany (4.8 per cent).

Professor Laurenceson said China has had political disputes with all of its top five import sources.

“So clearly trade and some political tension with China can coexist,” he said.

“But no other exporter is facing the same breadth of trade disruption that Australia is.”

Along with iron ore, liquefied natural gas — Australia’s second biggest export to China — has been undisturbed.

Sales of Australian wool, another resource on which Chinese producers are dependent, are also at record levels.

The wine and lobster industries have felt the most pain.

A more than 200 per cent tariff on Australian wine exports last November shuttered the $1.3 billion export trade almost overnight.

The hugely China-exposed $600m lobster trade has also been devastated after they were added to Beijing’s unofficial blacklist 8 months ago.

US President Joe Biden’s top Asia adviser Kurt Campbell last week warned that Beijing’s punishment of Australia “appears to be unyielding” and advised the Morrison government to settle in “for the long haul”.