The risky business of seeking financial advice

The chances of finding good, independent financial advice at a reasonable cost are once again under threat.

The chances of finding good, independent financial advice at a reasonable cost are once again under threat.

Lenders and borrowers offering 40-year mortgages are an unfortunate sign of the new reality – even if property prices are falling.

Big lenders are launching longer life home loans to capture new business and get around existing limits set by regulators.

A dramatic bust-up between hospitals and health insurers over soaring costs is set to accelerate a rush for risky overseas medical treatment.

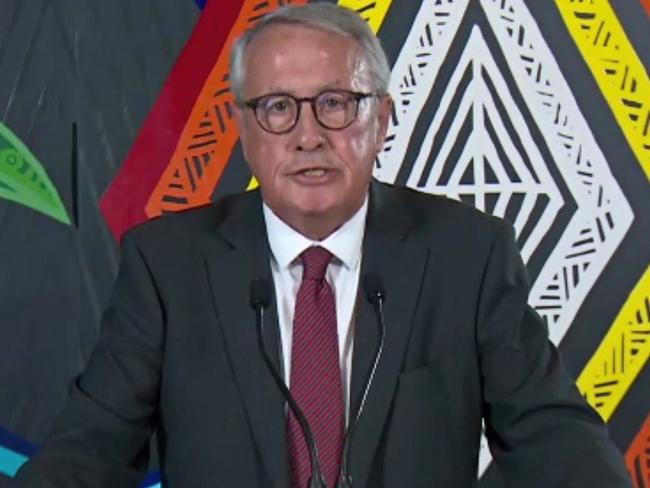

Wayne Swan has apologised ‘unreservedly’ for the excessive delay in paying millions of dollars to grieving families in an extraordinary address to the super giant’s annual meeting.

Financial advisers and their clients aren’t standing by as industry fund Cbus is mired in a string of scandals; they have been moving their money out.

A heated brawl between private health insurers and the nation’s hospitals has gone public. Something has to give. So far it’s the patients who look likely to pay more, no matter who wins.

While health insurers are in a fight with private hospitals, it’s a good time to review your own cover. Here’s how you can cut your bills.

Confused? Health insurance is crucial and complex, but it gets easier if you grasp a few key details. This is what you need to consider.

Monthly declines are significant. Three key negative signals persist across the market.

Original URL: https://www.theaustralian.com.au/author/james-kirby/page/9