Same old story of debt and excess as coffers overflow with royalties

Otherwise, it’s the same story: excessive growth in the number of public sector workers, major cost blowouts and delays in an overly ambitious infrastructure program – called the Big Build in both states – too much government debt and unrealisable plans for the future.

Premiers Palaszczuk and Andrews are essentially carbon-copies of each other.

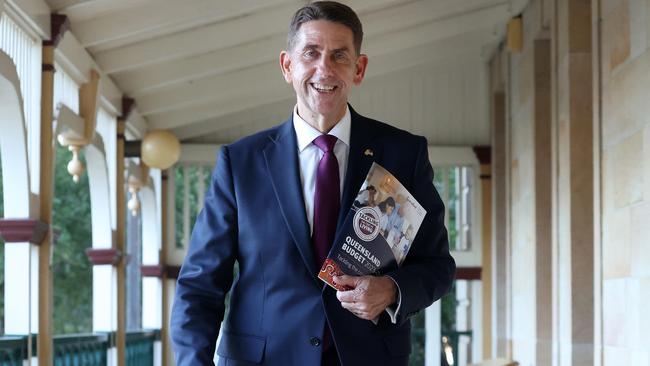

The only real story in the Queensland budget handed down on Tuesday by Treasurer Cameron Dick is the surging revenue from coal royalties. The size of the impact is astonishing. In 2021-22, the actual revenue from coal royalties was $7.2bn. This financial year it is expected to come in at $15.3bn, a more than doubling of the amount.

The strength in the prices of both thermal and coking coal has guaranteed this outcome, although the jacking up of the royalty rates contributed a third of the additional revenue. The GST deal done with Western Australia, and which involved none of the other states being worse off, is also protecting Queensland’s GST revenue.

The Queensland Treasurer has much in common with his fellow Queensland resident, the federal Treasurer, Jim Chalmers, in that both men weirdly emphasise the budget outcomes for the current financial year. That’s the one that is about to end; less attention is paid to the outlook for the budget bottom line in the next four years.

So Dick crows about the largest surplus every recorded by a state government – over $12bn – this financial year, but speaks softly about the projected deficit next financial year and the wafer-thin surpluses after that. Those tiny surpluses are hardly worth writing down. He is also fairly reticent about the build up of government debt over the period, with net debt (excluding government-owned corporations) increasing nearly threefold to $47bn in 2026-27.

Queensland’s debt position may not be as bad as Victoria’s but it’s close – and don’t forget that the size of Queensland’s population is only 80 per cent of Victoria’s.

Unsurprisingly, given the money burning a hole in his and the Premier’s pockets, there is a raft of handouts, including across-the-board energy rebates and free-of-charge kindergarten and swimming lessons. But unlike the Victorian government’s decision to slow the pace of infrastructure spending, it’s all systems go in Queensland, notwithstanding the acknowledged explosion in costs for both labour and materials.

This could end badly.

It’s hard to select the craziest spending decision in Tuesday’s budget, but initiating a wildly expensive pumped hydro project that might generate electricity for 24 hours, tops, is a definite contender. (Maybe Dick hasn’t read about the Snowy 2.0 fiasco.) It’s part of the government’s ill-conceived Queensland Energy and Jobs Plan which, according to the government blurb, “will provide clean, reliable and affordable power for generations”.

The budget includes $19bn over the four years for the QEJP.

But here’s an irony: the government also expects to receive some additional $2bn in revenue from its coal-fired electricity plants because the switch to renewables hasn’t gone precisely to plan and the previously forecast decline in wholesale electricity prices is now not expected to happen within the forward estimates. Oops.

It is surely paradoxical that the things that are propping up the Queensland budget – coal and coal-fired electricity, in particular – and are funding all the government handouts are exactly the same things that the government wants to eliminate – to save the planet, naturally. Go figure.

These days, I hang out in both Queensland and Victoria. I like to think of Queensland is like Victoria, but with coal.