Western Sydney offices still vacant amid working from home debate

Businesses continue to work out the balance between working from home and getting people back into the office.

The post-pandemic desire to continue working from home could be driving down commercial real estate sales in western Sydney, according to a new report from Ray White.

Their end-of-financial-year report, covering 2022/23, shows the amount of office space available in western Sydney was down 47.45 per cent on the previous financial year.

While that translated to about $660m in sales transactions, it’s still a third behind the 10-year annual average.

The report found sales of retail space went the other way – up 53.56 per cent, representing about $1bn.

However, the report notes the retail property market has always experienced volatility.

Ray White managing director of commercial western Sydney Pete Vines said the report had good news and bad news.

“There’s a lot going on in the world at the moment, various factors affecting various property types,” Mr Vines said, acknowledging Covid had a significant impact on Sydney’s commercial property market – specifically, office space.

“People working from home isn’t necessarily conducive to expensive office space.

“Businesses are still working out if workers will come back to the office at all or maybe one or two days a week.

“And as interest rates go up, people want a greater return on their money … so values of commercial offices have dropped.

“At the moment, the buyer pool is quite thin because we don't have visibility on what interest rates are doing yet. You have to be a brave person to go buy a large office investment.”

It’s a far cry from the first half of 2017 when Property Council figures showed Parramatta had a zero vacancy rate for A-grade office space.

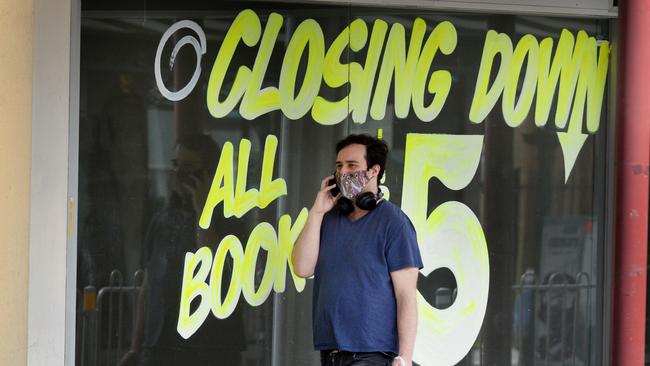

Retail property is experiencing its own struggles post-pandemic.

“Retail is a funny one,” Mr Vines said. “Food and beverage are still going relatively well, the services side of retail.

“Fashion, electrical, those types of things, there's a continuing shift away from bricks and mortar to online.

“That’s reduced people’s need to have physical stores … all you need is a website, and the amount of competition has increased.

“Retail will continue to be impacted by inflation – as it goes up, people hold back on spending.”

The only type of commercial property doing well in western Sydney, according to the Ray White analysis, is industrial property.

“It’s been the big winner from Covid,” Mr Vines said. “Retail is going into warehouses, they need to be accessible, a lot of people have started businesses where they operate from home but they still need warehouse space.

“Traditionally, industrial sits on big pieces of land close to transport and arterial roads … there’s a limited amount of land and a limited amount of stock … it’s put pressure on rents, and in some cases (they) have nearly doubled.”

Figures from Colliers, published in April, found the industrial vacancy rate in western Sydney for the year’s first quarter was just 0.2 per cent.

Analysis of the 2016 census by Western Sydney University found more than 300,000 people were travelling out of the region for work daily – a quarter of them professionals who, presumably, work in some sort of office.

Meanwhile, the Property Council predicts the population of western Sydney to swell to about three-million people by 2036, making it the nation’s third-largest economy.

Looking ahead, Mr Vines predicts all types of property will continue to be problematic.

“Commercial offices will remain tricky, there’s going to be a fair bit of vacancy, and if the economy isn’t booming, new businesses aren’t starting,” he said.

“There's a lot of immigration and a natural demand for housing, which we’re not able to keep up with, so residential pressures will continue to push.

“I think industrial will remain strong … I’m not sure we’ll continue to see rents run like they have in the last few months because as consumer finances tighten they don’t spend as much.

“There’s always the exceptions to the rule, but generally across the market, land in western Sydney will continue to be challenging because construction costs tend to be high at the moment.”