Why new RBA boss must stand up to Labor

It’s not sufficient for the government to claim monetary and fiscal policy are working in the same direction. Clearly they are not.

It’s not sufficient for the government to claim monetary and fiscal policy are working in the same direction. Clearly they are not.

It’s understandable Treasury didn’t want to over-estimate the surplus, but to be wrong by this much is a complete embarrassment.

Labor’s proposed workplace reforms will overturn settled arrangements across industry. The costs for employers to comply will be immense.

It was Paul Keating who said good policy was good politics. Sadly, it’s a lesson that largely has been ignored by politicians for nearly two decades.

The way to understand the Albanese government’s forthcoming tranche of industrial relations changes is to recognise its strongly held view that the only legitimate form of employment is permanent.

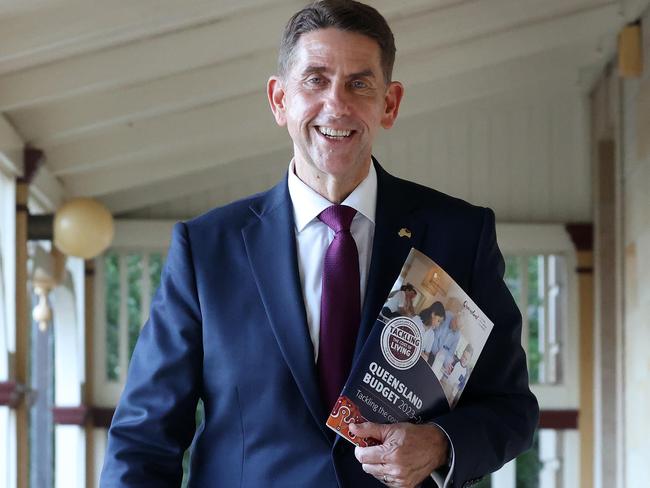

The real story in the Queensland budget handed down by Cameron Dick is the surging revenue from coal royalties.

Jim Chalmers must know that wage increases without productivity rises will lock in inflation, or possibly accelerate the rate.

What the Treasurer doesn’t seem to appreciate is that unless all instruments of economic policy – monetary, fiscal and wages – are acting in unison, the costs of getting inflation back under control will be much higher.

Businesses are likely to be hit from a number of directions: higher wages, higher debt servicing costs, ongoing inflation and weaker demand.

Jim Chalmers claims the recent budget was tough but also responsible. But by setting out average spending figures across six years the federal Treasurer was gilding the lily.

Original URL: https://www.theaustralian.com.au/author/judith-sloan/page/14