Economy weathering the China trade sanction storm

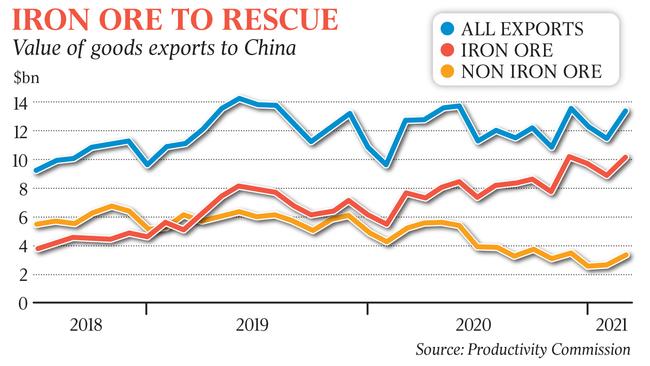

Australia is weathering the escalating trade war with China, due to surging iron ore sales and exporters finding alternative markets for barley and coal, the Productivity Commission says.

Australia is weathering the escalating trade war with China, due to surging iron ore sales and exporters finding alternative markets for barley and coal, the Productivity Commission says.

But the Morrison government’s key economic adviser warns of the distorting effect of pandemic assistance to “zombie” companies, the risk of adverse impacts from the HomeBuilder grant scheme, and the flawed strategy of picking winners in manufacturing.

In its annual review of trade and assistance, released on Wednesday, the commission notes Covid-19 and tougher screening have choked the flow of foreign direct investment, with the US pulling funds out of Australia for tax reasons and China more than halving its transactions.

It also states that assistance to industry, mainly via tax breaks, was most pronounced for manufacturing and agriculture, while tariffs on inputs continue to hurt construction.

PC chairman Michael Brennan said the measures introduced during the pandemic “have supported the survival of inherently efficient businesses”.

“Nonetheless, a key policy challenge will be the orderly removal of assistance as Australia’s economic recovery continues.”

Last year, the value of goods exports fell by 7 per cent, while imports fell by 5.7 per cent. As well, with borders closed to foreign students and inbound and outbound tourism, services exports fell by 30 per cent and imports plunged by 45 per cent.

The commission says the impact of China’s trade penalties on affected industries will depend on how reliant they are on the Chinese market, how easily they can access alternative markets, and the prices they will receive.

As other countries divert exports to China, new markets will open up for Australia. Exports of barley (for feed) have increased to Saudi Arabia and Asia, and a trial is under way selling premium malting barley to Mexico. Australian coal has found new customers in Japan, India and Pakistan.

But the commission says finding new markets is likely to prove more challenging for more differentiated, and hence less substitutable, products such as wine.

Flows of foreign direct investment into Australia fell from more than $56bn in 2019 to less than $30bn last year. Australia’s largest flows came from Japan, Britain and Singapore.

The net flow of direct investment from China was $1.6bn last year, well down on its 10-year average of about $5bn a year.

Mr Brennan said “the severe economic impacts of the pandemic have been accompanied by worsening trade relations with China” and “the economy has generally been resilient to this major development”.

The PC notes many of the measures introduced last year, such as the $89bn JobKeeper program, have been temporary and emergency-focused responses to the pandemic “rather than measures intended to prop up otherwise unviable businesses. However, providing emergency assistance still entails risks,” it says. “The longer assistance is provided, the greater its overall cost to taxpayers.

“But more subtly, the longer assistance is provided, the greater the likelihood that it props up less efficient (or ultimately unviable) firms while providing windfall rents to profitable businesses.”

The free-market ethos of the PC is reflected in concerns over subsidies to industries and regions through the Modern Manufacturing Strategy and disaster recovery payments that encourage under-insurance, poor location choice and discouraging disaster mitigation.

While HomeBuilder has had a stimulatory effect, the PC says its added value cannot easily be determined and may have increased construction costs.

“Industry-specific assistance … risks being overgenerous and providing unnecessary windfall gains to recipients, which can make these programs expensive and poor value for taxpayers,” it says.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout