PM hits back over Palaszczuk ‘tear down’

Scott Morrison says he won’t buy into ‘insults’ from Qld’s Deputy Premier, as border lockdowns cloud positive economic news.

Scott Morrison says he won’t buy into ‘insults’ from Qld’s Deputy Premier, as border lockdowns cloud positive economic news.

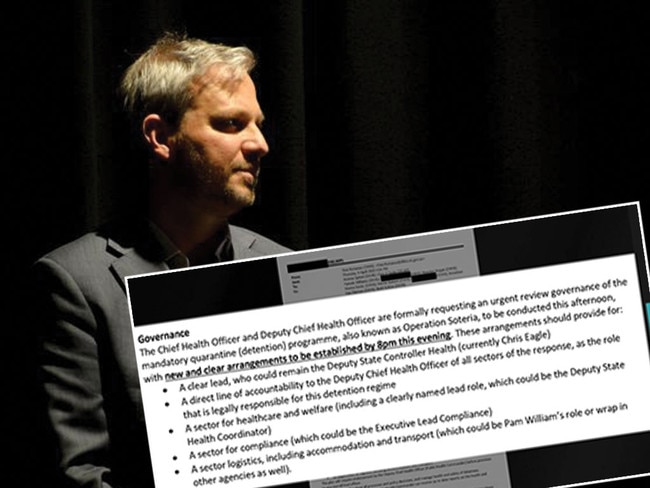

As an explosive email reveals health chiefs demanded ‘urgent’ review of quaratine scheme, Victoria’s CHO says he wasn’t consulted on the use of private security guards for it.

QBE among insurers hit by landmark UK ruling which raises pressure on industry to pay out business interruption claims linked to the pandemic.

Bus drivers say the transport industry faces a wave of bankruptcies in coming months after failing to receive relief from state government charges.

A member of the ADF has been fined after entertaining a female guest while in mandatory quarantine in Sydney.

A positive case of COVID-19 has been detected at Newmarch House more than two months after health authorities declared the facility’s deadly outbreak was over.

Australians have an outdated view of manufacturing, which also often struggles to attract the capital it needs, a new report finds.

Dozens of coronavirus close contacts sent an erroneous text message by DHHS as Andrews reverses course on last rites for dying.

Qantas urges 20,000 stood-down staff to petition states and territories to re-open borders and find a common definition for a ‘hot spot’.

As business accuses Daniel Andrews of a ‘scorched earth’ retail plan, the NSW Premier says border limits will cause economic chaos.

Original URL: https://www.theaustralian.com.au/author/david-ross/page/200